After Hong Kong Bitcoin ETF, Australia joins the party: Will BTC rise again?

- Hong Kong Bitcoin ETFs will start trading this week.

- Australia joins the BTC ETF mania; will APAC demand boost BTC prices?

The much-awaited and unique “in-kind” Hong Kong Bitcoin [BTC] ETFs are here. Slated to start trading on Tuesday, the 30th of April, market watchers view the debut as a game changer for Asia.

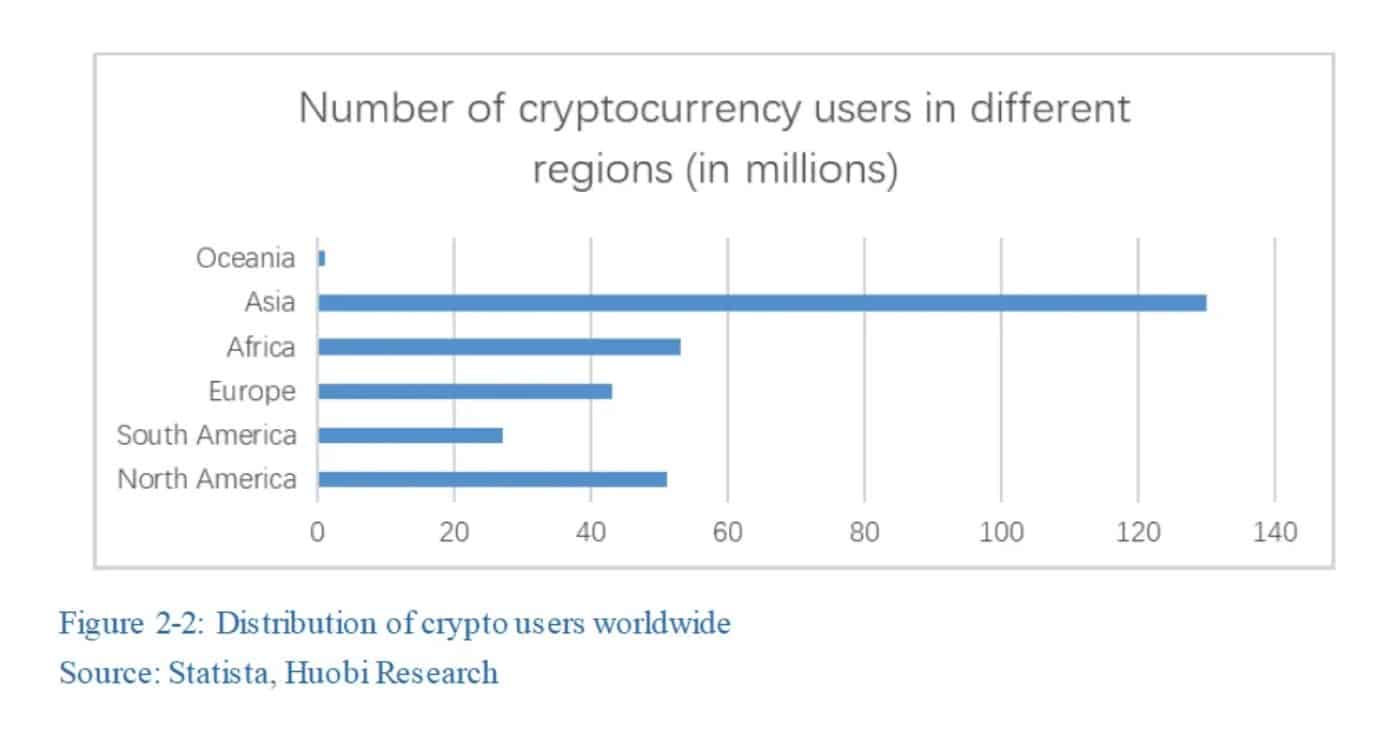

One market watcher, Willy Woo, underscored the Hong Kong ETF’s significance in the region by citing Asia’s highest crypto user statistics.

“The Asian market in user count is BIGGER than the US and European markets combined.”

Hong Kong Bitcoin ETFs fee wars and market size

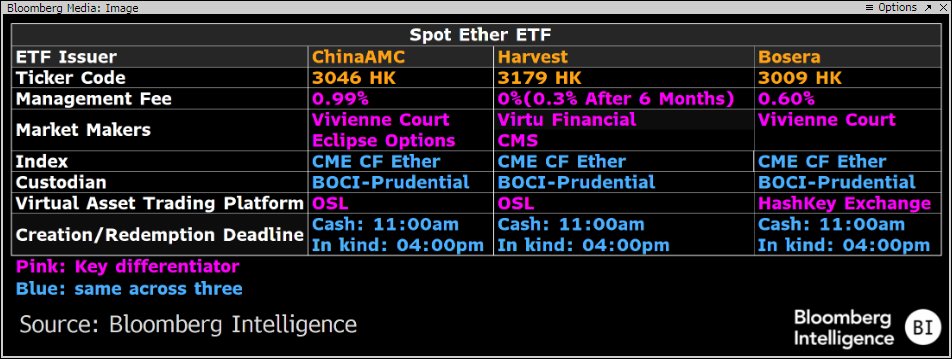

The first batch of approved products from Bosera, ChinaAMC (Hong Kong), and Harvest Fund will go live on the Hong Kong stock exchange on the 30th of April.

On average, Bloomberg analyst James Seyffart noted that Hong Kong issuers have set very low charges that could attract fee wars.

“A potential fee war could break out in Hong Kong over these #Bitcoin & #Ethereum ETFs. Harvest coming in hot with a full fee waiver and the lowest fee at 0.3% after waiver.”

There was initial excitement about the potential impact on BTC prices if Hong Kong spot BTC ETFs start trading.

In mid-April, Singapore-based crypto research firm, Matrixport, projected that Hong Kong’s spot BTC ETFs could attract $25 billion in inflows.

However, a Bloomberg analyst, Eric Balchunas, downplayed the estimates as it became apparent that Mainland China would face restrictions.

The analyst updated his previous $200 million estimate to $1 billion in AUM (assets under management), noting that,

“Our asset estimate is now $1b in first two years (which is healthy IMO but still nowhere near the $25b that some have said), but a lot depends on infrastructure improvement.”

Additionally, the report noted that the APAC region had only around $250M in current BTC ETFs shared between Hong Kong and Australia-based funds.

“The Asia-Pacific region’s BTC ETFs currently manage $251 million in assets, split between three funds in Kong Kong and two in Australia.”

Australia follows U.S., Hong Bitcoin ETF frenzy

However, Australia is reportedly in the advanced stages of enlisting more spot BTC ETFs on its larger Australian Stock Exchange (ASX).

A recent Bloomberg report, dated the 29th of April, highlighted that potential issuers like Van Eck, BetaShares, and DigitalX have lodged applications for spot Bitcoin ETFs in Australia.

ASX did not provide an official timeline. However, an eventful approval could fuel institutional adoption and strengthen Hong Kong Bitcoin ETFs and the overall APAC region.

In the meantime, BTC’s price hovered slightly above its range-low of $60.8K.

Given the US Fed rate decision scheduled on Wednesday and a lot of liquidity on the chart positioned on the upside, wild volatility is likely this week.