Hyperliquid delists JELLY JELLY crypto after price spike – $12M vault loss narrowly averted!

- A leveraged attack on Jelly Jelly (JELLY) Futures left Hyperliquid reeling, exposing protocol vulnerabilities and rattling investor trust

- HYPE token dropped by 22% after validator vote, signaling community’s doubts about platform governance

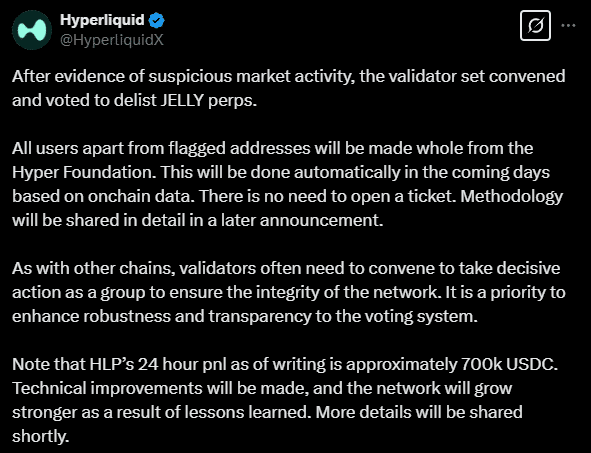

On 26 March, Hyperliquid [HYPE] delisted JELLYJELLY (JELLY) Futures after a massive short position triggered a market-wide shakeout.

Whale wallet profits as vault bleeds

A trader opened a $6 million short with 20x leverage, then bought JELLY spot to force liquidations. The prices surged 400–500%, pushing the liquidator vault into a $12 million unrealized loss. Without action, a sustained rally could have liquidated the vault entirely, if JELLY hit a $150 million market cap.

However, the validator committee acted fast. They force-settled JELLY at $0.0095, flipping the situation. What looked like a $10.63 million disaster became a $703,000 net gain.

And yet while the vault was bleeding, another wallet entered the scene.

Wallet 0x20e8 entered a long position worth $8.2 million as the liquidations unfolded. It exited within minutes, securing $8 million in profit.

Now, this wasn’t the first time such a pattern emerged. In fact, the move echoed a prior exploit involving BERA in February.

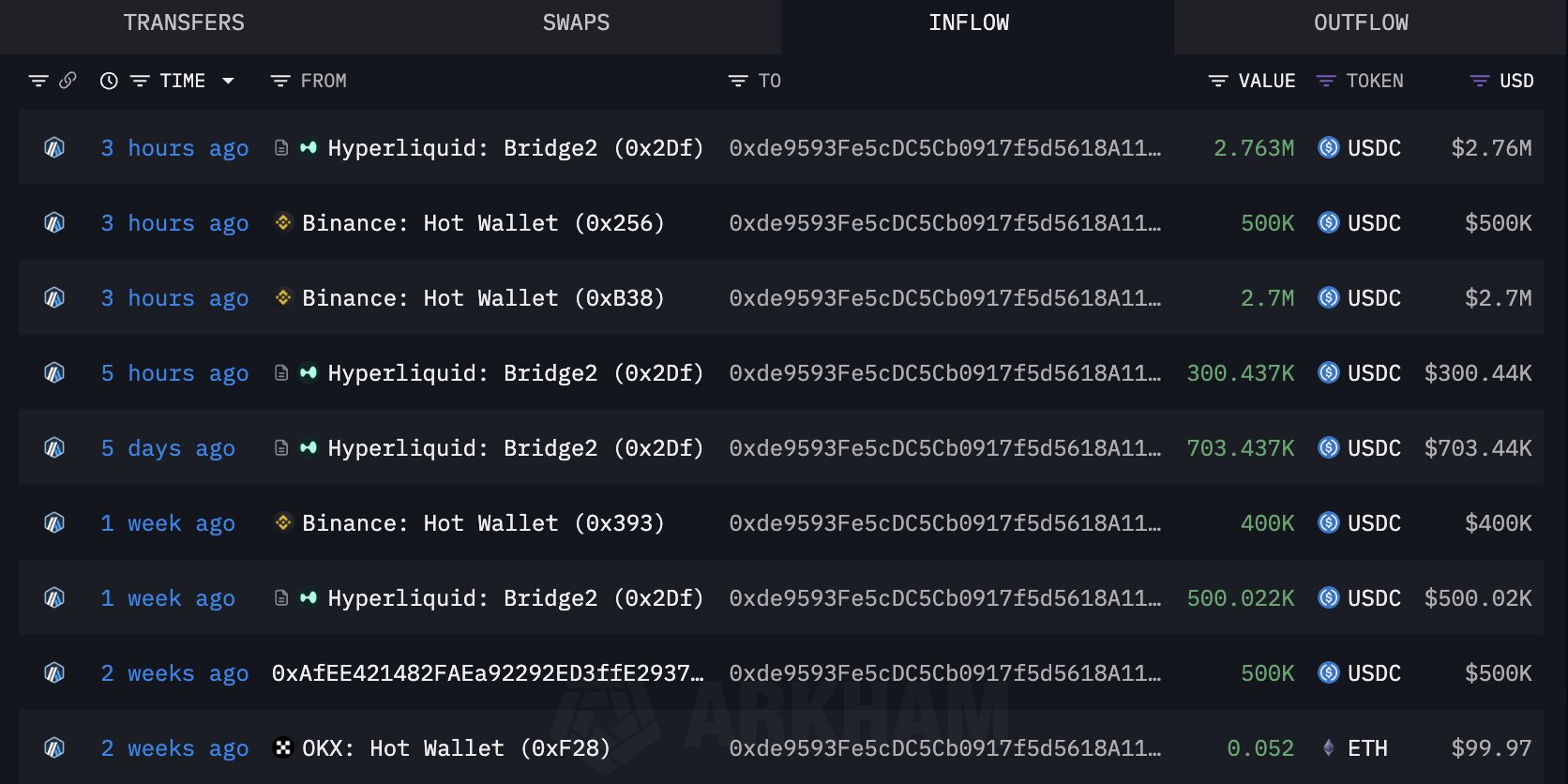

Meanwhile, wallet 0xde95 was traced as the short origin.

It sold JELLY spot to force upward pressure, driving the vault into risk. Here, it’s worth noting that five wallets linked to the attacker have acquired 10% of the token’s supply since 22 March.

In some way, the on-chain patterns hinted at deliberate coordination.

Data confirms manipulation, not organic growth

JELLY’s market cap hovered between $10 and $20 million. That made it vulnerable to manipulation by even modest capital.

To put it simply, just $4–8 million in spot buys shifted the market cap by over 400%.

Trading volume surged by 1,852%, climbing to $170 million in a day. Transaction count jumped by 997%, with 272,000 trades recorded.

Active trader count rose by 961% while liquidity stayed stable at $2.99 million.

And yet, sell volume slightly outweighed buys — $85 million versus $84 million — suggesting manipulation over organic demand.

On-chain links revealed that five wallets connected to the original whale now hold 10% of JELLY’s total supply. That’s roughly $1.9 million in tokens acquired between 22 March and the day of the incident.

Beyond wallet connections, trader behavior on the JELLY token page exploded. Transaction counts and volume soared. That kind of market activity doesn’t happen by chance — Especially not within a single day.

Needless to say, Hperliquid’s response raised new questions.

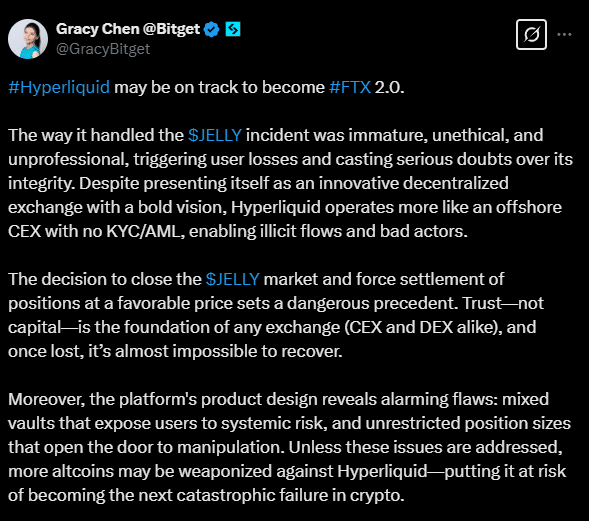

Critics call out centralized behavior

Gracy Chen, CEO of cryptocurrency exchange Bitget, publicly denounced Hyperliquid’s decision-making process.

“Despite presenting itself as an innovative decentralized exchange with a bold vision, Hyperliquid operates more like an offshore [centralized exchange].”

Drawing comparisons to past collapses, Chen warned,

“Hyperliquid may be on track to become FTX 2.0.”

Chen further criticized the force-settlement decision as “immature, unethical, and unprofessional,” emphasizing the long-term consequences of undermining market trust.

“The decision to close the $JELLY market and force settlement of positions at a favorable price sets a dangerous precedent. Trust—not capital—is the foundation of any exchange […] and once lost, it’s almost impossible to recover.”

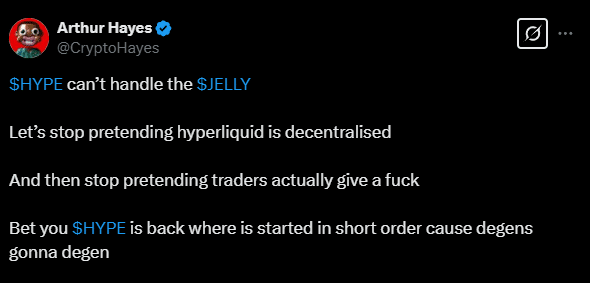

Clearly, the validator vote mirrored actions taken by centralized exchanges under pressure.

Arthur Hayes commented on the contradiction, noting that the protocol’s branding didn’t match its behavior.

However, the delisting wasn’t the only red flag.

Exchange links raise more red flags

ZachXBT connected attacker wallets to exchanges like OKX, Binance, and MEXC — All of which listed JELLY shortly after the delisting.

As validators voted, the HYPE governance token dropped by 22%, hinting at shaken user trust. Wallet 0xde95 withdrew $6.26 million before account freezes. Just $900,000 remained locked.

The vault’s 4.8x leverage exposure turned a $6 million short into a $12 million liability.

Until low-cap leverage is reeled in, more JELLY-style plays may follow.

For now, Hyperliquid has avoided collapse. Even so, this episode did expose its governance.