AAVE to retest range lows – Will bulls sustain the recovery?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- AAVE dropped below the March swing low of $65

- Short-term selling pressure for AAVE eased at press time

Aave [AAVE] has been oscillating between the $60 – $65 price range in the past five days. The narrow range followed a breach below the March swing low of $65 on 8 May. Bitcoin [BTC] reclaimed the $27k price zone at press time, offering altcoins little recovery hope.

Is your portfolio green? Check AAVE Profit Calculator

The mild bullish momentum after the BTC move boosted AAVE to target the late February/April range low of $65. However, the $65 range low could become a key obstacle that must be cleared for bulls to gain leverage.

Will the bulls clear the obstacle?

Price action was below 20 and 100- Exponential Moving Average (EMA), reiterating sellers still had the upper hand at press time. In addition, the range low of $65 could offer resistance to bulls’ efforts, especially if BTC fails to stay above $27k.

The price rejection at $65 could see AAVE drop and retest the lower support level of $60. Any breach of the $60 level could sink AAVE to $56 or the January swing low of $51. These levels can act as short-selling targets in such a downswing scenario.

Conversely, the above thesis will be invalidated if AAVE close above $65. Such a decisive daily candlestick close above range lows will reaffirm bulls’ rising influence. However, they’ll have to clear the obstacles at 20-EMA ($67.2) and 100-EMA ($73.2) to aim at the late February/April range highs of $84.

Meanwhile, the Relative Strength Index (RSI) rebounded slightly above the 25 mark, showing a little buying pressure in the past few hours. On the other hand, the Chaikin Money Flow (CMF) eased after rebounding from the zero mark, highlighting that capital inflows eased.

Short-term selling pressure eased slightly

How much are 1,10,100 AAVEs worth today?

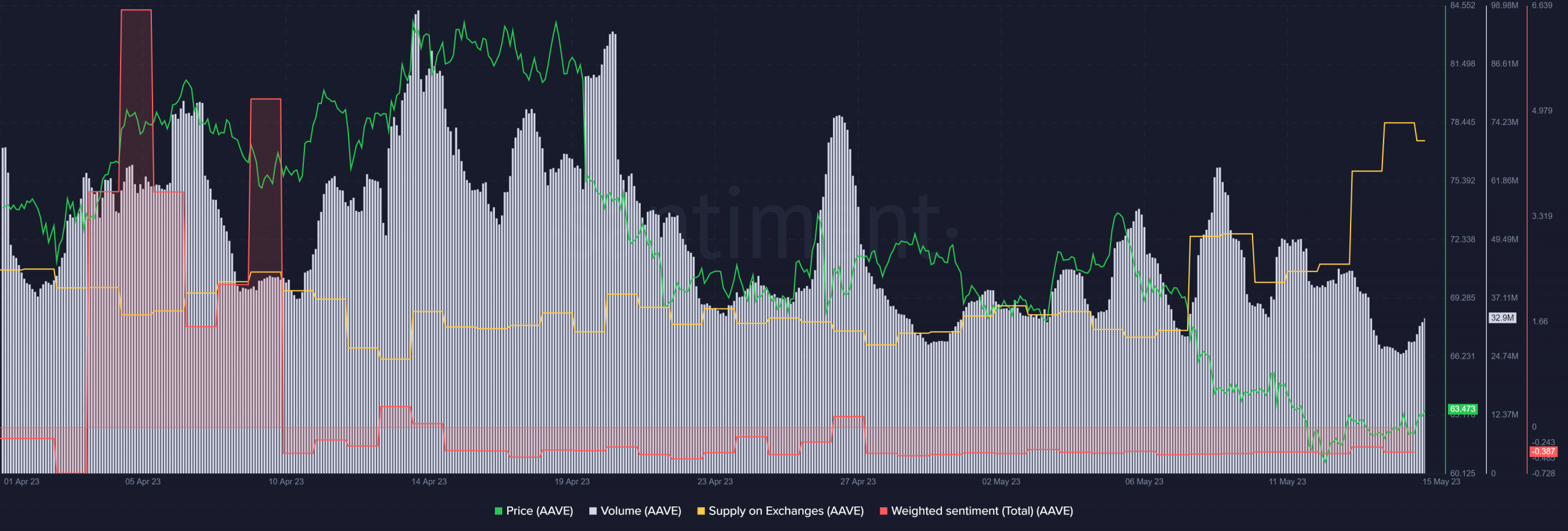

AAVE’s weighted sentiment has remained negative throughout the first half of May, capturing investors’ reservations about the asset in the past two weeks. In addition, elevated short-term selling pressure was witnessed from 11 May, as shown by a spike in supply on exchanges.

However, the supply on exchanges dipped slightly at press time, indicating short-term selling pressure eased after BTC reclaimed $27k. However, investors should track BTC’s price action, trading volume, and weighted sentiment before making moves.