A look at how the crypto market fared in Q3

- The 90-day historical volatility plunged to multi-year lows in September.

- The woes of the world’s largest crypto trading platform Binance continued in Q3.

The third quarter of 2023 extended the crypto market’s low volatility era, which began in the final months of Q2. Barring intermittent bouts, the sector failed to show sustained price movements in either direction, frustrating both market bulls and bears.

Crypto market in hibernation

According to a quarterly report published by crypto market data provider Kaiko, the 90-day historical volatility plunged to multi-year lows in September. Infact, the top two assets in the sector, Bitcoin [BTC] and Ethereum [ETH], recorded less volatility than the oil market.

As seen over the years, most traders have been drawn to cryptocurrencies owing to their high volatility. After all, they utilized the rapid price fluctuations to flip coins for quick profits.

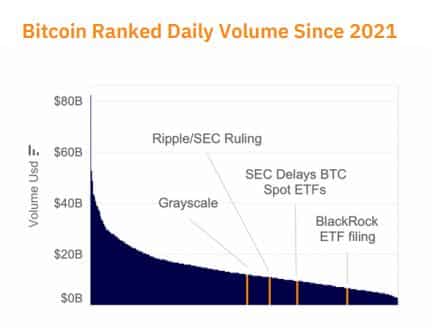

However, as prices remained confined to tight trading ranges, active traders significantly curtailed their market participation. Bitcoin’s spot volume averaged $6 billion throughout Q3, down from $7 billion in Q2 and $13 billion in Q1, data showed.

Interestingly, even major legal wins like the Grayscale verdict in August failed to provide a decisive swing in the market.

Spot ETF optimism failed to activate the market

Most of the excitement around the market in Q3 was rooted in the anticipated approval of several Bitcoin exchange-traded funds (ETF). If green lighted by the U.S. Securities and Exchange Commission (SEC), these financial instruments would offer an easier way to gain exposure to crypto assets.

Notably, Ark Invest and 21Shares were the early movers when it came to filing for a spot Bitcoin ETF. The pair filed the application earlier in April, followed in June by a rush of applications from other TradFi titans such as BlackRock.

However, Q3 was synonymous with delays and uncertainty surrounding spot ETFs. Recently, the SEC deferred a decision on proposed ETFs from Ark and 21 Shares for the third straight time.

The SEC has a maximum of 240 days to approve or deny an ETF from the date of the filing. This meant that the regulator would reserve its verdict until at least January 2024.

Kaiko noted that “ETF enthusiasm proved short-lived and failed to provide a significant catalyst” to the market in general and Bitcoin in particular.

Binance goes deeper in misery

The woes of the world’s largest crypto trading platform continued in Q3. Unrelenting regulatory pressures forced the crypto behemoth to shut shop in Germany and Russia, even as it was battling a lawsuit in the U.S.

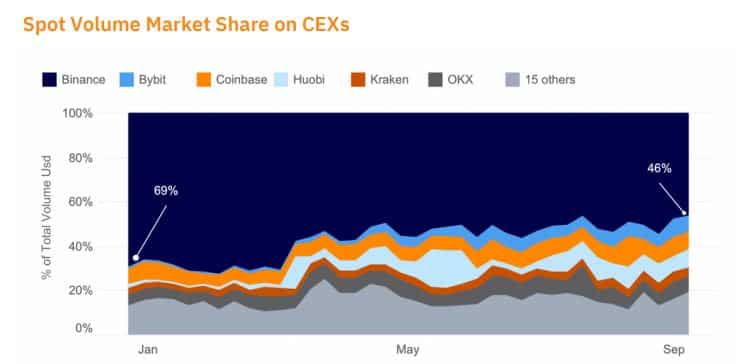

Note that Binance had withdrawn from other major markets like the UK and Australia earlier in the year. As a result, Binance’s spot market share narrowed further in Q3, dropping from 69% at the start of the year to 46% at the end of September.

However, despite the fall in market share, Binance, along with a few other major players, accounted for the bulk of the trading activity in the market.

As per the report, liquidity in the market became more concentrated. Just eight trading platforms were responsible for 90% of global market depth and trading volumes. Infact, Binance alone accounted for more than 30% of market liquidity.

Highly concentrated markets meant that liquidity was not distributed evenly across exchanges. The fundamental problem with this asymmetry was that the collapse of one entity had the potential to pull the entire market down.

The collapse of the FTX exchange last fall serves as the most significant example that could be used to support this argument.

The case of XRP and other alts

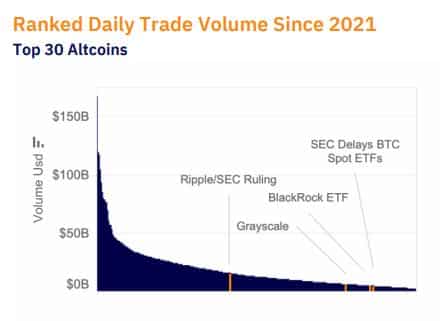

One of the highlights of the last quarter was the verdict on the hotly-contested legal battle between the SEC and Ripple Labs [XRP].

The court’s judgement exonerating Ripple of wrondoings in the sale of XRP tokens to individual investors resulted in a brief but intense spell of trading activity. In fact, XRP eclipsed BTC and ETH in market share temporarily.

However, once the euphoria passed, XRP’s gains were reversed, and transaction volumes trended lower in the next two months.

Moreover, the expectations of an XRP-induced market-wide altcoin rally failed to come to fruition. The top 30 altcoins’ average daily trade volume was $5 billion in Q3, down from $6 billion in Q2 and $7 billion in Q1.