PI’s price to $0.75 next? – Yes, but its hike will depend on…

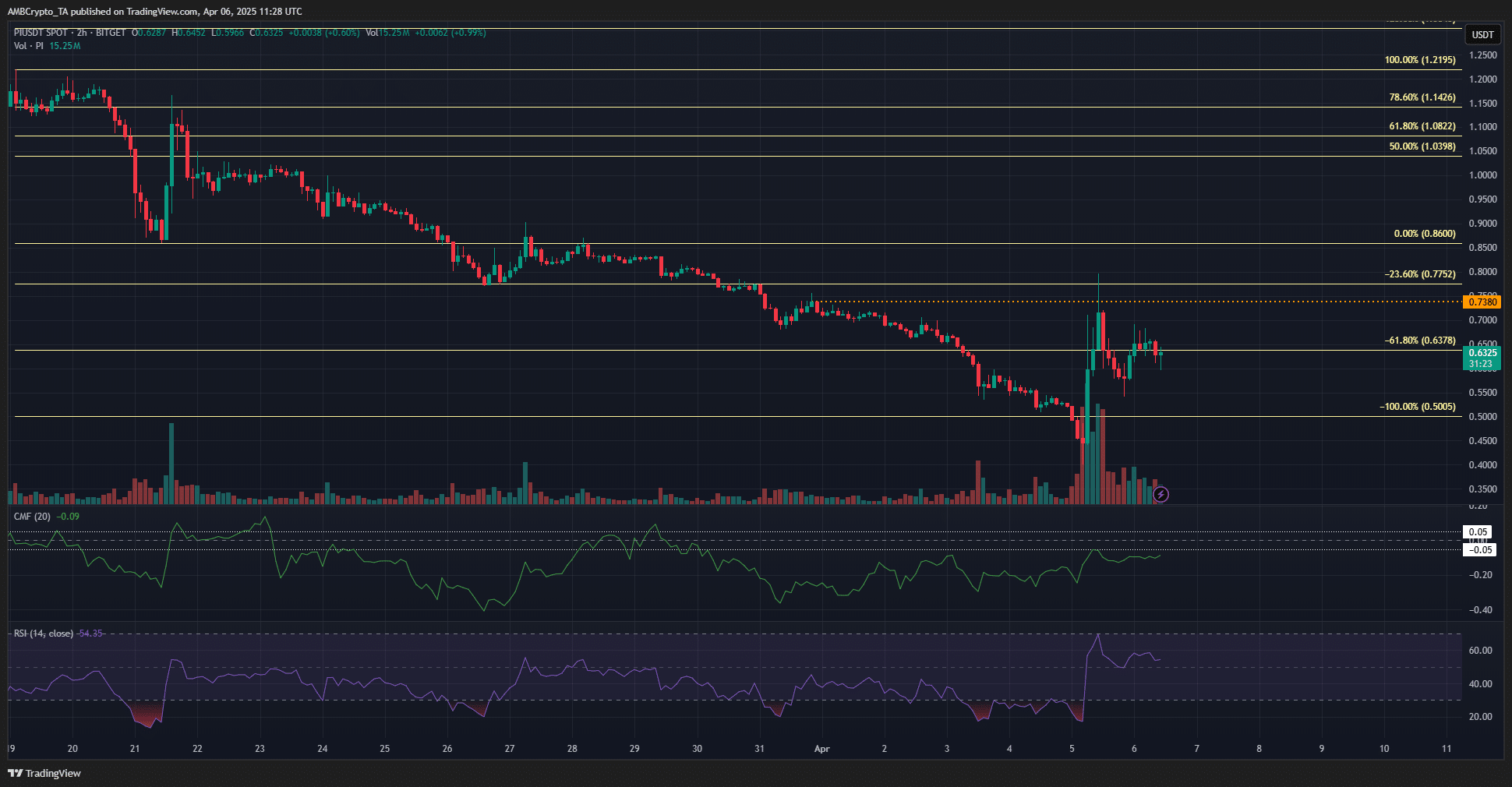

- Pi Network token saw the RSI climb above 50 to signal bullish momentum, but this could be a false alarm.

- The capital outflow and the funding rate suggested that bears were dominant.

Pi Network [PI] had been in a bearish trend in March. In an earlier analysis, it was highlighted that the Pi token would fall toward $0.64. It had fallen that low and even lower, reaching $0.4 over the weekend.

The trend has not shifted bullishly yet, even though the token saw a 99% price bounce in the 6-hour time frame, on the 5th of April.

The $0.75 was a critical resistance level in the short term. In the long term, fears of centralization persisted and helped explain the consistent selling pressure.

Pi token retests overhead liquidity pocket, bulls rebuffed

The volatility on Saturday did not end with a bullish structure break on the price chart. The $0.738 (orange) level was the lower high from March for the bulls to breach. They momentarily took prices to $0.8 but were unable to maintain the gains.

The subsequent selling pressure around the local high suggested bearish dominance. For the bulls, PI has, at best, entered a short-term consolidation phase. The $0.55 and $0.75 levels were likely to be extremes of a short-term range formation.

However, it was likely that a range might not form. This was because of the strong selling pressure, which has not eased yet. The CMF has not wandered above the -0.05 level over the past week. This meant that strong capital outflow from the PI market was prevalent.

Without a pause in selling pressure, it would be exceedingly difficult for the bulls to drive a rally. Despite the RSI being above neutral 50, bullish strength was not on display.

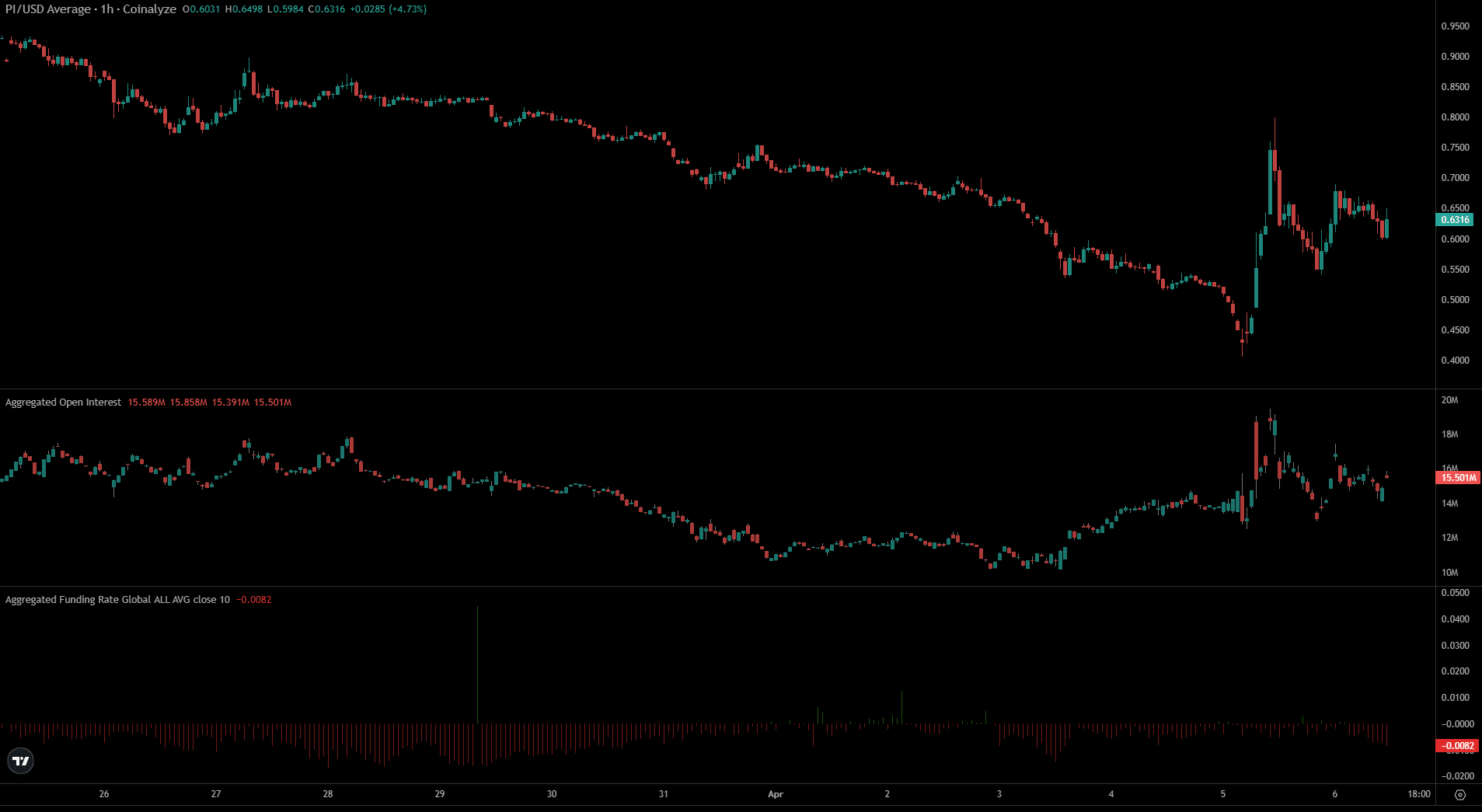

Source: Coinalyze

The Open Interest has ticked higher over the past three days alongside the wild price bounce from $0.4.

This indicated speculative interest and some bullish conviction in the short-term. On the other hand, the Funding Rate remained bearish.

Therefore, we might see a short squeeze in the coming days to trap the bullish speculators. Alternatively, if the PI price can reclaim $0.75 as support, a recovery could be in sight.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion