Bitcoin: With 2,106 whale wallets and counting, BTC’s big buyers are back! What now?

- BTC sees a shift in market sentiment, with vote up or down turning green for the first time in four months.

- Bitcoin whales are back in the market, with whale addresses hitting a 2025 high of 2106.

Over the past months, Bitcoin [BTC] has experienced extreme volatility, struggling to sustain an upward momentum. These struggles are mainly associated with growing pessimism over macroeconomic conditions.

However, after four months of pessimism and bearish sentiment, the market showed its first sign of a returning bull market just a couple of days ago.

According to Axel Adler, the Bitcoin Sentiment Vote-Up or Down metric turned green for the first time.

When this turns green, it suggests that the majority of participants are optimistic and expect Bitcoin prices to rise. Thus, social sentiment is leaning bullish with crowd psychology shifting.

Whales lead the charge

Interestingly, this change was most pronounced among large holders.

At the start of 2025, there were 2,054 wallets holding over 1,000 BTC. That number dipped to 2,038 amid rising uncertainty.

However, over the past few days, whales are back in the market and are aggressively accumulating.

The return has pushed the Number of Addresses higher, with the number of these addresses reaching 2106, which is a 2025 high.

The surge in the number of whale addresses suggests that whales are now even more optimistic compared to the market participants.

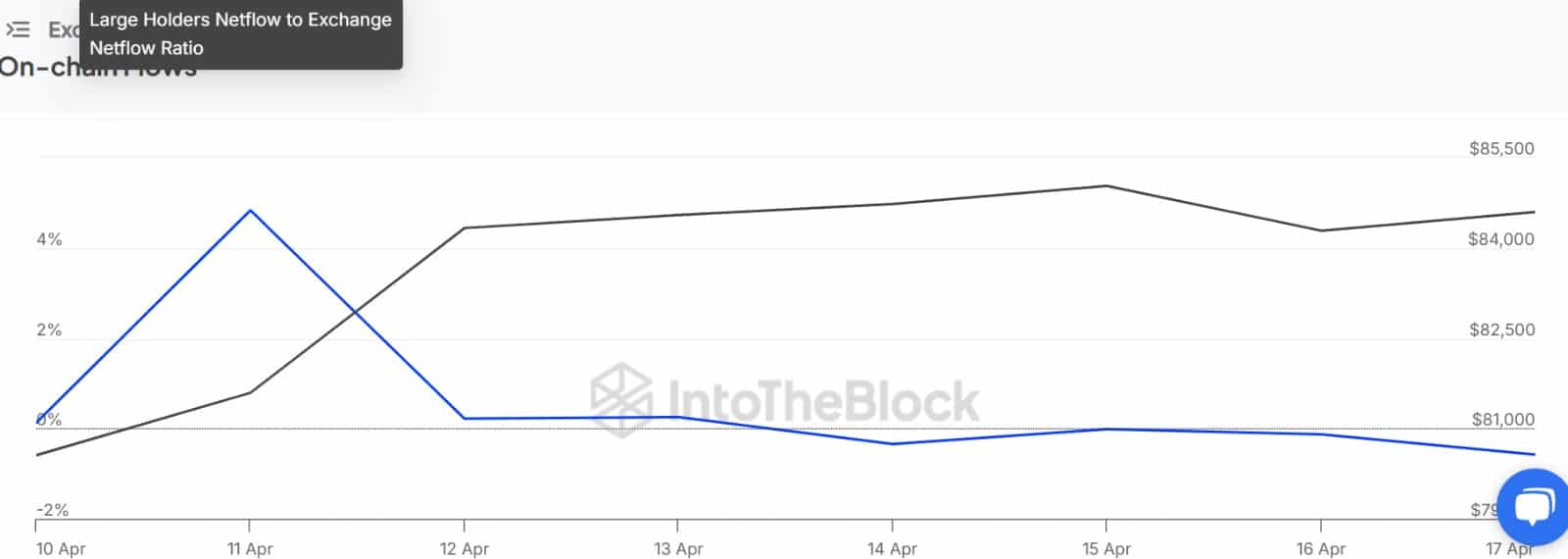

Of course, the uptick suggested rising confidence. On-chain data confirmed it—whales recorded a sustained negative Exchange Ratio for five consecutive days.

Besides whales, even other market participants have turned optimistic.

For the first time in 17 days, U.S. institutional investors have turned bullish. Looking at the Coinbase Premium Index, it has turned positive for the first time in more than two weeks.

Such a shift suggests that even U.S. investors are now anticipating Bitcoin’s prices to rise.

What it means for BTC

The shift in market sentiment reflects growing confidence in Bitcoin.

As such, most participants now expect prices to reclaim a higher resistance. When whales, institutions, and retailers shift their sentiment, it means that Bitcoin is now stable enough to see another leg up.

If optimism holds, BTC could reclaim $86,190. A sustained move might open the door to $88,500. However, if consolidation dragged and whales flipped risk-off, BTC risked slipping toward $81,616.

Either way, the market stood at a turning point. Momentum now hinged on sentiment follow-through and whale conviction.