Aave [AAVE]: As demand for wstETH on the protocol rises, can it bring in new users

![Aave [AAVE]: As demand for wstETH on the protocol rises, can it bring in new users](https://ambcrypto.com/wp-content/uploads/2023/05/unnamed.jpg.webp)

- Demand for wstETH surged as Aave witnessed a rise in network activity.

- However, the demand for the AAVE token remains low.

In the DeFi lending market, protocols such as MakerDAO[MKR] and Compound Finance were seen making large improvements and achieving immense growth. However, the demand for wstETH on Aave [AAVE] indicates that Aave might soon make its mark in this competitive space.

Is your portfolio green? Check out the Aave Profit Calculator

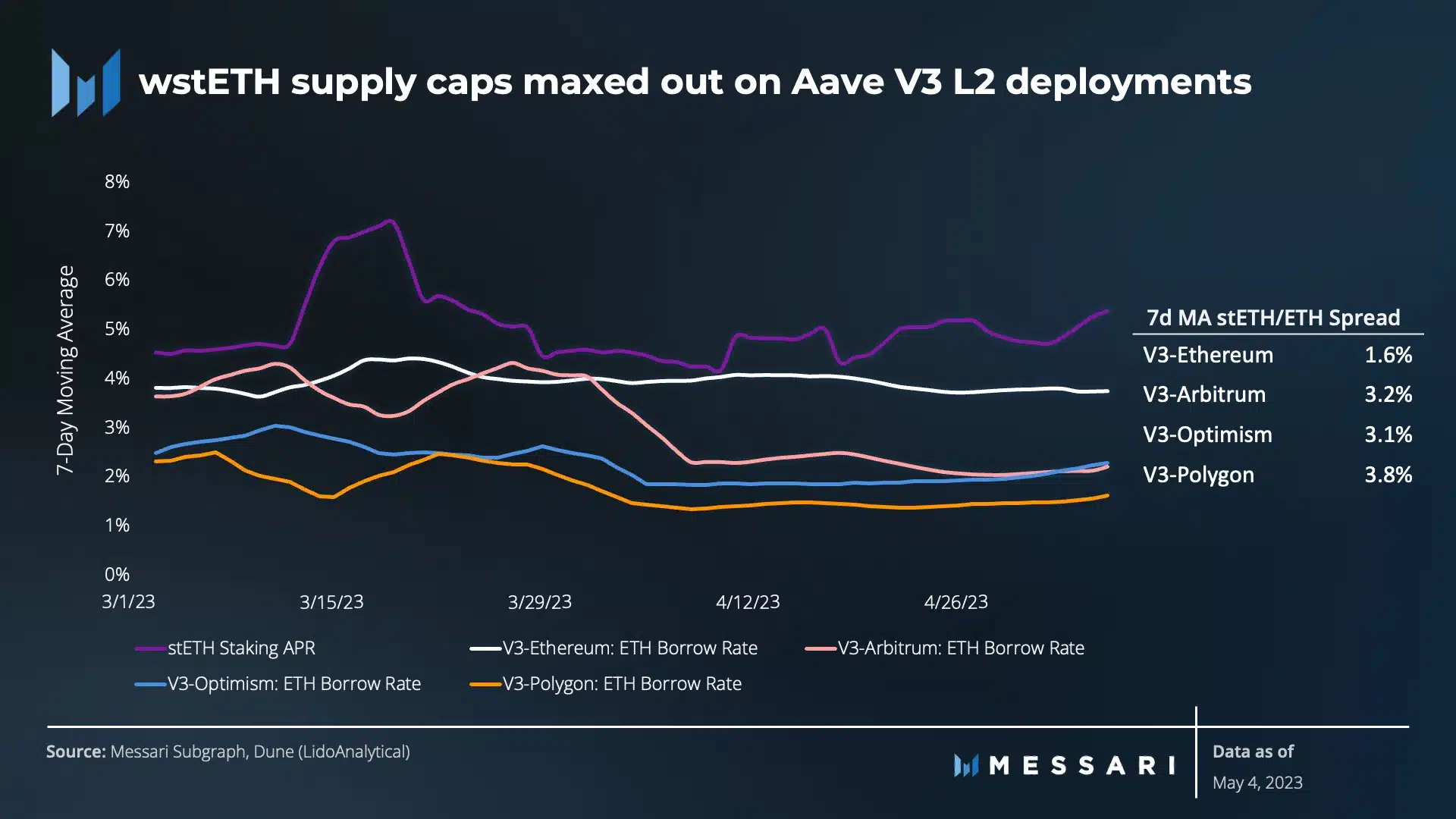

As per Messari’s data, the supply limit for wstETH was reached on the Aave V3 Polygon market within just two days of its introduction.

This outcome was anticipated as Aave’s Arbitrum [ARB] and Optimism [OP] markets experienced maximum wstETH supply caps for the past 30 and 17 days, respectively.

At present, the Ethereum [ETH] borrowing rates on Aave’s layer-two (L2) markets are approximately two times lower than those on the Ethereum network.

This resulted in a significant increase in the expected return of leveraged stETH/ETH positions, which entails supplying wstETH, borrowing ETH, and swapping ETH for wstETH.

It is probable that the L2 Ethereum borrowing rates will gradually move towards the rates observed on the Ethereum network. It is expected to happen as the wstETH supply caps are expanded and additional L2 solutions are adopted.

Nevertheless, there are chances that any increase will be protracted, as the spike in supply caps is subject to liquidity prerequisites and approvals by the DAOs.

An example of this would be the existence of an ongoing vote on the Aave governance platform. The goal of which was to raise the wstETH supply cap from 6,000 to 12,000 on Optimism.

The current state of Aave

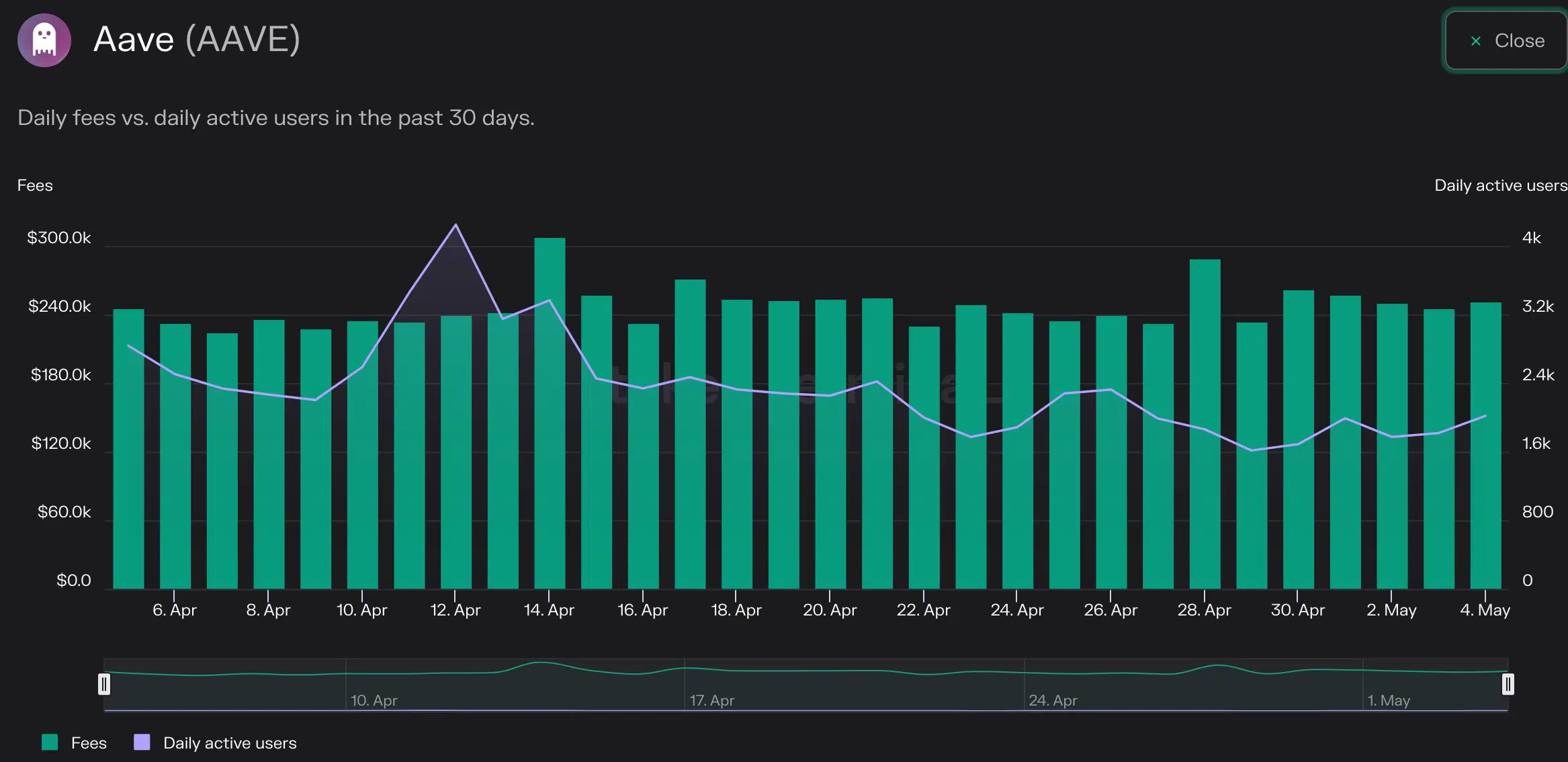

Due to the high demand for wstETH, Aave’s protocol health has improved. Over the last week, the number of daily active addresses on the network increased by 8.4%.

As a result, the fee generated by Aave also began to surge and observed a spike of 6.4%.

Realistic or not, here’s Aave’s market cap in BTC’s terms

However, despite the positive growth experienced by Aave, its token did not witness similar developments. Over the last month, the price of AAVE fell significantly. Coupled with that, whale interest in the token started to shrink as well.

Network growth of AAVE also fell during this period. This showed that new addresses weren’t interested in the AAVE token at press time.