A sneak peek into what the next few days will look like for Solana-Serum duo

The past week has been quite underwhelming for most of the market’s tokens. Coins like Solana and Serum that had once embarked on independent rallies, also ended up succumbing to the broader market downtrend this time.

The price of SOL, by and large, remained stagnated around the $200 mark, while SRM hardly moved beyond $5.

Sustained dip?

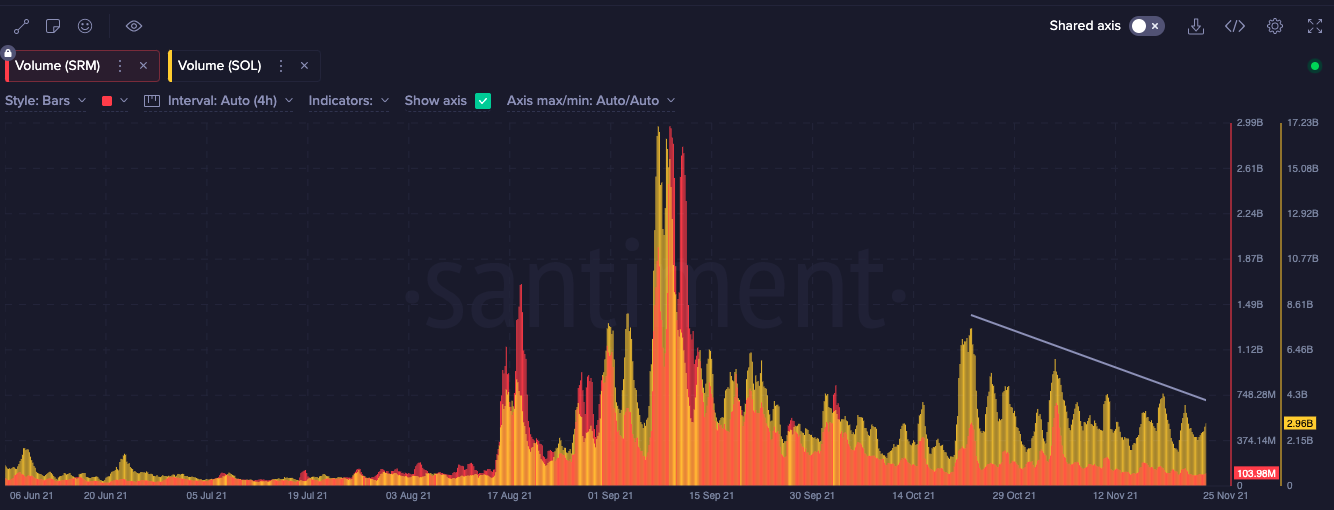

Towards the end of October, both Solana and Serum’s volumes started making consistent spikes on the charts. However, the aforementioned trend couldn’t carry forward to November.

As can be seen from the chart attached below, the alts’ volumes have started inching down south on almost a daily basis. Well, insufficient volumes indicate the lack of momentum and the fading interest of market participants.

Thus, it is quite crucial for this metric to change its direction, for the underlying alts’ prices to witness some action.

Source: Santiment

In effect, both Solana and Serum’s Sharpe ratio have massively shrunken over the past few days. Just a week back, this metric for Solana was hovering around 6, but, at the time of writing, the same merely reflected a value of 0.74.

Things seemed to be even worse for SRM. This metric straight away dived into the negative territory over the past week and projected a reading of -3.09 at press time.

What this means is that the new investors who’ve entered the Solana/Serum market aren’t being fetched with adequate returns for the risk borne by them. In effect, there’s not much incentive for others to get into their arena.

Source: Messari

Despite the not so glossy state of the price and the aforementioned metrics, both the coins have been able to keep up with their market-cap dominance. At the time of writing, SOL had a 2.6% influence in the overall market while SRM was also seen hovering around its usual 0.04% mark.

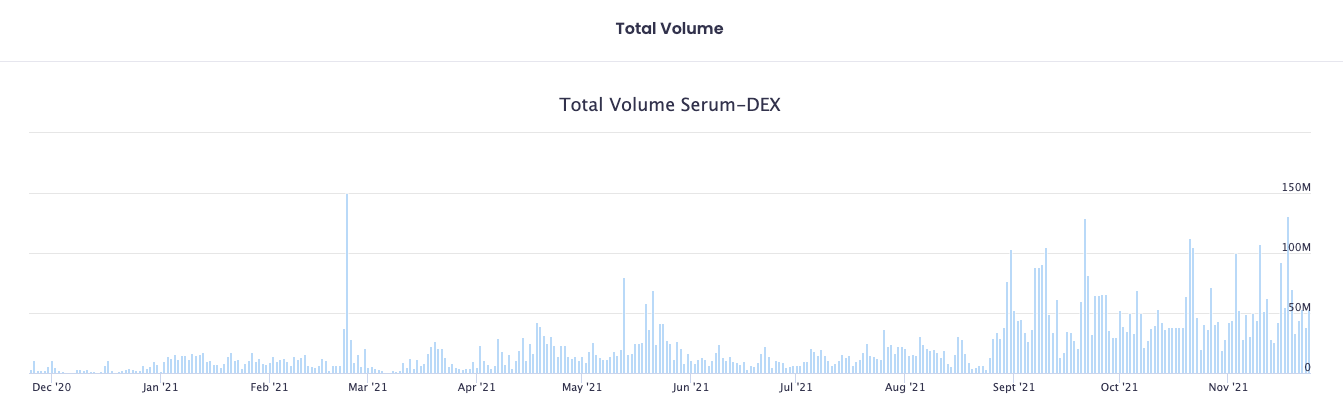

Further, the trade volume on Serum’s DEX has been more inclined towards the upside. Well, it is a known fact that Serum is a decentralized exchange built on Solana. The high DEX volumes, as such, indicate an increase in adoption. Now, the same is fairly a good sign for both Solana and Serum.

Source: stelareum.io

The NVT ratios of both the networks further witnessed a macro level improvement. What this means is that their respective valuations are outpacing the value being transferred on their networks. This, to a large extent, is indicative of their growth phase.

Source: Messari

Even though the state of the sentiment and returns-related metrics aren’t quite healthy at the moment, it shouldn’t be forgotten than both Solana and Serum’s fundamentals remain quite strong. The next few days would be quite tricky for both alts.

However, if they manage to sail through this phase and momentum re-enters their respective markets, nothing much would stop their surge.