After a 150% pump in 6 hours, will BOME rally yet again?

- BOME saw a steep retracement, but bulls managed to defend a key support level.

- The sentiment was not yet in favor of the buyers, even though prices slowly climbed higher.

Book of Meme [BOME] saw a retracement begin on the 16th of March. Prices fell by 49% over the next 24 hours to reach a key support level. Speculator sentiment also leaned in favor of the sellers.

The meme coin saw phishers exploit the BOME token’s recent success. AMBCrypto reported on these developments, noting that $100 million has been lost to phishing attacks already this year.

The short-term bias appeared bullish once more

A near 50% pullback in a day was a relatively steep drop, even though a 150% rally occurred within just six hours on the 16th of March.

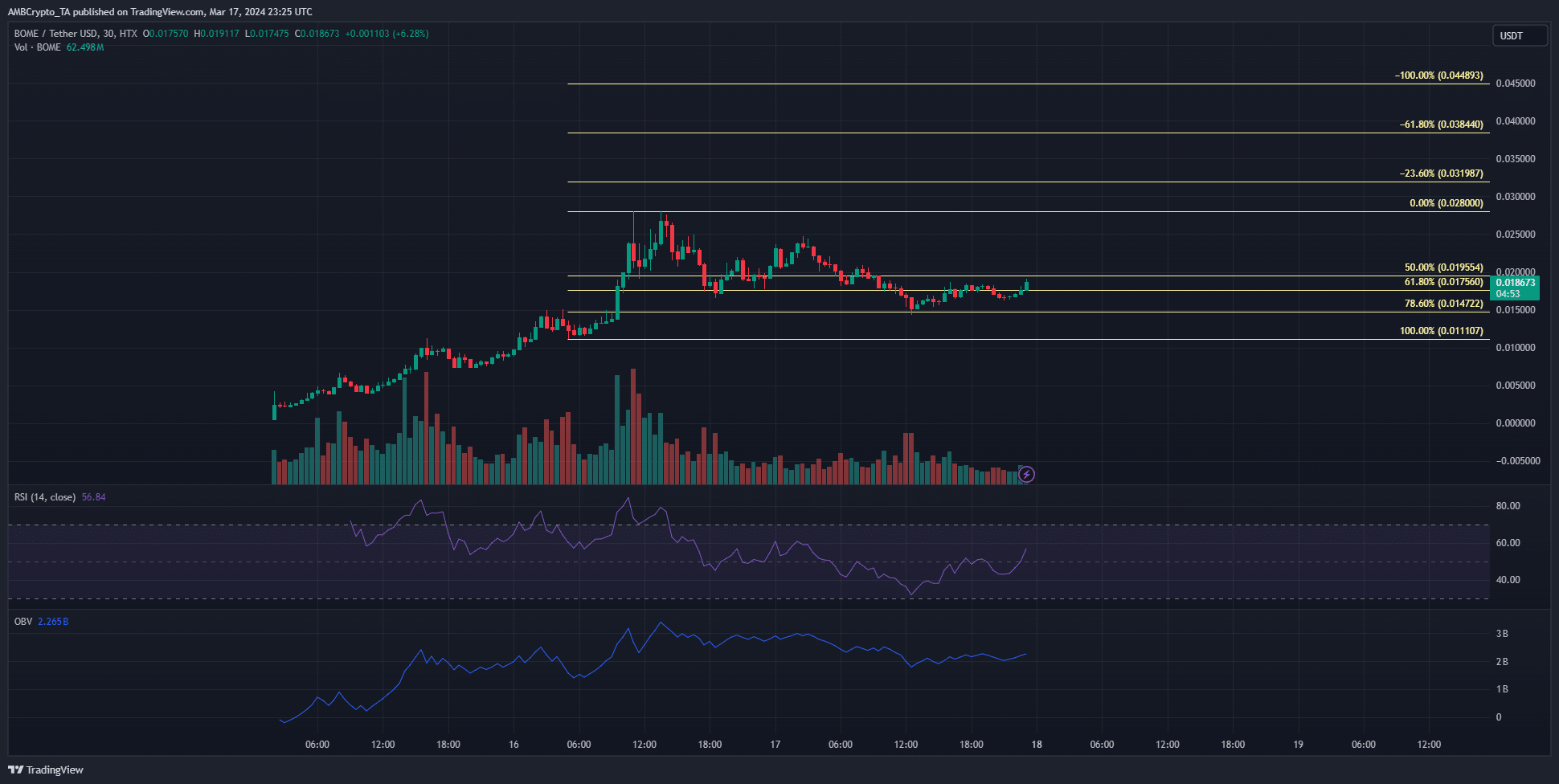

The Fibonacci retracement levels (pale yellow) showed that the 78.6% retracement level at $0.0147 was retested as support.

Bulls managed to defend this level and drive prices higher. A move above the $0.0247 level would flip the market structure bullishly.

The RSI on the 30-minute chart climbed back above neutral 50 and signaled bullish momentum in this timeframe.

Even though the price action was bullish, the OBV has trended downward over the past 36 hours. The selling volume has been persistent, and the buyers did not yet have the upper hand.

This might result in BOME being unable to flip the market structure bullishly.

Short sellers seize the opportunity during volatility

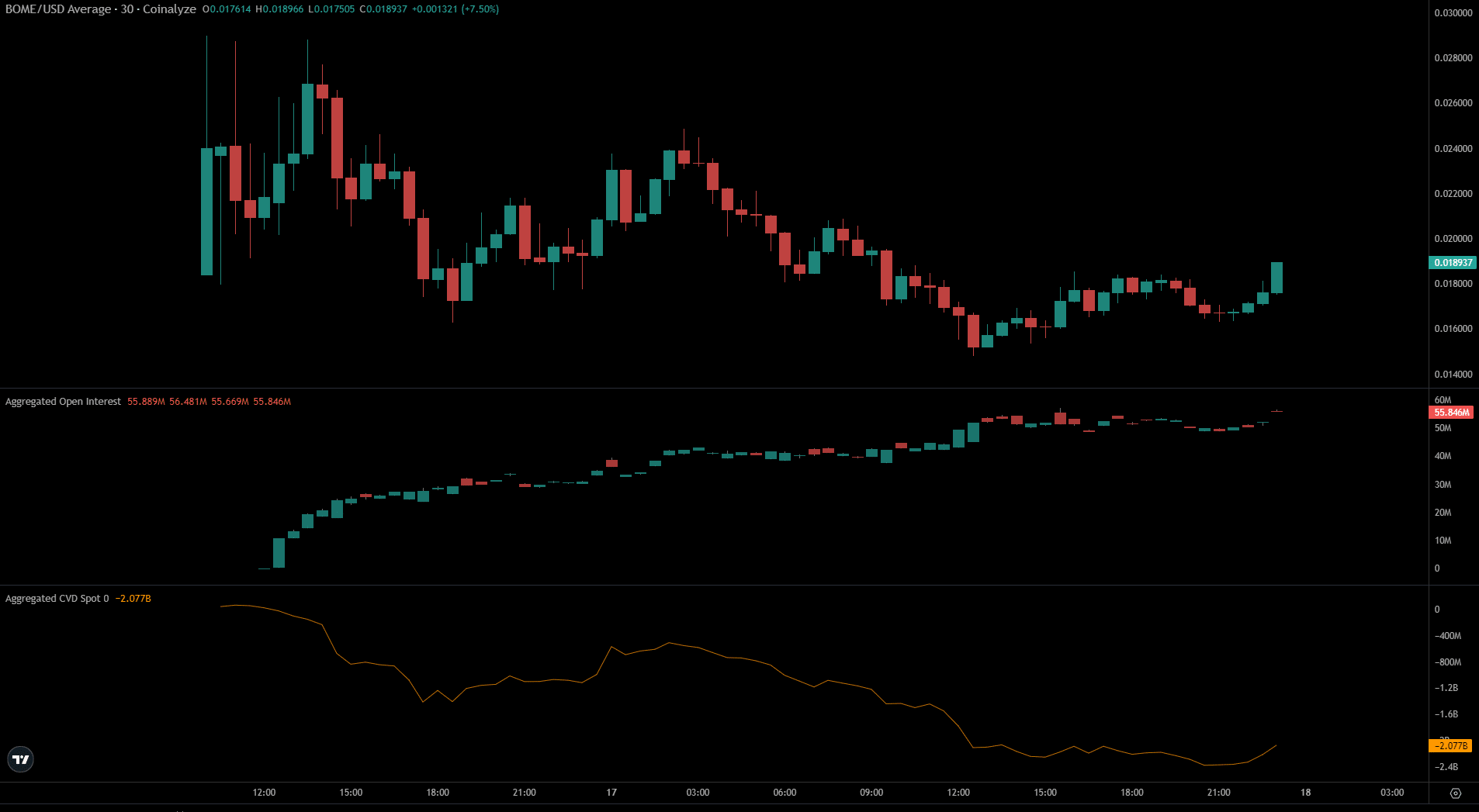

Source: Coinalyze

On the 17th of March, BOME fell from $0.0246 to $0.0152. During this 38% plunge, the Open Interest behind the token surged from $40.2 million to $51.8 million.

This increase in OI while prices plunged was indicative of short positions being opened.

Is your portfolio green? Check out the BOME Profit Calculator

This highlighted strong bearish sentiment amongst speculators. The spot CVD also fell swiftly. Since then, the spot demand has not yet recovered.

The Open Interest continued to dawdle at the $55 million mark, even as prices rose slowly. The bullish momentum was not yet present.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.