AAVE eyes 30% rally despite key hurdles – How it can happen

- AAVE is on the verge of a rally, but two major obstacles ahead could hinder its progress.

- Liquidity flow to Aave has been high, with market participants placing bets.

Aave [AAVE] is beginning to recover after recording a major market loss of 30.91% in the past month.

Press-time data showed that in the past week alone, the asset has rallied 6.66% and has added another 1.40% in the past 24 hours.

Analysis shows that growing liquidity into the Aave protocol has contributed to this growth, and the asset could benefit further once it overcomes major barriers that might hinder its potential upward rally.

Rocky path ahead for AAVE

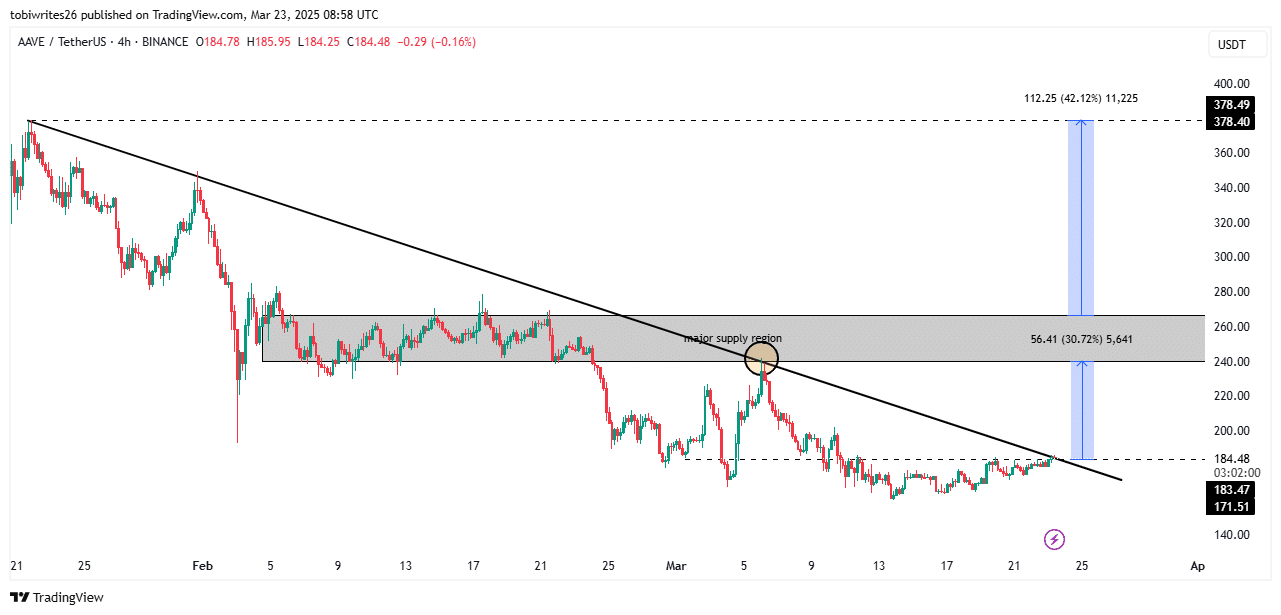

AAVE is at a major crossroads as it attempts to breach the descending line pattern that has formed on its 4-hour chart. This pattern tends to be bullish in most instances when it forms in the market.

If AAVE takes a bullish path, then the asset would need to breach the descending line—its first obstacle—and then rally at least 30.72% to the next major barrier, the supply region marked on the chart.

This level is significant as it induced the current AAVE decline that began on the 5th of March.

AAVE could see further declines from the supply level or consolidate within the region, as seen on the left side of the chart.

If market momentum remains high and AAVE exits this supply region, it could make another leg up, rallying 42%.

Ecosystem grows as selling pressure drops

AMBCrypto analyzed AAVE’s potential to breach the current descending-line obstacle ahead and found that liquidity flow into its ecosystem would play a key role in achieving this.

The market capitalization-to-total value locked (TVL) ratio is a metric used to assess the ecosystem’s value relative to its price growth.

When low, it implies the ecosystem is expanding with more interaction from participants, which has a long-term effect on price.

At press time, this ratio stood at 0.15, suggesting ecosystem growth. So, it may only be a matter of time before AAVE rallies.

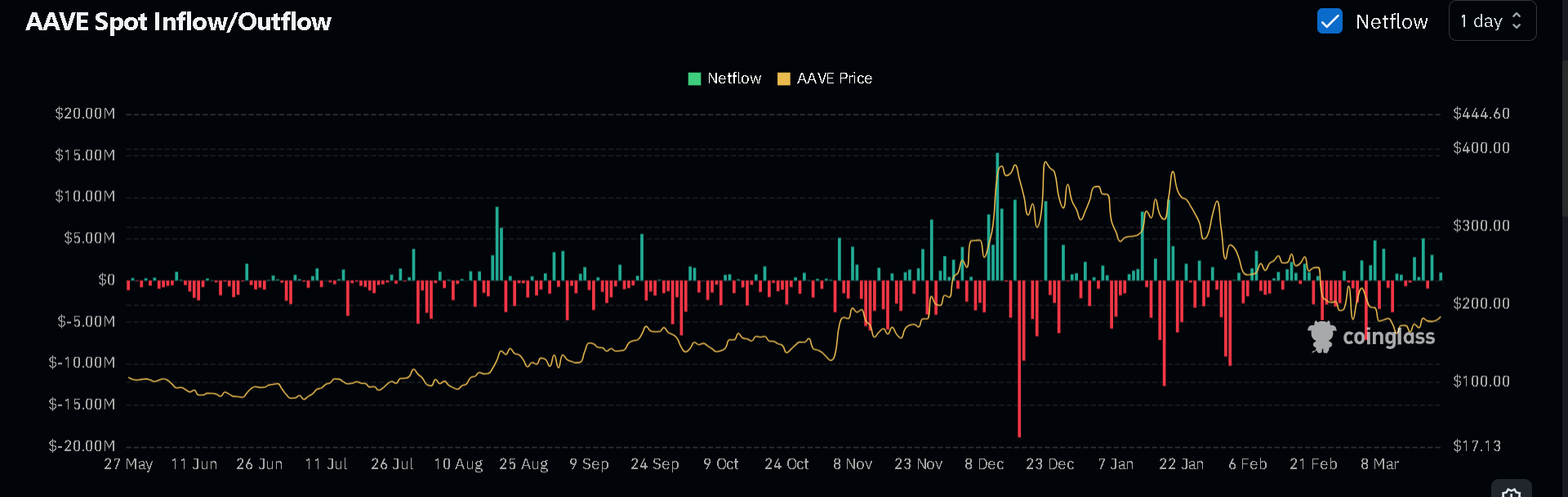

In the spot market, selling pressure has declined among traders who were previously highly bearish.

As of the 19th of March, these traders sold $5.5 million worth of AAVE, a trend that continued in the following days with several more millions sold.

Press time data shows that selling has dropped to $110,000 worth of AAVE—a notable decline. Such a shift implies that sellers are reducing, and buying could soon begin.

Buyers taking charge of the market would play an important role in AAVE achieving its 30.72% rally mapped on the chart.

More traders are betting on a breach

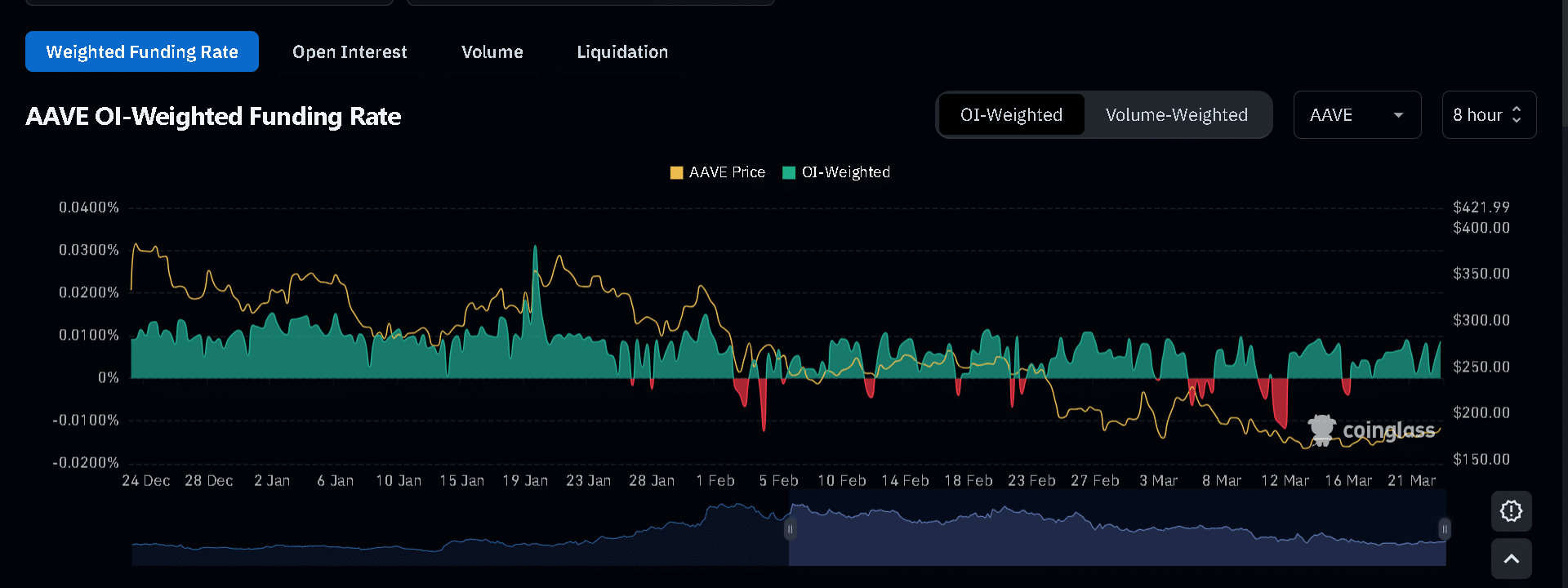

Even in the derivatives market, traders are betting on an AAVE price rally.

At the time of writing, the OI-Weighted Funding Rate, which combines funding and Open Interest to determine market sentiment, has turned positive at 0.0087%.

A positive reading implies that buyers in the market are taking over, as more unsettled contracts are dominated by longs, who are paying a premium fee periodically to maintain their positions.

Derivatives market volume is also skewed in favor of bulls, as the Taker Buy-Sell Ratio has turned 1.0056. Whenever this ratio crosses above 1, it indicates more buying than selling within the past 24 hours.

If these key metrics continue to turn positive, then AAVE could see a major price rally moving into the week.