After gold, can Bitcoin take on the stock market

Bitcoin has emerged as the optimum store of value in today’s world. In this digital era, everyone wishes to own some form of a digital asset. To what extent this is reflected in investor behavior, is worth exploring.

It is well-known that in terms of portfolio construction, the 60/40 allocation has been one of the most widely adopted strategies. Is Bitcoin about to change it? Or will investors stay wary of cryptocurrency forever?

Bitcoin is everywhere

It is noteworthy that over a period of time, the crypto-market has successfully attracted mainstream investors, including former skeptics. In fact, Bitcoin has become one of the most sought-after assets among investors. As a result, the age-old discussion of the 60-40 portfolio strategy is changing since Bitcoin too is becoming mainstream.

The 60/40 portfolio is a traditional investment structure, one where total investments are divided into 60% stocks and 40% bonds. This helps keep the risks to a minimum.

However, Bitcoin now provides strong ROIs. Ergo, it is suggested that a 5% allocation should be given to it as well. Another reason being – BTC yields higher returns than bonds (BND) and stocks (VOO).

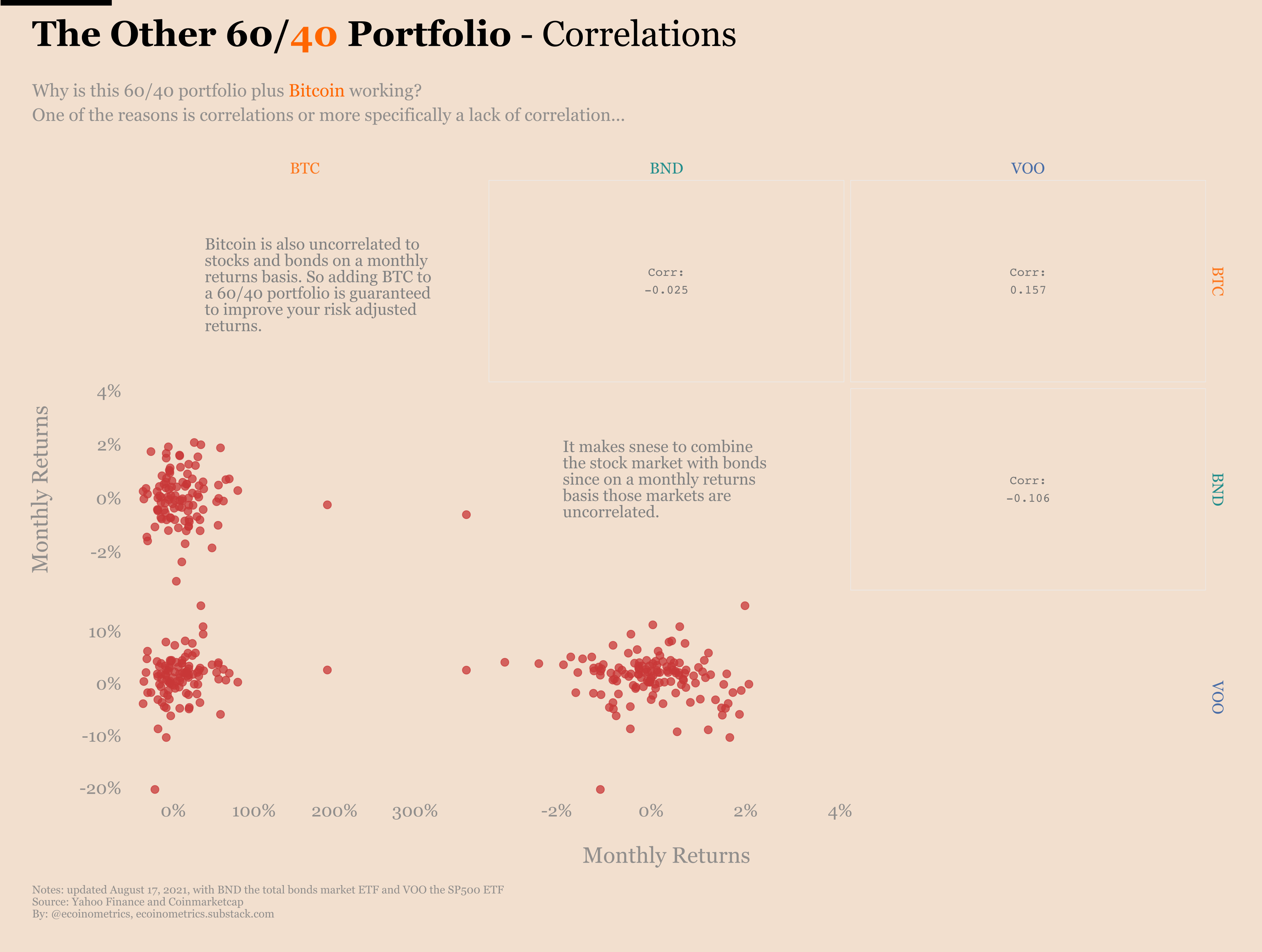

Adding Bitcoin improves risk-adjusted returns | Source: Ecoinometrics

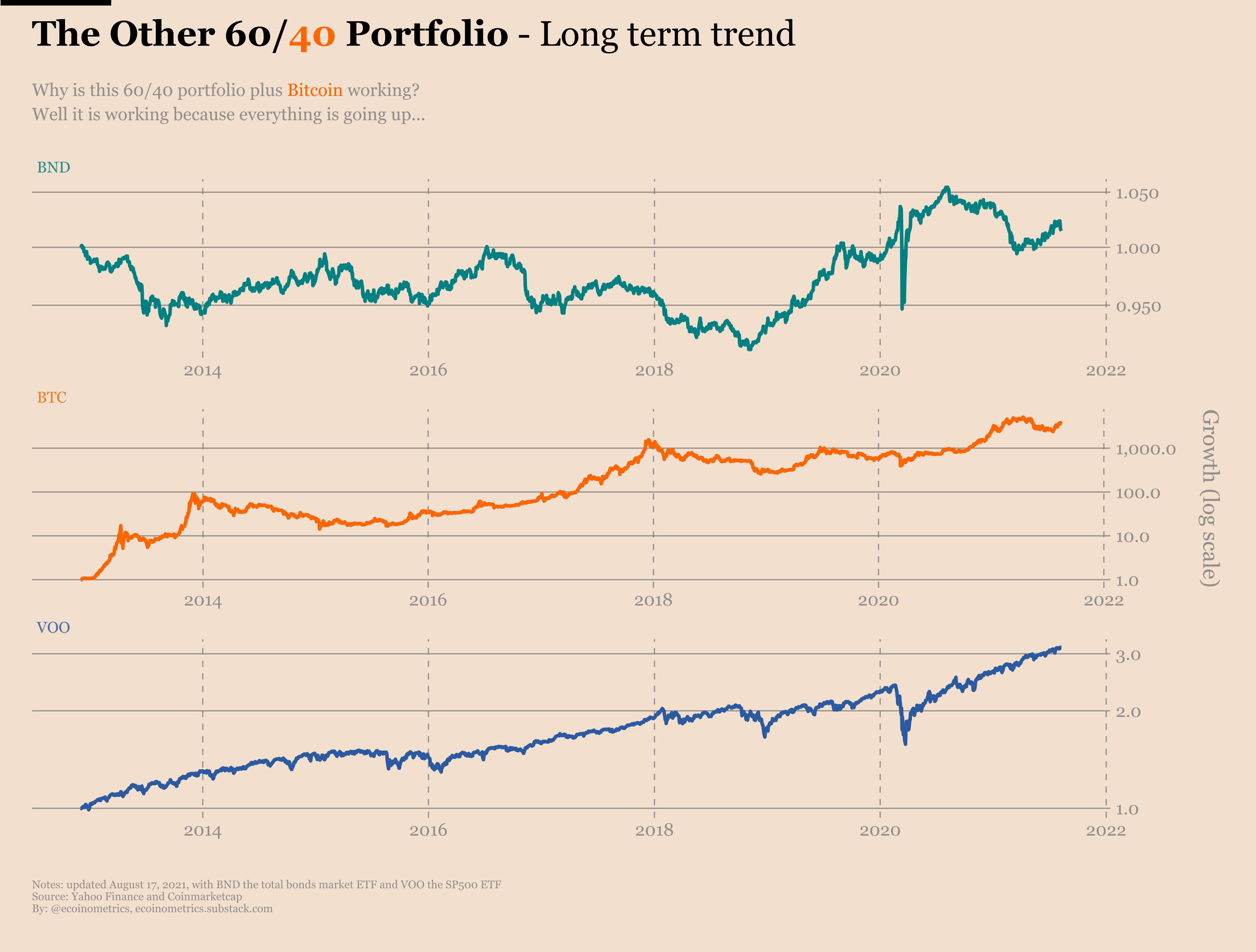

Additionally, in terms of growth and returns, Bitcoin also appears to be doing better than bonds and stocks.

The 60/40 portfolio growth | Source: Ecoinometrics

But then, there is a degree of speculation that comes in here. And, that needs to be dealt with. For instance, what would happen if people strayed away from the share market. If tomorrow an ETF gets listed, will it pull investors away from major and minor stocks?

No reason to worry?

In an exclusive interview with AMBCrypto, Chief Income Strategist of The Oxford Club, Marc Lichtenfeld provided some insight into the effects of such portfolio diversification. In his opinion, Bitcoin will not become a threat to the stock markets.

Lichtenfeld believes the crypto-market does not threaten the share market because people still do not consider it as a financial instrument. It is seen to be more of use to cybercriminals, which is why people currently refrain from investing in it.

According to him, if in the future, a Bitcoin ETF does get listed, it will not harm the other small companies that are listed on exchanges. This, because, in relative terms, these companies will be more trustworthy.

Additionally, the strategist claimed that participation is also an important factor here. That is why the share market is not affected by the crypto-market because participation is still lacking in the latter. For example, people refrain from making an account on Coinbase because of complex processes and their lack of understanding and fear of its possible use by criminals.

Even so, a lot of companies are cashing in on the crypto-hype by either purchasing Bitcoin or announcing intentions of buying them. This might also attract more investors into the market, the analyst added.

Adding Bitcoin to one’s portfolio does offer higher returns. Moreover, as the strategist pointed out, it is unlikely to bring any harm to the rest of the portfolio comprising of bonds and stocks.