Cardano’s hurdles: 3 ways long-term holders will shape ADA’s fate

- ADA’s price might retrace if holders keep their tokens from circulating.

- Technical analysis identified a key support at $0.45 that might prevent a plunge.

Cardano’s [ADA] long-term holders have refrained from moving their tokens back into circulation, AMBCrypto found after analyzing the Mean Dollar Invested Age (MDIA).

According to on-chain data from Santiment, Cardano’s 90-day MDAI jumped to 269 on the 15th of April. A decreasing MDIA suggests increasing network activity.

Historically, this tends to be promising for ADA as holders move their assets into circulation.

On the other hand, an increase in the metric does otherwise as stagnant investments tend to restrict an upswing. At press time, ADA joined the broader market recovery as its price reclaimed $0.49.

Challenges ahead

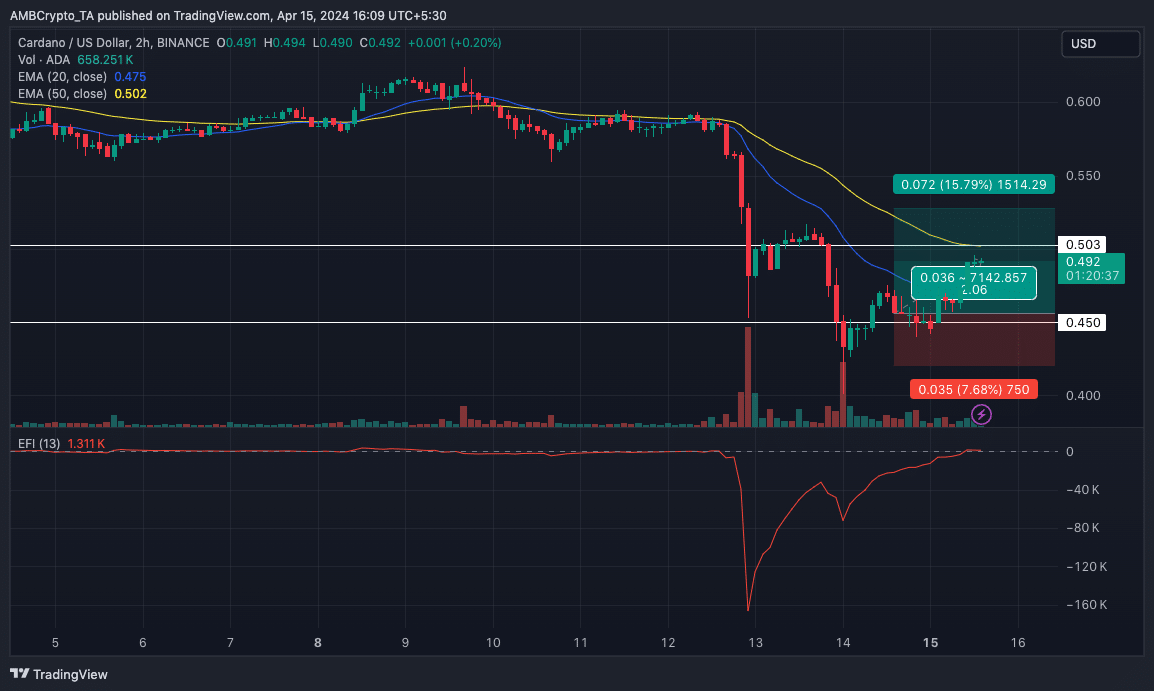

However, an analysis of the price action showed that the token had found it hard to test the $0.50 psychological level.

If the MDIA continues to increase, ADA might not evade $0.50, but it could drop below $0.49 in the short term.

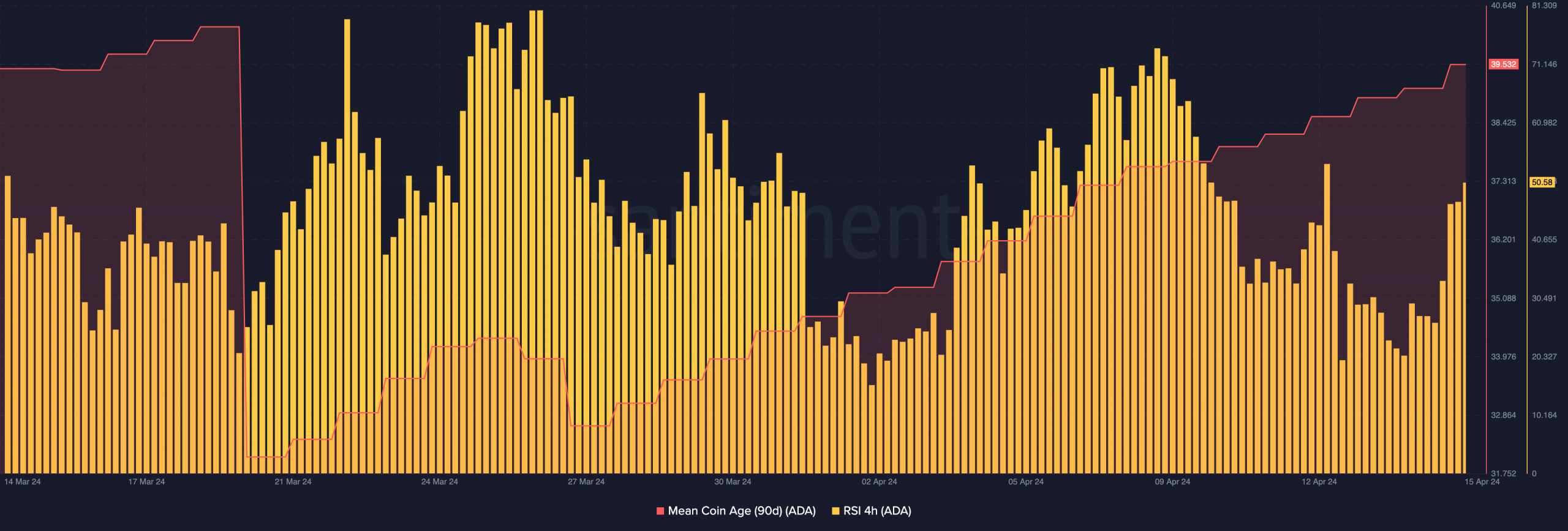

But this conclusion might be too hasty. As such, AMBCrypto went ahead to evaluate other metrics. One metric that we checked was the Mean Coin Age (MCA).

The MCA reveals similar signals to the MDIA, but with a slight difference. Here, a low coin age signifies that new coins have been accumulated, and discharged to a cold wallet.

But if the MCA increases, it means that a lot of coins have moved into circulation. Cardano’s correlation with an increasing coin age has been negative most times.

Therefore, the price of the cryptocurrency risked a notable decline despite the short-term bullish momentum. In a highly bearish case, ADA might drop to $0.46.

However, if the action of long-term holders changes, the value might be better.

Furthermore, a look at the Relative Strength Index (RSI) revealed that buying momentum was not solid.

Though the RSI on the 4-hour chart increased, the reading at 50.58, suggested that bulls were not in total control.

A rise to $0.53 is possible

If buying momentum increases, ADA might be able to break past $0.50. However, if the RSI keeps hovering around the midpoint, ADA might swing between $0.46 and $0.49.

From the 4-hour ADA/USD chart, the Exponential Moving Average (EMA) revealed that the bearish still existed. At press time, the 50 EMA (yellow) had crossed over the 20 EMA (blue).

This is termed a death cross, which typically indicates a bearish trend.

However, ADA had crossed above the 9 EMA, suggesting that bulls were trying to push the price higher. As things stand, the token might attempt to hit $0.50. But it could face resistance around the area.

Read Cardano’s [ADA] Price Prediction 2024-2025

A successful close could send Cardano toward $0.53. But rejection at this point might trigger another correction that could end up at the $0.45 support.

Meanwhile, the Elder Force Index (EFI) stalled, suggesting that ADA consolidate. If the EFI increases, then the token might break out. However, a decline in the indicator could confirm a falling price.