Aave takes the V3 party a notch higher but were the bears invited as well?

The proposal for deploying version 3 of the lending and borrowing protocol, Aave [AAVE] on StarkNet, passed the temperature check vote with an overwhelming mandate.

As per details, the Aave team put forward a proposal to begin phase-2 deployment of V3 on the zero-knowledge rollup (Zk-rollup), Starknet, on 4 April. The voting, thus for the same commenced soon after. Phase-2 will mark the full deployment of V3 on Starknet after the successful completion of phase-1.

The Aave governance team stated that network evaluation by service providers will be the next step in the process. This would be followed by an on-chain vote to approve the start of the deployment.

Is your portfolio green? Check the Aave Profit Calculator

Aave marches ahead

Expanding to multiple blockchains has been one of the major goals of the Aave ecosystem. Since the launch of the V3 version on Ethereum [ETH in January, the DeFi protocol has aggressively tried to branch out to other layer-1 (L1) and layer-2 (L2) blockchains.

Recently, Aave V3 was proposed for deployment on Binance’s BNB Chain, considering its large user base and growing DeFi ecosystem. The stakeholders extended unanimous support to the plan. Prior to this, the governance team approved the proposed deployment of V3 on the recently-launched Polygon zkEVM, another ZK-rollup.

In its latest iteration V3, Aave introduced a host of new features and enhancements. These include risk management tools and gas optimization functions which can reduce gas costs on the protocol by 25%.

Aave V3’s dominance could increase

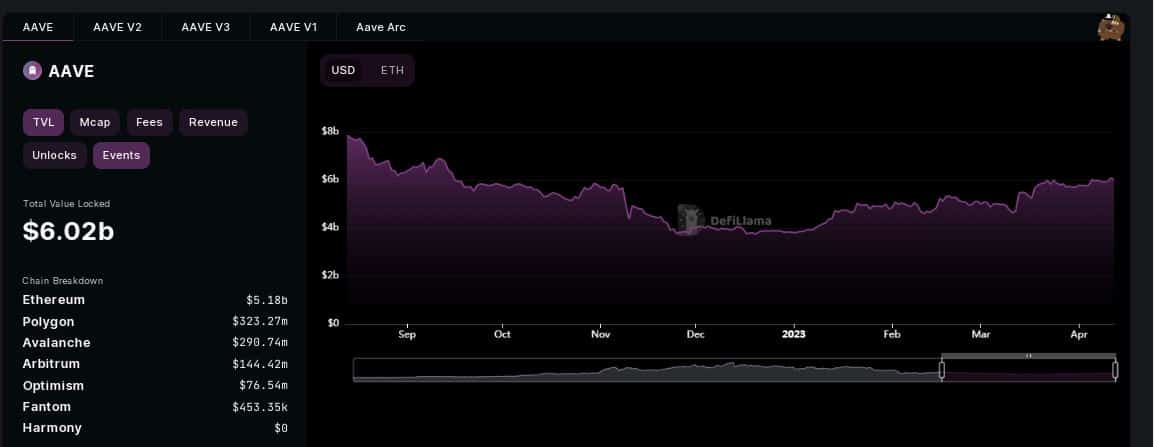

As per data from DeFiLlama, the protocol was already active on seven chains, with ETH leading the pack having a dominance of 85%. At press time, the value of funds deposited on the protocol’s smart contracts was worth over $6 billion, with more than 76% coming from Aave V2.

Aave V3 also boasted a 22% share, but with roadblocks for deployment on three more chains cleared, it could increase its piece of the pie considerably.

How much are 1,10,100 AAVEs worth today?

AAVE’s price on the other hand, failed to react enthusiastically to the decision around StarkNet deployment. The token registered a 24-hour drop of over 3% at the time of writing, data from CoinMarketCap revealed.

Infact, it was down by 2% over the last week, implying that developments around expansion didn’t provide a major boost to the token.

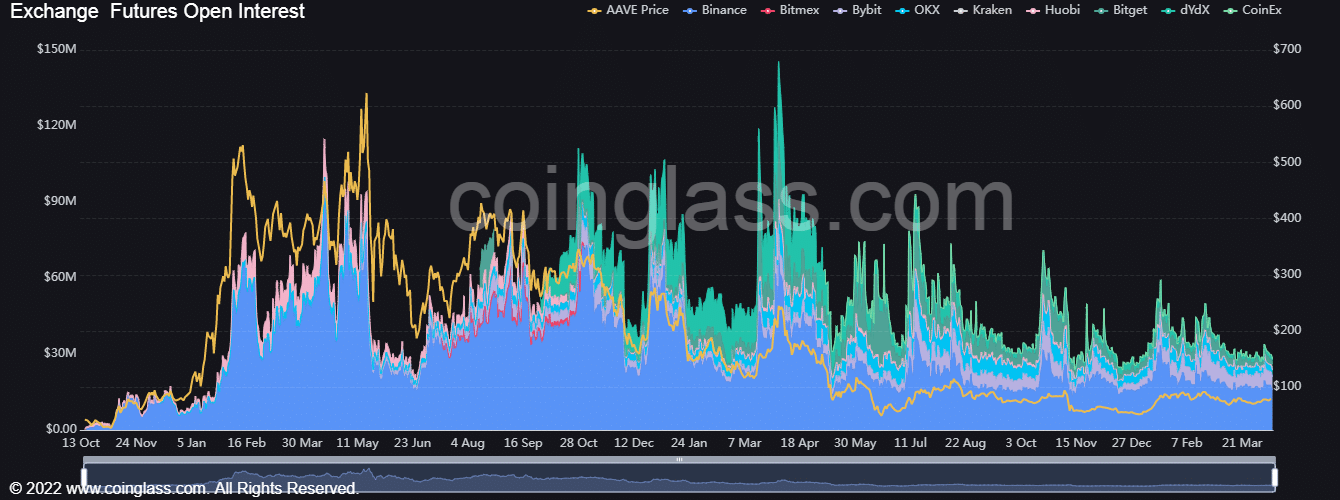

Moreover, AAVE’s Open Interest (OI) declined nearly 10% in the 24-hour period, per data from Coinglass. The drop in OI coinciding with drop in prices implied that long position traders were getting liquidated.

This could also be taken as confirmation of bearish clouds looming over AAVE.