After a noteworthy performance, what these metrics mean for Avalanche right now

Avalanche has become one of the most prominent blockchains in the last few weeks particularly when it comes to DeFi. But it’s supposed to be more than that. Considering most investors are still unaware or at the least barely educated about DeFi, they remain in the spot market.

And looking at Avalanche’s present conditions, these investors might not feel as great as they once did.

What’s up with Avalanche?

The month of October has been favorable for most coins in the market, with Bitcoin and Ethereum driving the rise. However, Avalanche is one of the only few altcoins that did not join the rally. At the moment AVAX is the only top 15 coin to be witnessing a price fall. At press time the altcoin was trading at $61.18.

AVAX price movement | Source: TradingView – AMBCrypto

Since the beginning of October, AVAX went down down by 8.22% from $67. The price indicators did not display any explicit signs of recovery either.

Relative Strength Index did not move from the neutral position for 4 days now. And the MACD is continually bearish.

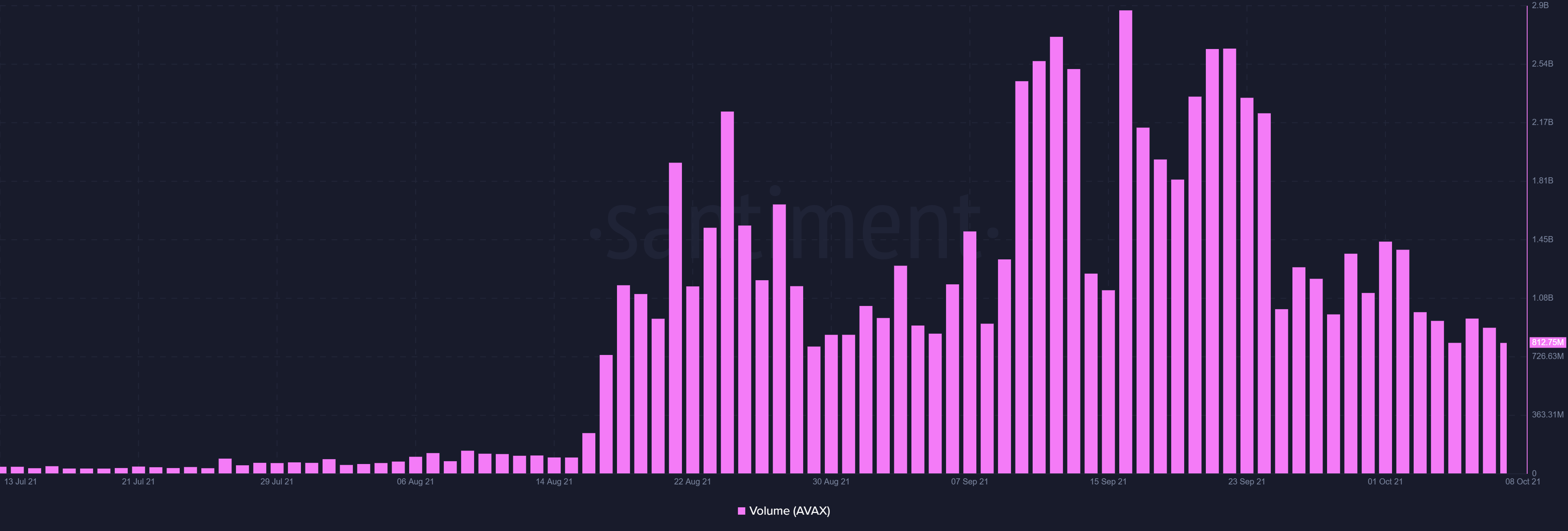

On top of that trading has been hit as well. Volumes are currently at a two-month low at $812 million, despite AAVE’s launch on the network on October 5.

Avalanche’s trading volumes | Source: Santiment – AMBCrypto

This can also be attributed to the network’s developers actually. Their contribution has reduced since the end of September which can be seen in the status of development activity which has fallen to a 2-month low.

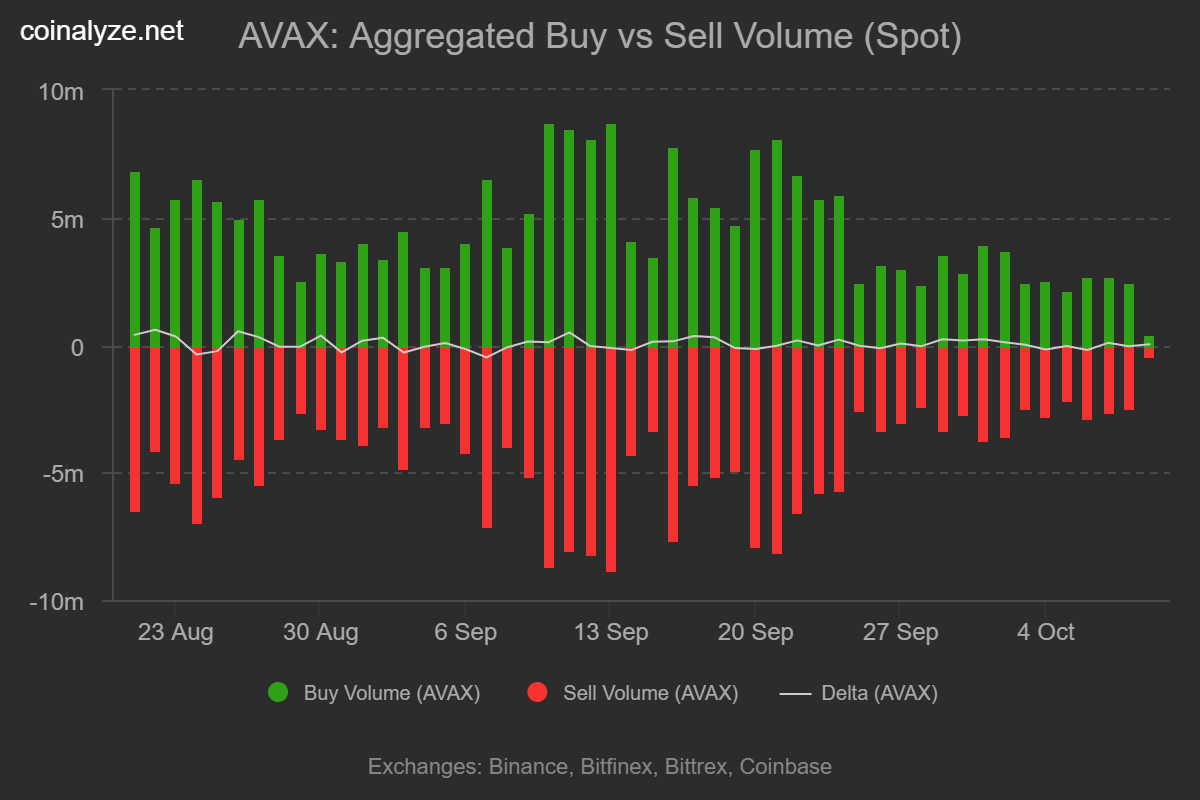

As a result, investors have slowed down across the spot and derivatives markets. Buying, selling, liquidations, everything has come down significantly.

AVAX buy-sell volumes | Source: Coinalyze – AMBCrypto

So no hopes for AVAX?

Actually, there is. On the DeFi front, the network has been performing as well as it always does, better in fact. In less than 5 days, the total value locked (TVL) on the network rose by $1 billion, 50% of which came in just from yesterday.

A huge contributor to this rise were 4 protocols which grew remarkably over the past week. “Anyswap,” a cross-chain swap protocol has grown by over 228%. Lending protocol “Abracadabra” saw a rise of 91%.

Further, “Wonderland” – the first DeFi reserve currency protocol has gone up by 97%. And lastly, a yield protocol called Zabu Finance contributed with a 122% growth.

So while the NFT and DeFi hype of the last few weeks have given AVAX a major push, the present conditions of the spot and derivatives market is a reality check for investors. DYOR and invest carefully.