A different kind of ATH for Bitcoin and why it might matter

The Bitcoin network made headlines this week after its hash rate managed to reach a new all-time high of 248.11 million terahashes per second. However, a slight drop was noticed on 14 February. Even so, there was strong support for a continued trend towards accelerated security on the network.

A deeper look at the contributing mining pools highlights that the Foundry pool has been dominating the hashrate for a while now. It even became the top Bitcoin mining pool in December last year. Interestingly, at the time of writing, it contributed 17.58% of the network’s total hash power; it had begun operations in June last year.

Foundry’s inception can be traced back to China’s blanket ban on Bitcoin mining in May last year. The effects of which were far-reaching due to the concentration of mining in the country. One of its biggest consequences was a shift in mining power to the USA. Companies like Foundry set up their shop in the country’s rural pockets, majorly in the states like Georgia and Texas.

Other companies have also followed Foundry’s model of picking up China’s losses. Thereby, making profits enough to become assets in Valkyrie’s new BTC mining ETF. No wonder many firms in the space can’t keep their hands off the sector. For instance, Bitfinex and Tether announced their own mining investments recently.

#tether and #bitfinex have been investing in #bitcoin mining recently. Our strategy is ensuring enough geographical and political diversity as a priority VS 1/2 cent electricity.

Cheap electricity can create concentration. Good for companies, not necessarily the best for BTC.— Paolo Ardoino (@paoloardoino) February 13, 2022

The mining craze has also been boosted by a positive push from politicians, many of whom have publicly invited the mining industry to set up shop in their state. Inclusive legislation has similarly accompanied this shift, with the Treasury Department recently claiming that crypto miners are not subject to tax reporting obligations. States like Kentucky and Wyoming already offer tax concessions to miners in a bid to attract the profitable industry to their region.

In fact, 2021 alone saw a total of 33 states pass bills supporting their cryptocurrency infrastructures, while 17 enacted new laws. USA’s mining infrastructure has gotten big enough. Also, Russia has been taking note of it. Positive regulations surrounding the industry are being expected soon.

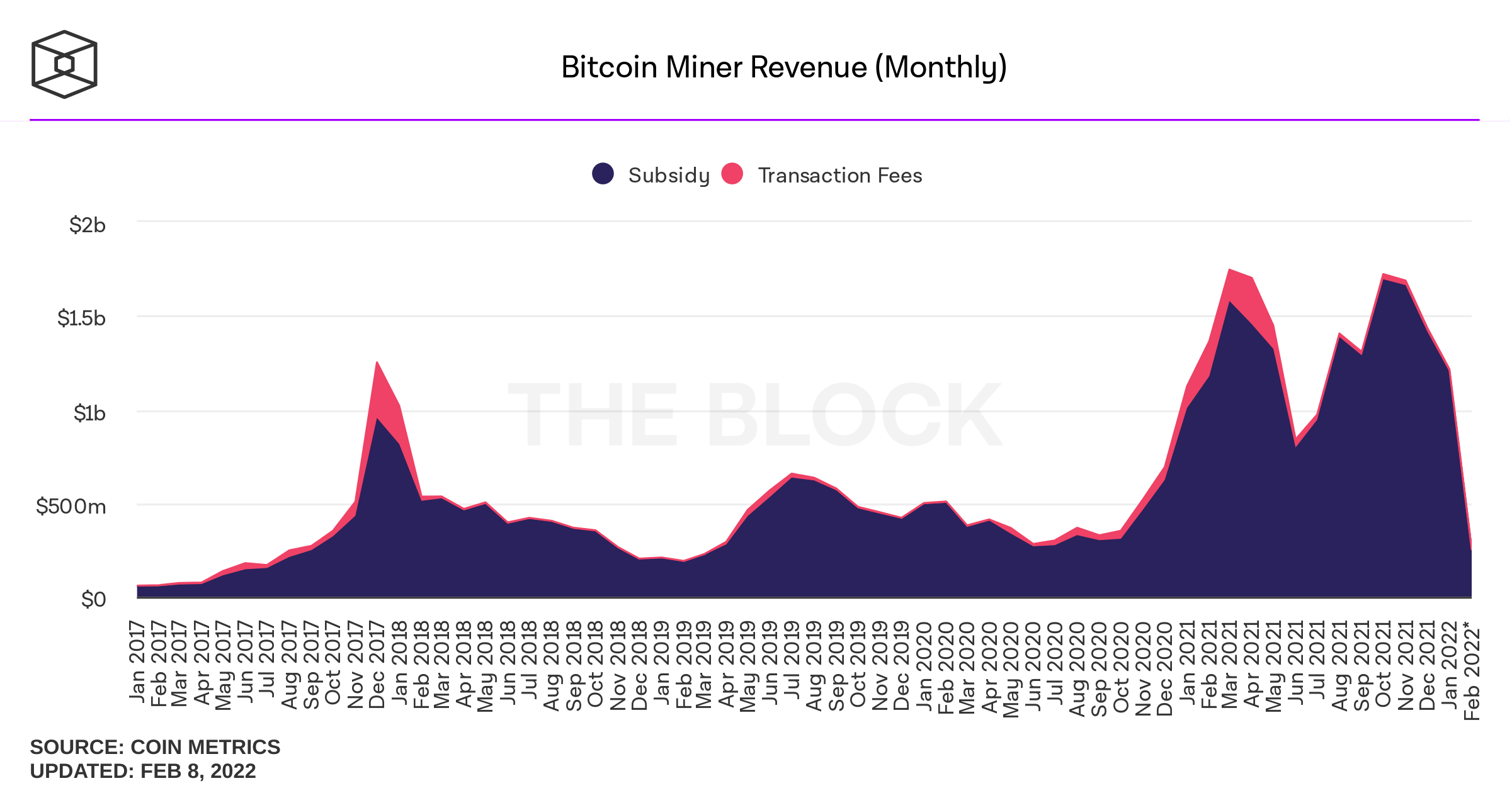

However, this growth spurt has not translated well for miners who on the contrary have seen their monthly revenues drop significantly since touching a new high in October 2021. This was around the same time when BTC’s price reached its new ATHs.

A fall in the adjusted on-chain volume and new addresses joining the network might have contributed to this trend further which had already been set in motion through the block halving that took place last year. As miner rewards get slashed further due to the halving, security on the network is expected to be ensured through the transaction fee.

However, this too has gone down significantly over the past year, 93.57% to be precise, thanks to scaling solutions such as the lightning network. Consequently, its contribution to mining revenue has also gone down in tandem, further lowering the miner’s income. Notably, it is difficult to examine if the increased hash rate will benefit investors. However, one thing can be ascertained, the ATH hash rate of Bitcoin will definitely have an impact on its price going forward.