Cardano

Cardano’s price may surprise you after Bitcoin’s halving – Here’s how

ADA was consolidating inside a bullish pattern, which hinted at a price uptick in the coming days.

- ADA was down by more than 23% over the last seven days.

- Most metrics and indicators supported the possibility of ADA testing the bull pattern.

Similar to most cryptos, Cardano [ADA] bears were leading the market as the token’s price charts remained red. However, there were changes of a trend reversal as a bull pattern formed on ADA’s chart.

Will this allow ADA to turn its charts green while Bitcoin [BTC] undergoes its next halving on the 19th of April?

Cardano bulls are waking up

The last week was disastrous for ADA investors as the token’s price declined by a whopping 23%. According to

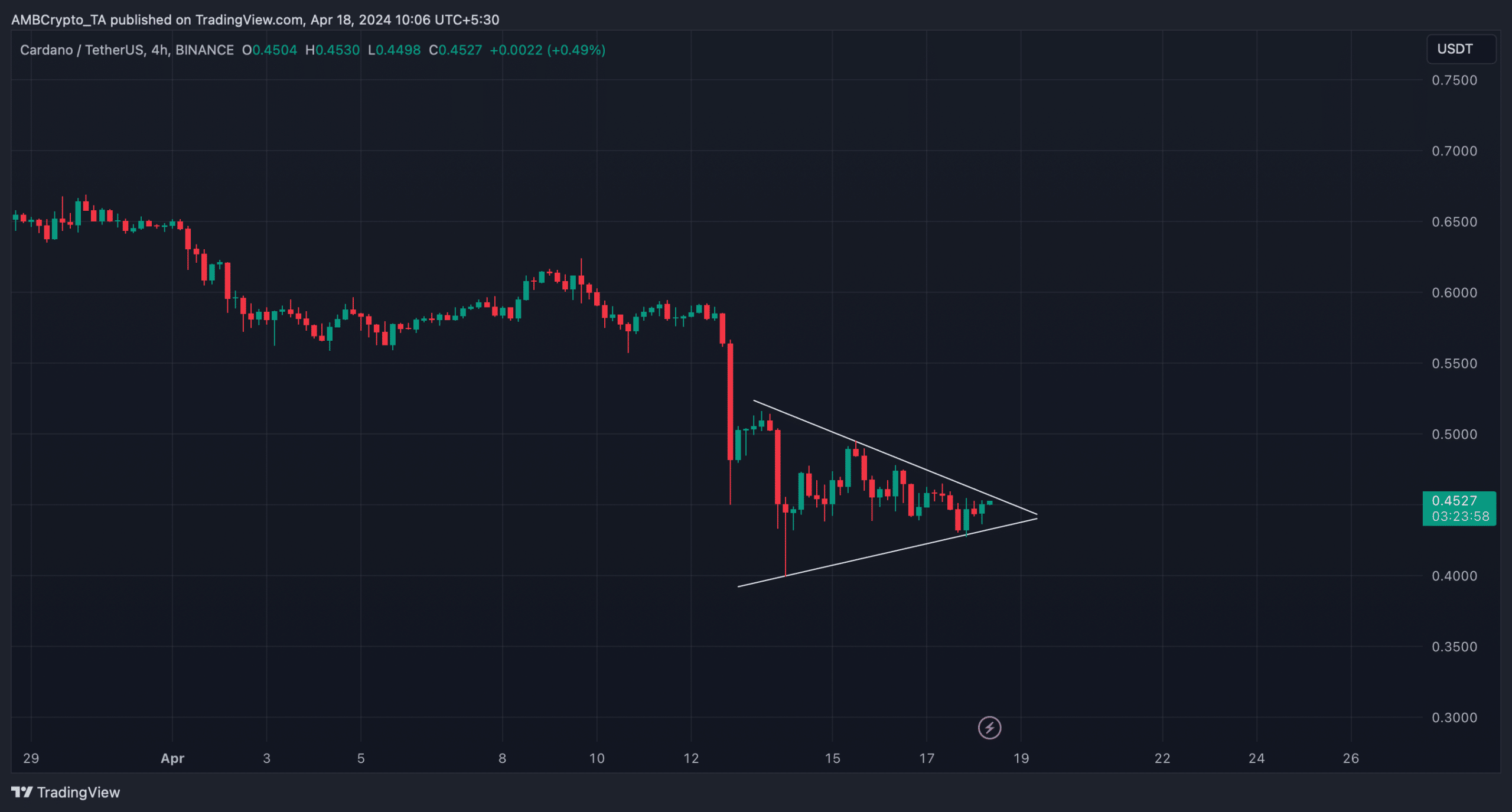

CoinMarketCap, in the last 24 hours, ADA dropped by over 2.5%.But there was more to the story, as ADA’s price was consolidating inside a bullish symmetrical triangle pattern at press time, which hinted at a bull rally.

AMBCrypto’s analysis of ADA’s 4-hour chart revealed that if the token’s price breaks above the $0.454 resistance level, then it might witness a strong bull rally as BTC undergoes its fourth halving process.

The possibility of ADA testing the pattern seemed high, as the token’s price had increased by 1.15% in the last 60 minutes.

At press time, it was trading at $0.4498 with a market capitalization of over $16 billion, making it the 10th largest crypto.

ADA on the right track

Apart from price action, a few of the metrics also looked bullish. AMBCrypto’s check on Santiment’s data pointed out that ADA’s 7-day MVRV ratio improved over the last few days.

Its Funding Rate had also dropped. Since prices tend to move the other way than the funding rate, there was a possibility of ADA registering a price uptick soon.

The token’s social volume remained relatively high throughout the last week, with a substantial spike on the 14th of April. The rise in social volume clearly reflected Cardano’s popularity in the crypto space.

Moreover, its Weighted Sentiment rose last week after dropping on the 14th of April, suggesting that bearish sentiment around the token started to decline.

To better understand whether ADA will manage to go above the $0.454 resistance level, we then took a look at its daily chart. We found that Cardano’s Relative Strength Index (RSI) was in the oversold zone.

Read Cardano’s [ADA] Price Prediction 2024-25

This indicated that buying pressure on the token might increase soon, resulting in a price increase. However, the MACD displayed a bearish advantage in the market.

The Money Flow Index (MFI) also declined, which hinted that ADA might take more time to turn bullish.