Aave targets L1s, L2s as the ecosystem gets into aggressive expansion mode

- Aave’s monthly average TVL for March jumped 10%.

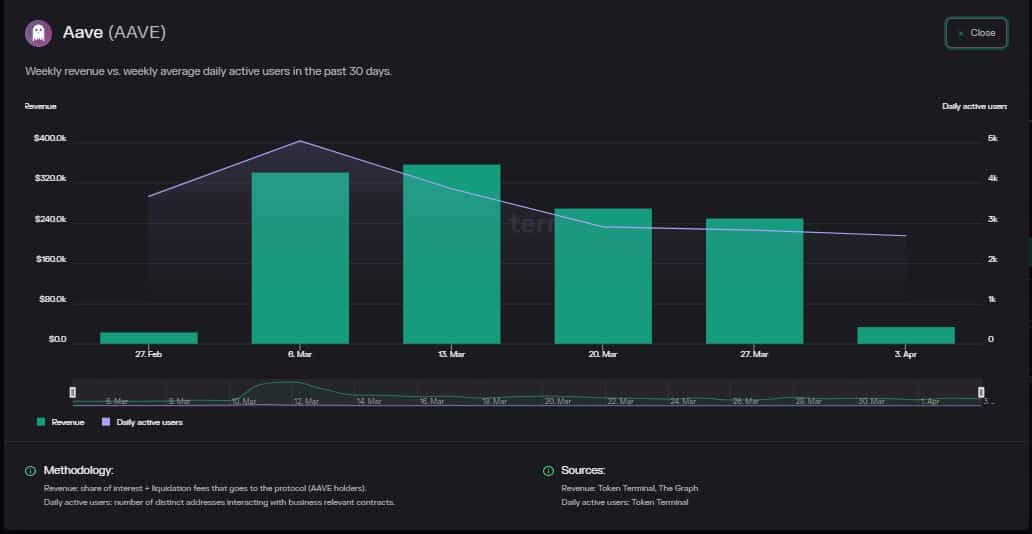

- The revenue in the last week of March plunged 8% from the previous week.

The total funds deposited on DeFi lending and borrowing protocol, Aave [AAVE], grew steadily since the start of 2023. As per Token Terminal, the monthly average total value locked (TVL) for March jumped 10% from the previous month’s data, and as much as 18% from January.

Additionally, the governance token of the ecosystem, AAVE, exhibited a remarkable year-to-date (YTD) growth of 42% and a weekly expansion of over 1o%, per CoinMarketCap data.

With favorable metrics to support, the DeFi protocol plans to foray into other popular layer-1 and layer-2 solutions.

How much are 1,10,100 AAVEs worth today?

The Aave Wave!

Mark Zeller, the founder of the Aave-Chan Initiative and an active participant in Aave’s governance, recently proposed to deploy Aave Version 3 (V3) on Binance’s BNB chain. The proposal was put forward considering the chain’s large user base and growing DeFi ecosystem which could help Aave mop up additional revenue. At the time of writing, stakeholders extended unanimous support for the plan.

The latest data from Token Terminal showed that BNB Chain was the second largest blockchain in terms of daily active users.

Apart from this, Aave was also looking to branch out to layer-2 blockchains. As per details from a temperature check that was released, the Aave team put forward a proposal to begin phase-2 deployment of V3 on the zero-knowledge rollup (Zk-rollup), Starknet. Phase-2 will mark the full deployment of V3 on Starknet after the successful completion of phase-1

Notably, the voting for the proposal has started and will go on till 10 April. The proposal received overwhelming support from the Aave community with a 99.99% vote going in its favor.

1) A new snapshot for the launch of Aave V3 on @Starknet is live. StarkNet is a ZK-rollup that operates as an Ethereum layer 2 (L2) chain.https://t.co/5HzDgQF7PL

— Aave (@AaveAave) April 4, 2023

It should be noted that the Aave token holders, who get voting rights in the DAO, have already given a thumbs-up to the proposed deployment of V3 on the recently-launched Polygon zkEVM. As per data from DeFiLlama, the protocol was active on seven chains, with 85% of its TVL on Ethereum [ETH].

Is your portfolio green? Check the Aave Profit Calculator

Areas of concern

Despite the hype around expansion, Aave’s key performance indicators showed a decline. The revenue in the last week of March plunged to $250.5k, a drop of 8% from the previous week. The weekly average daily active users plunged as much as 44% since the beginning of March.

At the time of writing, AAVE exchanged hands at $78.83, a jump of 6.48% in the last 24 hours.