‘A new era begins – The Stablecoin Multiverse,’ claims Tether CEO Paolo Ardoino

- Tether CEO Paolo Ardoino envisions a “stablecoin multiverse,” with rising adoption by firms and governments

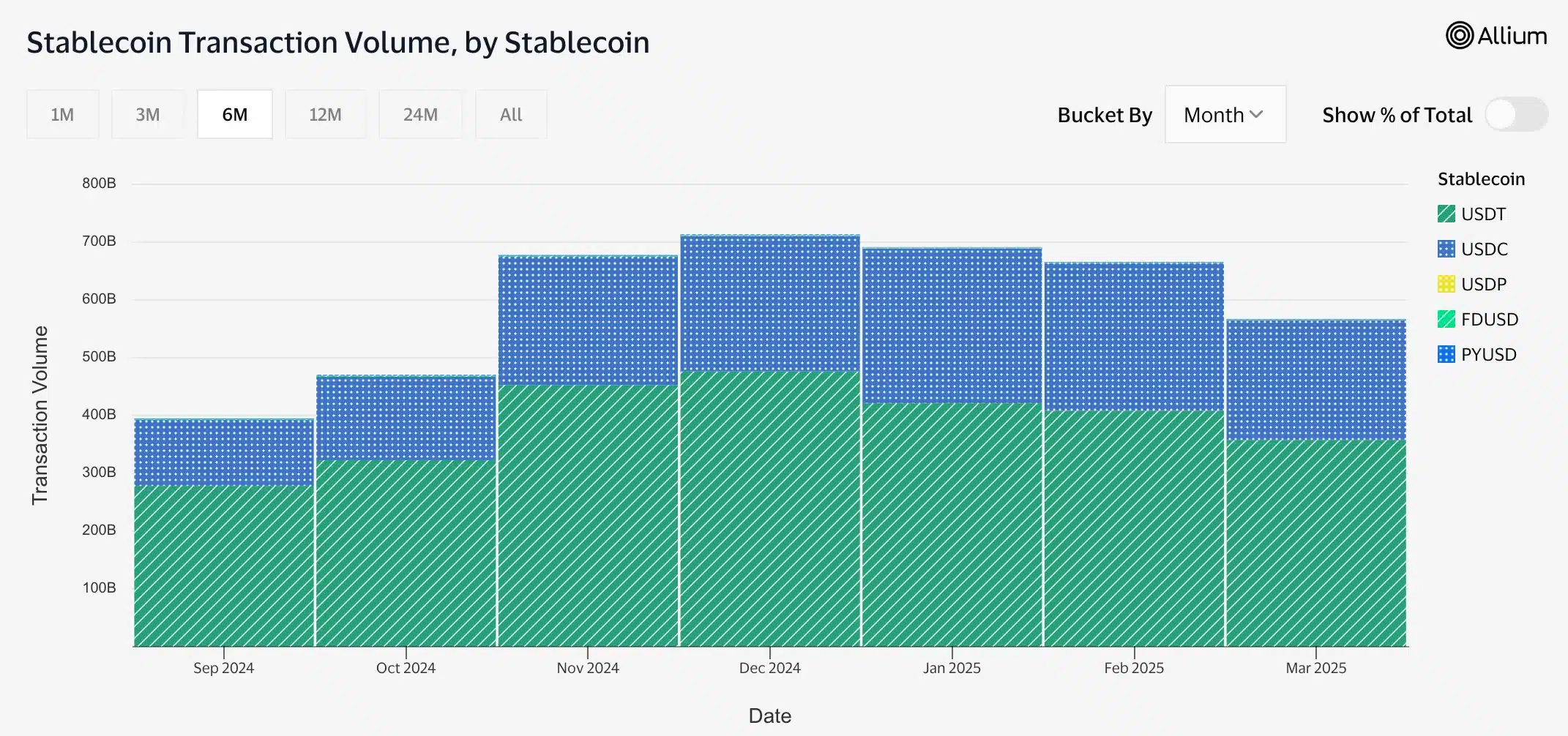

- USDT leads in transaction volume, but USDC’s rapid growth is a sign of increasing competition in stablecoins

Amid the broader market downturn, Tether CEO Paolo Ardoino has introduced a bold vision for the future of digital assets, dubbing it the “stablecoin multiverse.”

In a recent statement, Ardoino emphasized the increasing role of stablecoins in the global financial system, predicting widespread adoption by both private enterprises and government entities.

Taking to X, Ardonio noted,

“A new era begins : the stablecoin multiverse. Hundreds of companies and governments are launching (or will soon) their stablecoins. I’m very proud to see such massive adoption of a technology that Tether created back in 2014. Good luck everyone.”

What led to Ardonio’s prediction?

This statement followed the one shared by Fidelity Investments recently. The firm made headlines after it revealed its entry into the stablecoin space, signaling the growing interest of major financial institutions in this rapidly expanding sector.

The firm’s digital assets division, which already facilitates execution and custody services for Bitcoin [BTC], Ethereum [ETH], and Litecoin [LTC], is spearheading the initiative.

That being said, in a separate tweet, Ardoino added,

“Today Tether USDt has (conservatively) more than 400 million users across the world. Soon 1 billion. We always focused on the adoption from the ground up, working in the streets, among other people, while traditional finance was watching at us from their ivory towers. That’s the difference. That’s why we’re unstoppable together.”

Worth noting, however, that this was not appraised well by the crypto community. Some like Criptovaluta.it highlighted,

“It seems like everyone thinks it’s an easy business. Spoiler: it’s not.”

Is USDC overpowering USDT?

On the market front, Circle’s USDC has been rapidly gaining traction, recently hitting a record market cap of $60.2 billion – Surpassing its previous 2022 peak of $55 billion.

Over the past 3 months, USDC has significantly outpaced Tether’s USDT in growth, expanding its supply by $16.6 billion compared to USDT’s $4.7 billion.

Despite USDT’s dominance due to its deep liquidity and widespread adoption, USDC’s strong regulatory compliance, fully backed reserves, and institutional partnerships are making it a formidable competitor.

Metrics suggest otherwise

However, as per data from Visa on-chain analytics for March 2025, Tether still dominates the stablecoin market. USDT, at press time, recorded a staggering $357.35 billion in transaction volume, significantly outpacing USDC’s $207.80 billion.

Other stablecoins like FDUSD and PYUSD have also contributed to the growing sector. Even so, the gap between USDT and its competitors remains evident.

Therefore, despite who dominates the stablecoin market, given this kind of overall growth, the stablecoin era might arrive sooner than expected.