ADA and FET see increased whale transactions: What’s going on?

- Whale transaction counts for ADA and FET have ramped up in recent weeks.

- FET prices seem to have remained stable, while ADA has been experiencing volatility.

Fetch AI [FET] and Cardano [ADA] have drawn significant attention from whales in recent weeks, as both assets have seen increased transactions.

Read Cardano’s [ADA] Price Prediction 2023-24

Whales focus attention on ADA and FET

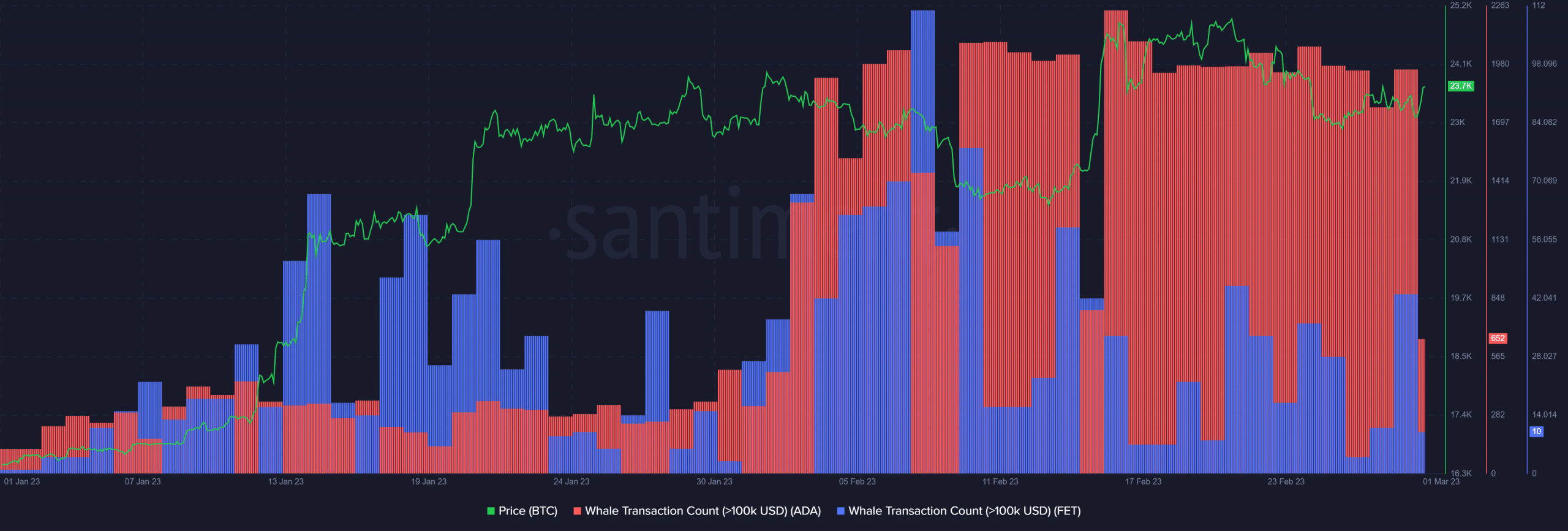

There has been a sudden uptick in activity on the “whale transactions” metric on Santiment, defined as those over $100,000. A metric review revealed that there had been scant activity in the months prior but that February has seen a string of increases in whale transactions for Cardano. There have been approximately 634 whale transactions as of this writing.

Whale transactions have also been occurring at respectable rates recently on Fetch AI. In contrast to ADA, whose whale transaction counts have been continuous, FET’s chart has been experiencing a few spikes. However, in the instance of FET, the significant surges in whale transactions began in January and have persisted ever since. Three transactions have been completed as of this writing itself.

With the recent spikes in the whale transaction count, has there been an impact on the prices of ADA and FET?

Cardano and Fetch AI on a daily timeframe

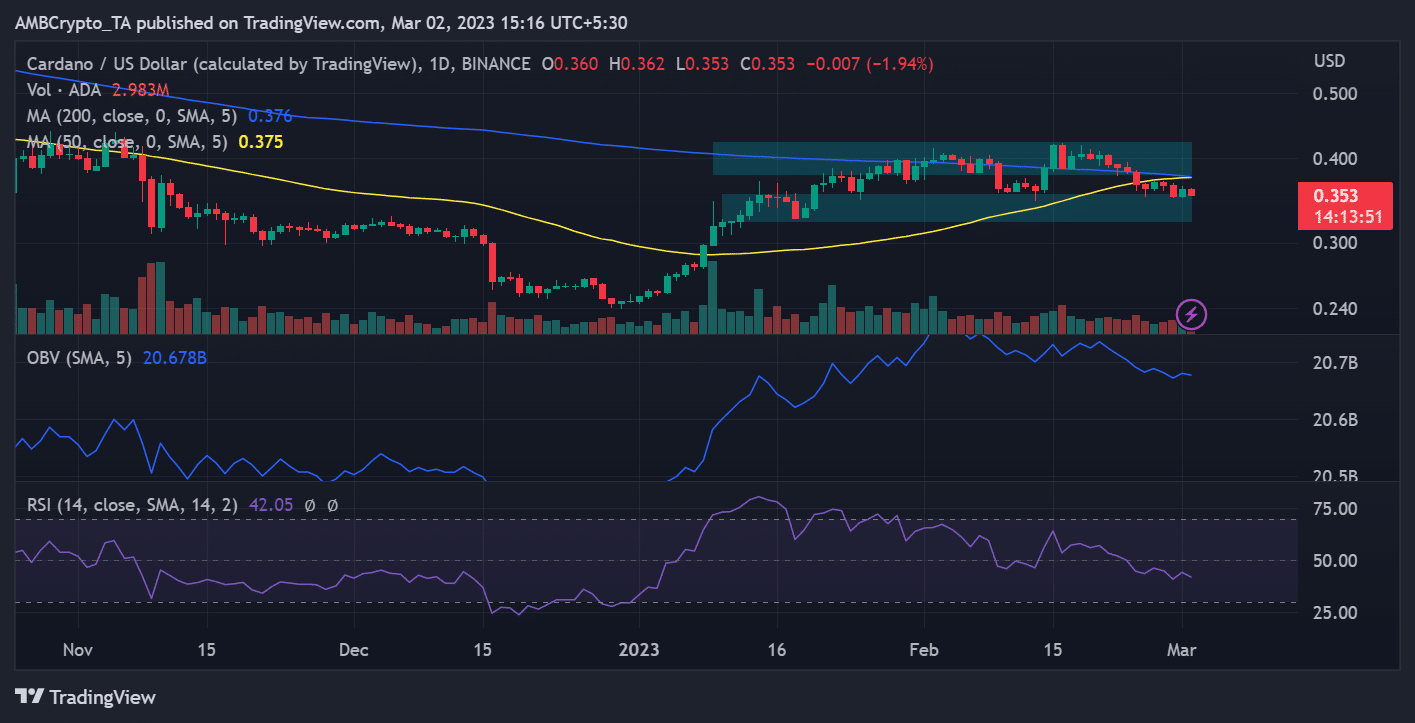

ADA has experienced a fluctuation in its price movement since January when it rose alongside the rest of the cryptocurrency market. Although it had swung, it was still attempting to hold a support level between $0.35 and $0.32. It sold at roughly $0.35, down almost 2% as of this writing.

The blue and yellow lines, representing the long and short Moving Averages, respectively, were going above the price movement. Because of their position, they also served as the resistance level at a range between $0.37 and $0.42. Also, it has declined into a bear trend, evidenced by the Relative Strength Index (RSI), which dropped below the neutral line on Cardano’s daily timeframe chart.

As of this writing, Fetch AI was down over 3.5%, trading at about $0.46. Unlike Cardano, its price trend has been flat and volatile to a lesser extent. In this instance, the short and long Moving Averages were below the price change and provided additional support. The $0.401 and $0.310 price regions offered immediate support.

The Relative Strength Index (RSI) line’s position indicated that Fetch AI was still firmly in a bull trend. As of this writing, the RSI line on a daily timeframe was above the neutral line and was over 55.

Is your portfolio green? Check out the Cardano Profit Calculator

Possible motivations for the whales

The sudden increase in the number of whale transactions for Cardano and Fetch AI may have been caused by several factors. The current market climate and the increasing accumulation ahead of a bull run are two plausible explanations that could apply to both assets.

Additionally, the unexpected interest in AI-related initiatives in the crypto business may have been an additional incentive for the heightened whale activity, at least in the case of Fetch AI.