As Bitcoin nears $105K, will BTC cross a new all-time high? – Assessing…

- BTC’s 3-month momentum has turned green – but similar setups have ended in sharp reversals.

- Funding Rate and RSI suggest growing optimism, but volume and resistance at $105K demand caution.

Bitcoin [BTC] is back in the green on a three-month timeline, showing a potential shift in market momentum. But while the uptick has sparked cautious optimism, seasoned traders aren’t celebrating just yet.

Past setups like this have led to sharp reversals, keeping traders cautious.

With Bitcoin approaching the critical $104,000-$105,000 zone, the next few days will be pivotal—will the rally hold or fade quickly?

Bitcoin: Why the 3-month momentum matters

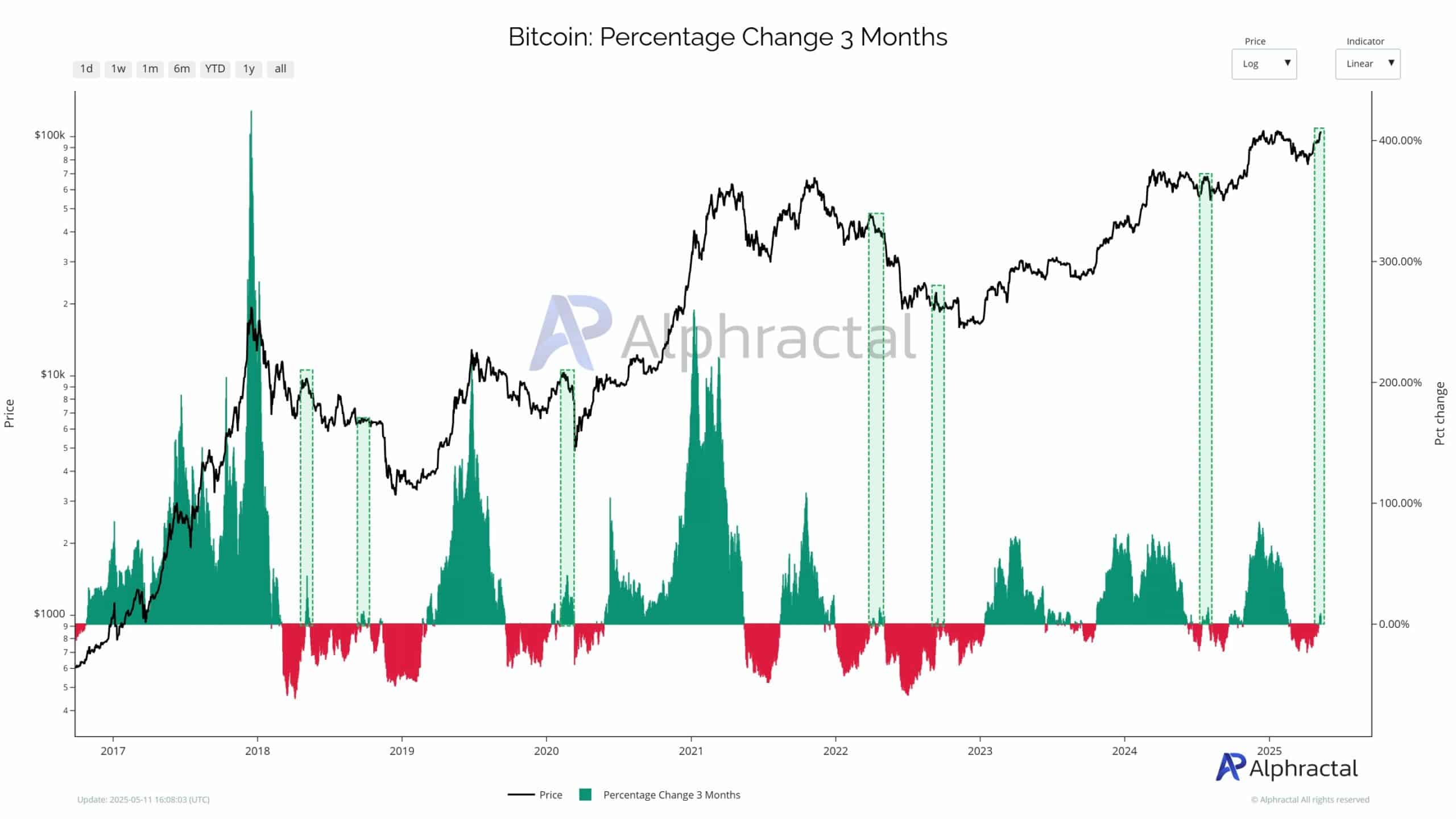

Recent data shows Bitcoin’s 3-month percentage change flipping decisively into positive territory – a signal that has historically preceded major market moves.

While this uptick can hint at brewing momentum, it’s not always bullish.

Past cycles reveal that similar green flips often occurred right before sharp rug pulls, catching traders off guard. The chart shows these percentage changes beneath the BTC price line, clearly marking moments of abrupt reversals.

In short: the current setup demands caution. Momentum is building, but without sustained follow-through, especially above the $104K–$105K level, it could once again be a bull trap in disguise.

Historical precedents and trader sentiment

The positive flip historically cuts both ways.

In early 2018, mid-2019, and late 2021, similar green reversals preceded sharp downturns, trapping momentum traders in painful rug pulls. Today’s setup is similar, making caution essential.

Complementing this backdrop, the aggregated funding rate has been steadily rising, peaking at 0.0132 at press time.

This indicates growing bullish sentiment as traders lean long, though not yet at euphoric levels. If the funding rate continues climbing, the market could become volatile.

The 104K-105K barrier

Bitcoin was testing the $104K-$105K resistance zone at press time, with momentum indicators showing uncertainty.

The RSI reached overbought territory at 74.46, suggesting a possible pullback unless bulls sustain pressure. Meanwhile, the OBV remained subdued, indicating that volume isn’t fully supporting the rally.

Both the 50-day and 200-day SMAs sit comfortably below, showing that long-term support remains intact.

If BTC breaches $105K with strong volume, a breakout toward new highs is possible. But without a volume surge, rejection and consolidation remain likely.