Russian central bank chief demands total crypto ban – Is Moscow shutting down digital trading?

- Bitcoin surged past $87k despite global regulatory uncertainty and central bank skepticism

- Russia and China’s crypto moves have fueled speculations about market impact and future regulations

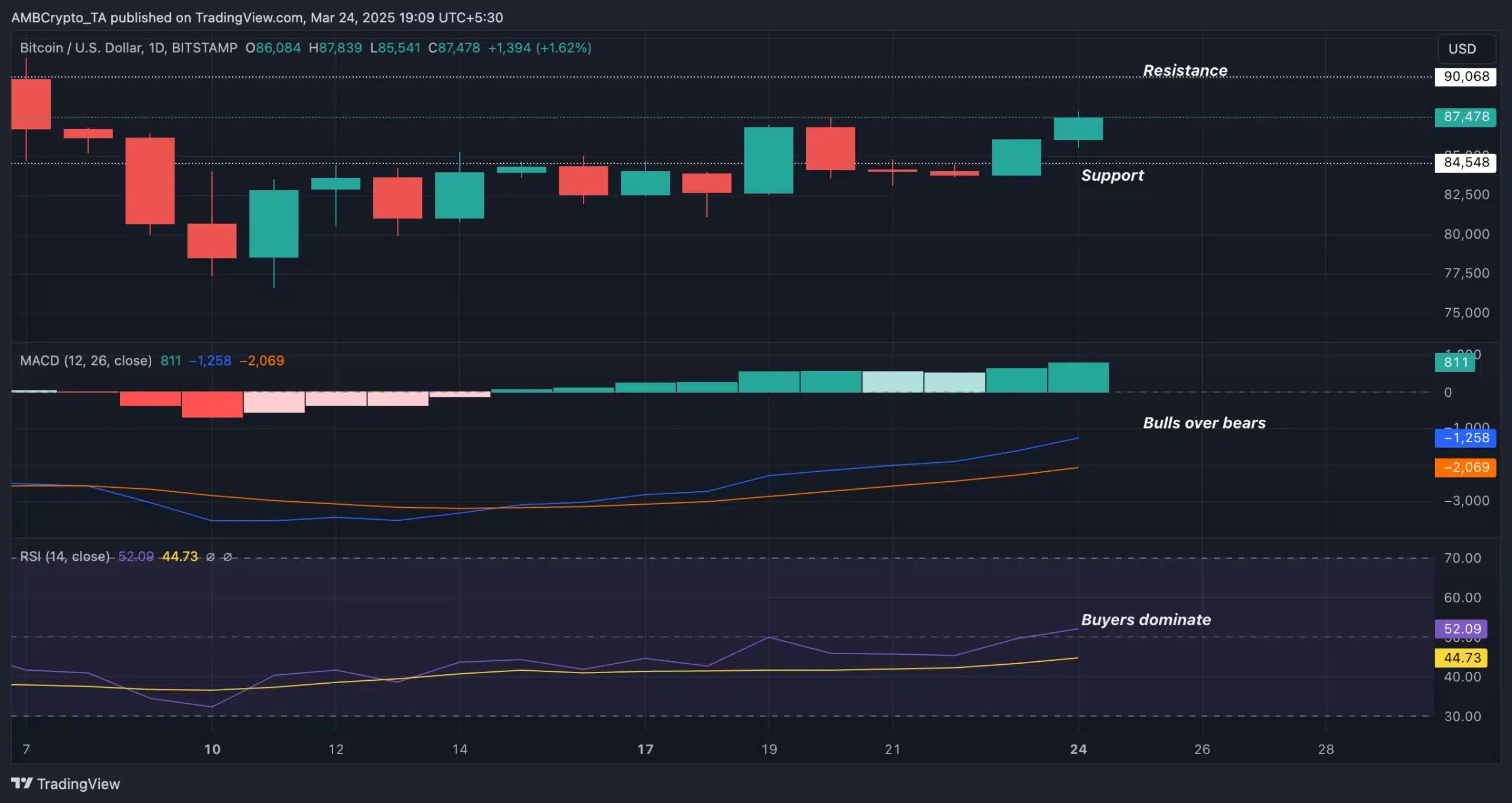

The crypto market has regained bullish momentum after a period of bearish consolidation, with Bitcoin [BTC] leading the charge. In fact, the global crypto market cap climbed to $2.86 trillion on the charts, marking a 2.86% hike in the last 24 hours according to CoinMarketCap.

For its part, Bitcoin, which previously struggled to break past the $85,000-resistance level, surged to $87,234.34 after gains of over 3%.

Moscow closes its doors on crypto

Meanwhile, regulatory scrutiny remains a key factor shaping the industry. The Bank of Russia, for instance, has proposed a ban on cryptocurrency settlements between residents outside the experimental legal regime (ELR).

The central bank is also pushing for penalties on those violating the restrictions, signaling a tightening position on digital assets within the region.

At a press conference, the head of regulators Elvira Nabiullina said,

“We remain with the old position that cryptocurrencies should not be allowed as a means of payment, so we propose to introduce a ban on settlements in cryptocurrencies between residents outside the EPR. Not only to introduce a ban, but also to establish liability for violating this ban.”

Other countries and their crypto position

While Russia’s Central Bank previously acknowledged the need for a regulatory framework to allow “qualified” investors access to cryptocurrencies, it has now proposed stricter controls on crypto settlements.

In fact, Russia’s latest proposal for a three-year experimental framework to allow select wealthy investors to trade cryptocurrencies also might fade away.

Meanwhile, Japan’s Prime Minister Shigeru Ishiba has voiced concerns over the opacity of Bitcoin reserve strategies in the U.S and other major economies. This skepticism has been echoed by Switzerland and the European Central Bank, both of which remain cautious about widespread crypto adoption.

Adding to the debate, the Bank of Korea (BOK) recently dismissed speculations about including Bitcoin in its foreign exchange reserves. In doing so, it cited extreme volatility as a major risk factor.

This clarification followed an official inquiry by Representative Cha Gyu-geun of the National Assembly. It highlighted the continued hesitance of traditional financial institutions about integrating Bitcoin into national reserves.

What’s more?

Finally, China’s alleged liquidations of nearly $20 billion worth of Bitcoin—stemming from the 2019 PlusToken Ponzi scheme—has sparked fresh speculations about the government’s crypto strategy.

While authorities claim the seized BTC was transferred to the national treasury, the lack of transparency has fueled concerns over potential market impact.

And yet, despite Russia’s cautious position and other nations struggling to trust Bitcoin, the leading cryptocurrency remains resilient. In fact, it has reinforced its dominance in the evolving financial landscape.