Analysis

AAVE consolidates losses above $61

AAVE was in a tight bearish grip amidst increasing uncertainty and leverage to sellers.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- AAVE price slumped below $69 amidst heavy macro headwinds.

- Range-bound extension on the cards ahead of US Jobs reports.

Aave [AAVE] sustained more losses from mid-July due to increasing market uncertainty. Notably, macro headwinds like shrinking global liquidity and the recent Fitch Ratings’ US credit downgrade have worried some investors.

Is your portfolio green? Check out the AAVE Profit Calculator

Over the same period, AAVE dropped from $88 to around $63 since mid-July, a >25% loss. Consequently

, Bitcoin [BTC] recorded losses, too. At the time of writing, BTC was below the range-low of $29.5k, reinforcing a likely bears’ leverage into the weekend.But the July US Jobs report, scheduled for 4 August 2023, could induce some little volatility into the weekend.

Further weakening after a breach of $69 support

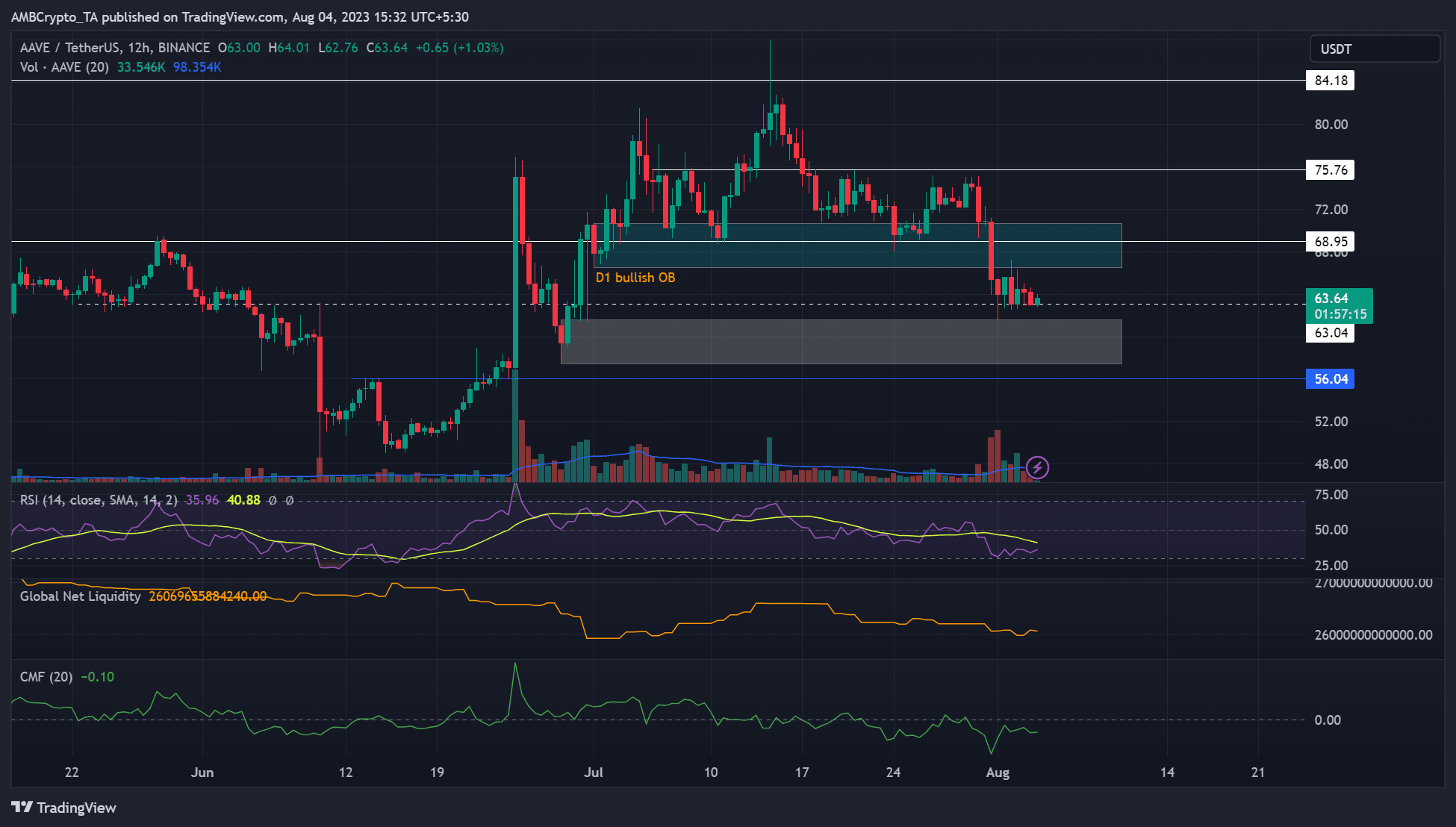

AAVE higher timeframe charts, especially the H12, weakened further after price action breached a key bullish order block (OB). The previous D1 bullish OB of $66.5 – $71 (cyan) aligned with support in March/April/ May of $68.95 but was flipped to a bearish breaker.

The move reinforces the sellers’ edge.

But the extended drop steadied and consolidated above another bullish OB of $57 – $62 (white). It shows AAVE consolidated losses above the immediate next support level. But a solid corrective rebound was still unlikely, according to price chart indicators.

For example, Global Net Liquidity, which tracks the availability of liquid assets in the global finance system, spiked in the first half of July and tanked later.

The indicator is yet to improve at press time and could affect capital injections into AAVE, as confirmed by the below-average Chaikin Money Flow (CMF).

In addition, the Relative Strength Index recorded a slight improvement but remained in the lower range, further reinforcing sellers’ edge around the weekend.

So, AAVE could extend its range trading between the bearish breaker ($66.5 – $71), cyan, and the next support zone ($57 – $62), white. Investors can seek gains by targeting range extremes.

Sellers’ little edge

Based on AAVE metrics from Cryptometer, sellers had little vantage ahead of the US Jobs report and weekend. Notably, 24-hour sell volume, as of the time of writing, was dominant at >51.2%, worth $6.5 million.

How much are 1,10,100 AAVEs worth today?

Besides, spot volume dropped by over 25% over the same period, which could further tip the scale in favor of short-sellers.

AAVE’s futures market metrics were also negative. According to Coinglass, the volume and Open Interest rates tanked by >40% and 8%, respectively. Collectively, the above metrics reinforce a bearish bias into the weekend.