Analysis

AGIX might be nearing peak of AI rally, here’s why

Few metrics painted a picture of strong bullish sentiment behind SingularityNET.

- The social sentiment and on-chain activity were extremely positive

- The technical analysis highlighted two key levels for investors to watch

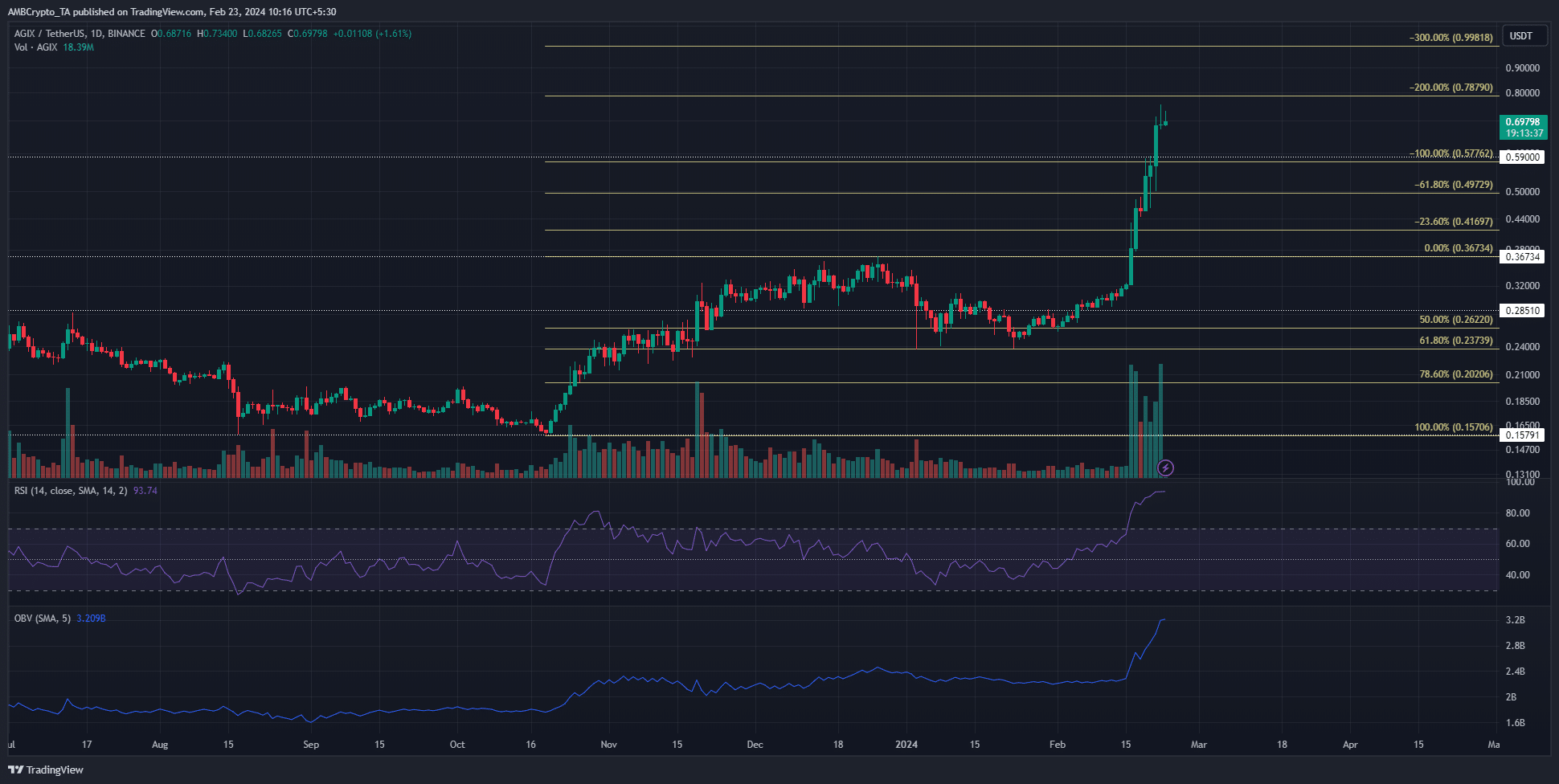

SingularityNET [AGIX] saw a rally of epic proportions in February. The token prices rose from the lows of $0.256 on the 1st of February, to trade at $0.697 at press time. This represented gains of just over 170% in 23 days.

The move above the $0.31 resistance on 15th February drove the majority of these gains. The $0.6 resistance was previously tested in March 2023, but the recent surge saw this level smashed apart. How much higher could the bulls take AGIX?

The Fibonacci levels showed a potential top was imminent

Based on the rally from $0.157 to $0.367 that took place from October to December 2023, a set of Fibonacci retracement levels (pale yellow) were plotted. These levels were chosen because the retracement in January saw the 61.8% level at $0.237 retested thrice as support.

Since then, AGIX has trended higher strongly and broken past the 100% extension level. At press time, it was close to the 200% extension level at $0.788. This could be a level that AGIX bulls

get exhausted at.The RSI has been in overbought territory on the 1-day chart for more than a week now. However, this does not necessitate a pullback by itself, as the trading volumes continue to be extremely high.

The OBV reflected this with a strong surge over the past ten days. Therefore, traders should also be prepared for a continued AGIX rally to the 300% extension level at $0.998.

Since this level is close to the psychological $1 mark, AGIX holders can plan to scale out of their positions between the 200% and 300% extension levels.

The short-term sentiment massively favors the buyers

Source: Coinalyze

The Open Interest soared massively over the past two days as AGIX jumped from $0.5 to reach $0.69. This showed speculators were confident going long and highlighted bullish sentiment.

However, the spot CVD has trended lower over the past five days. The dwindling buying volume supported the idea that AGIX might form a local top

near the $0.788 level.How much are 1, 10, or 100 AGIX worth today?

A recent Santiment post on X (formerly Twitter) noted that the on-chain activity was extremely high.

Other metrics such as holder growth and social dominance were also rising, which painted a picture of strong bullish sentiment behind SingularityNET.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.