A look at Solana as it logs a surge in revenue, prices and more

- Solana’s TVL remained above the $1 billion level for multiple weeks.

- SOL was down by 2% in the last 24 hours, and market indicators were bearish.

Solana’s [SOL] Total Value Locked (TVL) has been rising since the beginning of this year. In fact, the metric continued to hold at its highest value since January 2023. This was encouraging, as it indicated that the number of assets that were being staked on Solana was high.

Is your portfolio green? Check the Solana Profit Calculator

Apart from TVL, its revenue also gained an upward momentum, which was positive for the blockchain’s growth. A closer look at Solana’s overall ecosystem provided a better understanding of its growth.

Bird’s-eye view of Solana

As per DeFiLlama’s data, Solana’s TVL remained comfortably above the $1 billion level for multiple weeks. This also translated into a hike in blockchain revenue.

The chart pointed out that after a decline, SOL’s revenue gained upward momentum in the middle of June 2023. Apart from that, a hike in the blockchain’s daily active addresses was also noted.

However, not everything was in SOL’s favor, as its popularity in the decentralized space declined. This was evident from the drop in its DEX volume. On top of that, SOL’s daily transactions also fell over the last few weeks.

A similar declining trend was also seen in the blockchain’s NFT ecosystem. For instance, Dune’s data revealed that SOL’s daily NFT transactions plummeted over the last month.

Moreover, SOL’s total NFT trade volume sank sharply, as did its number of unique addresses that bought less than $1,000 and more than $100,000 of NFTs last month.

Solana’s price responded accordingly

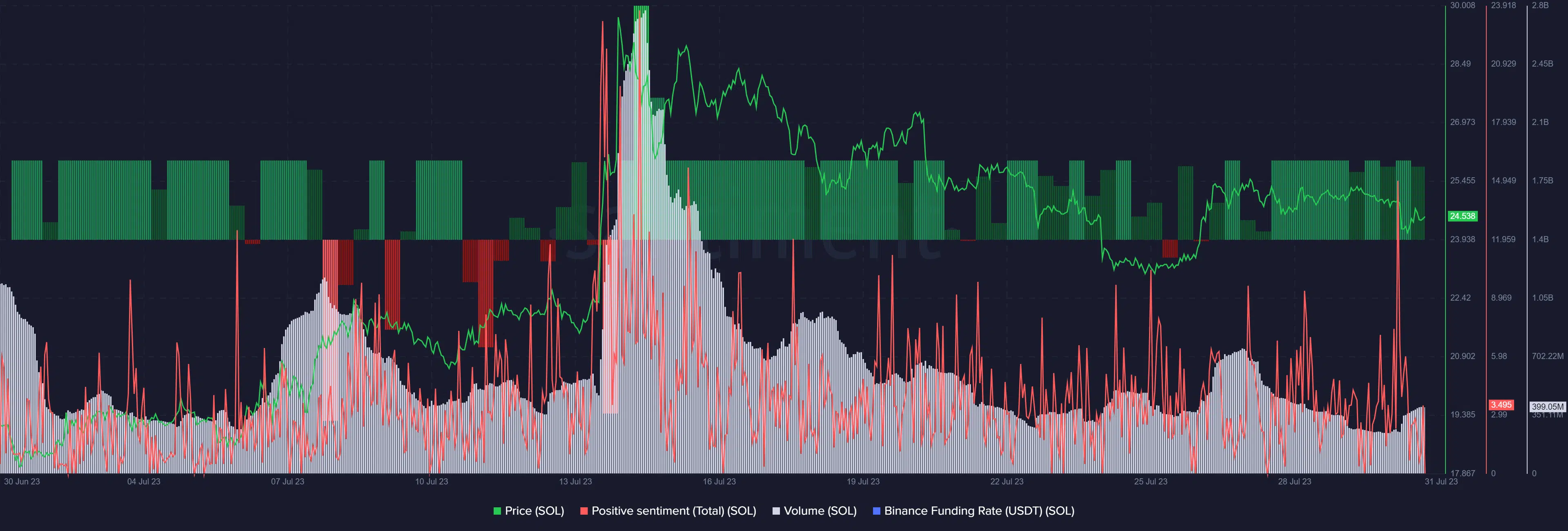

Solana’s achievements in the DeFi space had a positive impact on its price as the token’s value rallied last month. Its price went near the $30 mark in mid-July, which was bullish. The hike in its price also allowed it to flip quite a few cryptos and become the 9th largest by market capitalization.

During the bull rally, SOL witnessed a massive uptick in its volume. Positive sentiment around the token remained high, reflecting investors’ confidence. SOL also remained in demand in the derivatives market, which was evident from its green Binance funding rate.

SOL investors should consider this

Though the last month’s gains were encouraging, the bears have buckled up. According to CoinMarketCap, SOL’s price declined by nearly 2% in the last 24 hours alone. At press time, it was trading at $24.55 with a market cap of over $9.9 billion.

Read Solana’s [SOL] Price Prediction 2023-24

The price decline was accompanied by a considerable increase in its trading volume, which is typically bearish. SOL’s MACD displayed a bearish edge in the market.

Additionally, the Bollinger Bands revealed that the token’s price entered a less volatile zone, decreasing the chances of a sudden northbound movement.