Examining Ethereum’s latest liquidations and its value as an investment now

- About $165 million in long ETH positions were liquidated as ICO participant deposited 1,700 ETH worth $3.18M into Binance

- Despite ETH’s market cap, the network saw a fall in transaction activity, user growth, and fees/revenues

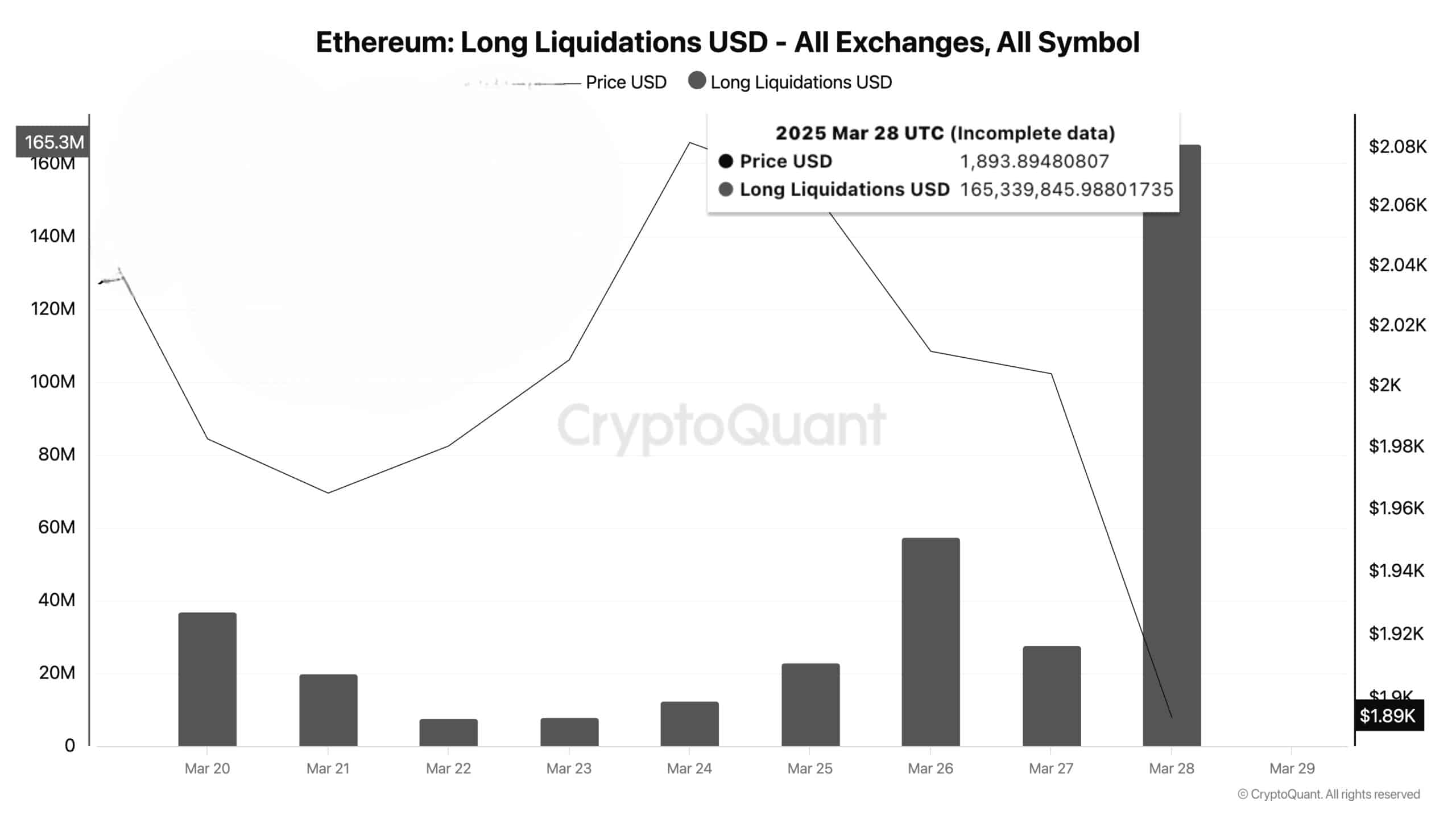

Ethereum [ETH] has seen significant market correction lately. Thanks to the same, traders have faced losses of $165 million from long position liquidations.

Large-scale liquidations occurred as leveraged traders encountered unexpected price declined which compelled many traders to sell their assets.

High quality market liquidity could continue to push ETH’s price south, which could lead to greater price fluctuations on the charts.

These massive long position liquidations are a sign that bullish power has been weak, making future leveraged entry unlikely in the coming sessions. The negative market impressions might make ETH unable to reach critical support areas. This could fuel additional massive selling that would extend the downtrend.

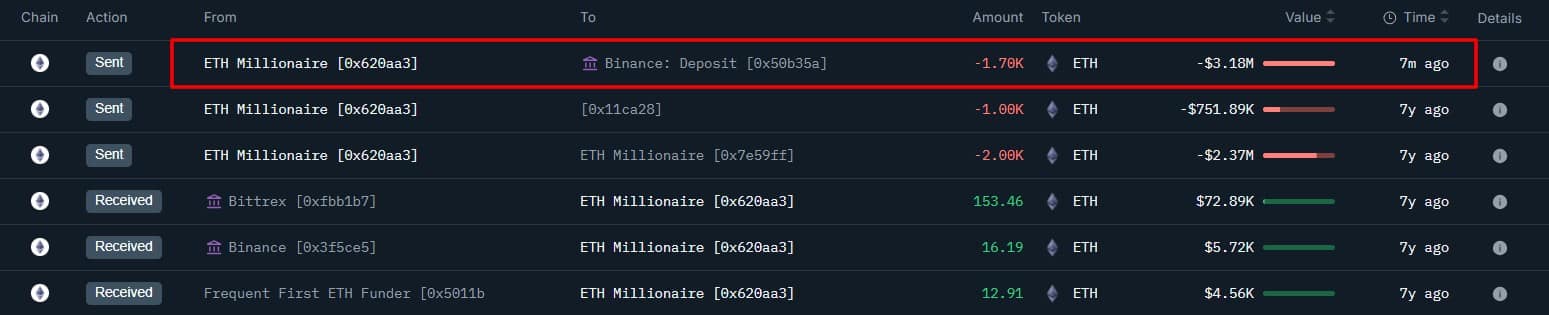

That’s not all though as additionally, an Ethereum ICO participant with no recent activity in seven years sent 1,700 ETH valued at $3.18 million to Binance.

The unusual movement demonstrated that the holder may have planned to sell their coins – A sign of sell-side pressure.

Source: Onchain Lens

Whales generate market instability by relocating their existing assets since market speculators try to predict their objectives. In this particular case, the deposited ETH might lead to real sales by investors so unfavorable market conditions could emerge for Ethereum.

However, ETH has recently showed minimal changes if the whales perform investment strategies with their funds, instead of conducting sales activities.

Max pain price level and network activity

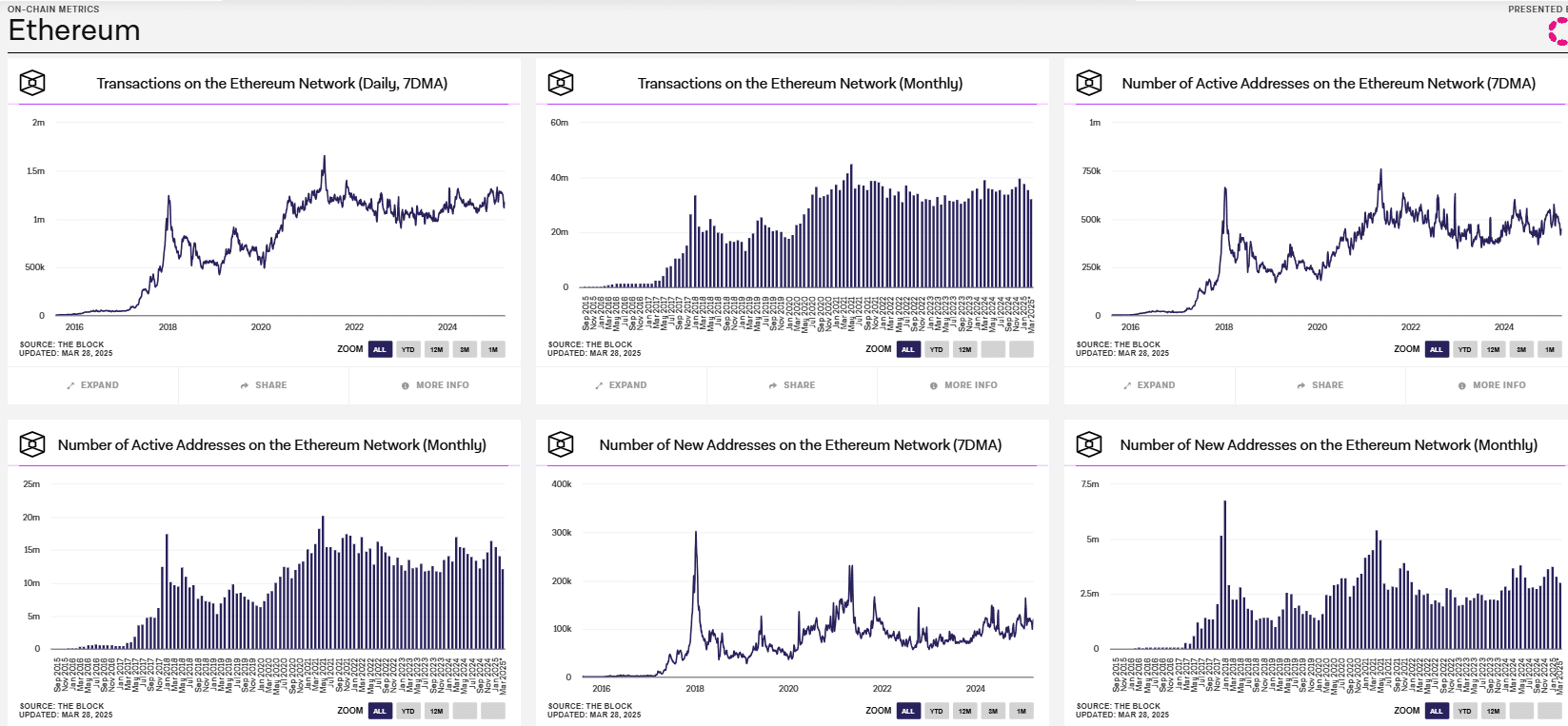

At the time of writing, bearish sentiment seemed to be emanating from the Ethereum blockchain. For example – The number of daily transactions remained around 1M as the usage steadily decreased across the board.

While transaction frequency for a month surpassed 40M, however, it fell short of reaching its peak numbers.

Active addresses stayed below 750k as user involvement seemed to be declining. And yet, the monthly active addresses totaled more than 10M – Indicative of sustained user engagement in the long-term.

New Ethereum network addresses (7DMA) revealed declining statistics since they fell to numbers under 100k. The 2.5M monthly new addresses created less maximum impact than previously recorded spikes of new addresses.

For its part, Ethereum’s price broke down through the April max pain point of $2,200 – A level that has historically served as support.

What this means is that more downside can be anticipated.

Is ETH good as an investment or as a utility network?

Right now, Ethereum might be functioning more as a primary utility system. Especially since the data suggested user addition and transaction operations did not reflect growing trends.

The appeal of Ethereum investments could fall depending on constant adoption rates remaining stagnant. The fall in network use, along with major holder sell-offs of whales and hike in liquidations of long positions, are all signs of negative sentiment. Finally, ETH’s falling price continues to create doubts about its capability to serve as an investment asset.

To put it simply, the market environment for Ethereum is unclear right now.