TRUMP whales spend $6.4M – Will one dinner keep the bulls hungry for more?

- Whales have changed their minds and have begun channeling funds back into the TRUMP token as they accumulate.

- The derivatives market metric gives a mixed signal on the possible direction of the price from its current level.

In the past 24 hours, Official Trump [TRUMP] recorded a modest 1.57% gain, a sharp contrast to last week’s 79% surge.

Whale accumulation and spot market trading activity have remained high; however, some derivatives metrics show that sellers are opposing TRUMP’s attempt to repeat last week’s move.

Whales accumulate TRUMP again

In fact, whales appeared to be betting on TRUMP again, as interest reignited ahead of Donald Trump’s exclusive dinner.

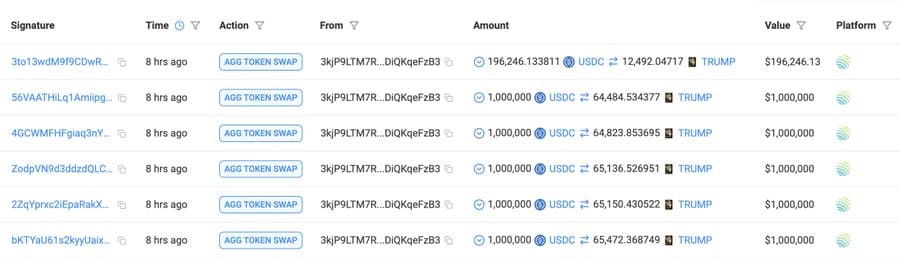

Two new whales in the market have collectively purchased a massive amount of TRUMP worth $6.42 million.

The first whale, who initially sold off their holdings, regained interest following the dinner announcement, buying 337,950 TRUMP for $5.2 million.

The other whale pivoted their trade, offloading their Fartcoin [FARTCOIN] holdings and switching to TRUMP after a $1.22 million buy. This buying activity follows two days of consistent selling from the spot market, which has now halted.

Previously, spot traders had sold approximately $27.63 million worth of TRUMP in 24 hours, stalling its earlier momentum.

A shaky stance but bullish signals

Having said that, derivatives market data reflected a fragile balance between bullish and bearish forces. This is reflected in liquidation data over the past 24 hours, which shows a near balance between short and long liquidations.

At the time of writing, $4.42 million worth of long positions were forcefully closed, while $4.37 million worth of short positions were also closed.

This near-equal liquidation level between longs and shorts implies a trade balance, with no decisive direction for price movement.

However, sentiment still leans toward long traders, as the OI-Weighted Funding Rate rises. The OI-Weighted Funding Rate compares multiple derivatives market metrics to predict the market’s potential direction.

With a positive reading of 0.0116%, it suggests the market is in a bullish phase, likely to continue rising.

TRUMP bears still lurk

Despite bullish signals, the Funding Rate has continued to stay negative. At the time of writing, the funding rate dropped to -0.0019.

A dip into negative territory implies that short traders are paying a premium in fees to maintain their positions.

This setup gives short traders an advantage, with more active positions compared to long traders. Additionally, Derivatives Trading Volume remains negative, currently below 1, reinforcing bearish sentiment.

The Long-to-Short Ratio, which indicates whether buying or selling volume dominates, shows sellers in control.

If this ratio continues to stay below 1, TRUMP’s price is likely to experience further declines.