Analysis

ADA breaks out the range two-month range high — are more gains expected?

The Open Interest of Cardano, which had been rising with the prices a few days ago, has been lukewarm over the past two days to indicate waning positive expectations from speculators

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Cardano was firmly bullish in the short-term

- A liquidity hunt to the south was one scenario that could unfold, especially if BTC loses its bullish impetus

Cardano [ADA] recently showed a positive funding rate and increased Open Interest (OI), signaling short-term bullish strength. This sentiment saw ADA reach $0.298 before experiencing a pullback.

Read Cardano’s [ADA] Price Prediction 2023-24

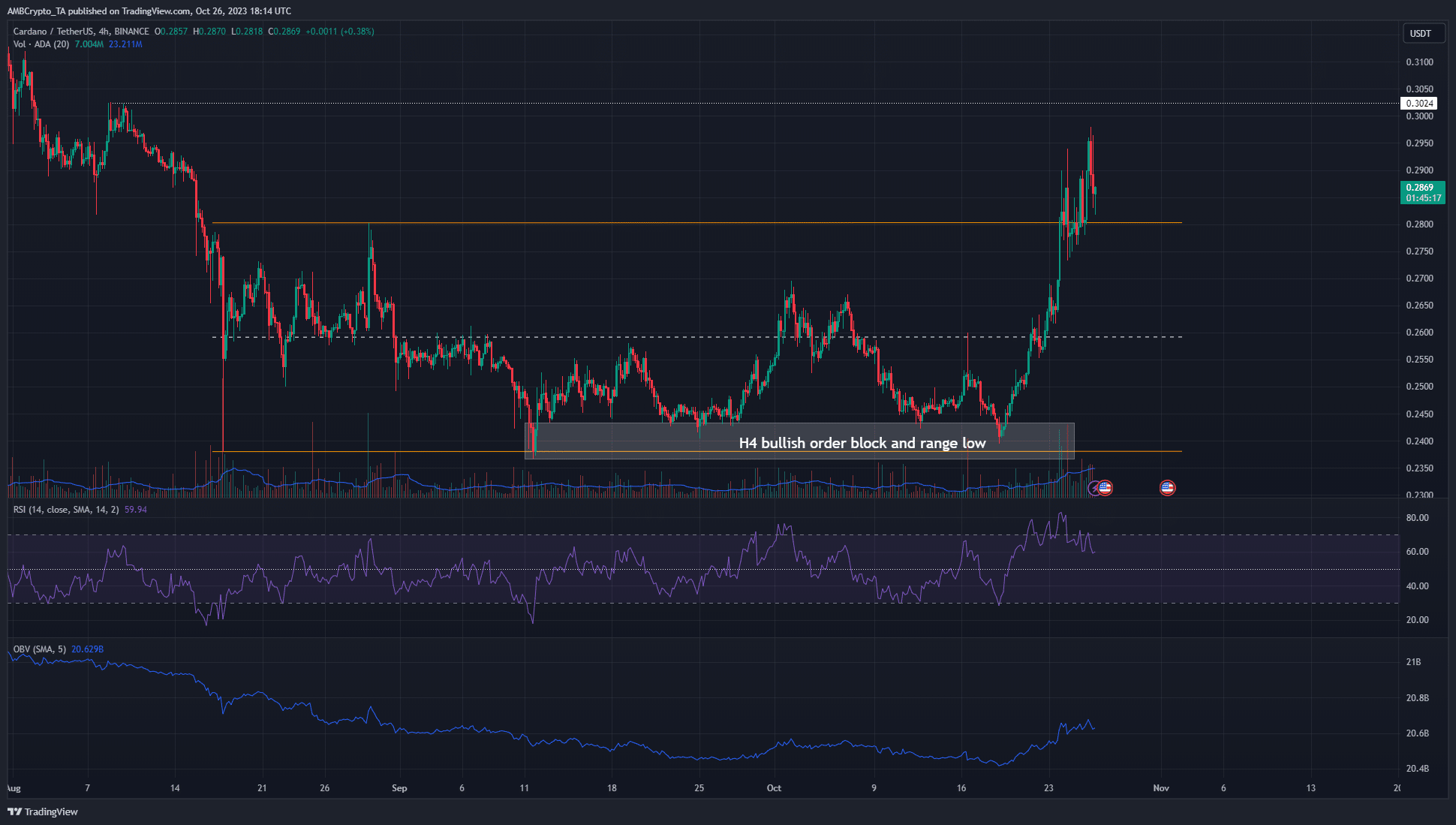

The range that ADA traded within was respected a little more than a week ago. The confluence of support at the $0.24 territory and Bitcoin’s [BTC] bullishness, saw ADA streak toward the $0.3 mark.

Can Cardano bulls keep the run going?

The range (orange) extended from $0.238 to $0.28. On 24 October ADA swept past the range highs alongside an uptrend on the On-Balance Volume (OBV). The bullish four-hour market structure and rising OBV meant buying volume was present and backed the price trend.

The Relative Strength Index (RSI) was also well above neutral 50 and reflected hefty upward momentum. But is this enough to ensure continued gains for the token? Any healthy trend has significant pullbacks, and one such could be around the corner for ADA.

To the north, the $0.3 was a notable higher timeframe resistance level and was also a psychological level for the bulls to contend with. It was possible that ADA would consolidate beneath this level before another push northward.

Liquidation levels highlight a key level that could witness a hunt

Source: Hyblock

The Cumulative Liq Levels Delta had advanced deep into the positive territory. It captured the idea that bulls were in a riskier position than bears as things stood. The liq levels showed multiple long liquidations worth more than $2 million sat in the $0.268-$0.272 band.

Source: Coinalyze

Will we get such a dip? The data from Coinalyze showed that we might. The OI has been lukewarm over the past two days to indicate a market whose bullish sentiment has waned in the short term.

How much are 1, 1o, or 100 ADA worth today?

More importantly, the spot Cumulative Volume Delta (CVD) was in decline, a worrying factor for the bulls. An increase in sell pressure could see ADA dip to $0.27 or lower. BTC’s volatility or even a drop toward $30k could see ADA undo a good chunk of its recent gains.