AI or bust? Crypto mining sector looks for options as Bitcoin mining revenues drop

- Bitcoin’s mining sector is struggling, with revenue declining sharply

- Transitioning to AI data centers might present significant cost and logistical challenges for Bitcoin miners

In August, Bitcoin [BTC] saw some significant volatility, trading between $64,000 and $57,000. The cryptocurrency continued its downward trend into September, with BTC priced at $56,816.75 at press time.

Despite a modest 0.38% hike over the past 24 hours according to CoinMarketCap, technical indicators seemed to suggest a persistent bearish trend.

Bitcoin mining’s AI bet

That’s not all though. Amidst this uncertainty, BTC mining companies are exploring diversification into high-performance computing data centers to boost revenue.

However, Phil Harvey, CEO of Sabre56, a blockchain data center consulting firm, believes that such a transition is fraught with challenges and may not be as feasible as it appears.

Speaking to a media outlet, the exec claimed that transforming a crypto mining facility into an AI or high-performance computing data center is significantly costlier.

He pointed out that while running a typical mining operation costs between $300,000 and $350,000 per megawatt, AI data centers demand a much higher investment. Somewhere along the lines of $3 million to $5 million per megawatt— An increase of 10 to 15 times.

Harvey also noted that even with a gigawatt of power, only about 200 megawatts could feasibly be redirected to high-performance computing tasks.

He said,

“There’s probably around 20%, I would imagine, of each miner’s portfolio that is actually capable of delivering key attributes like power, data, and land in order to facilitate AI.”

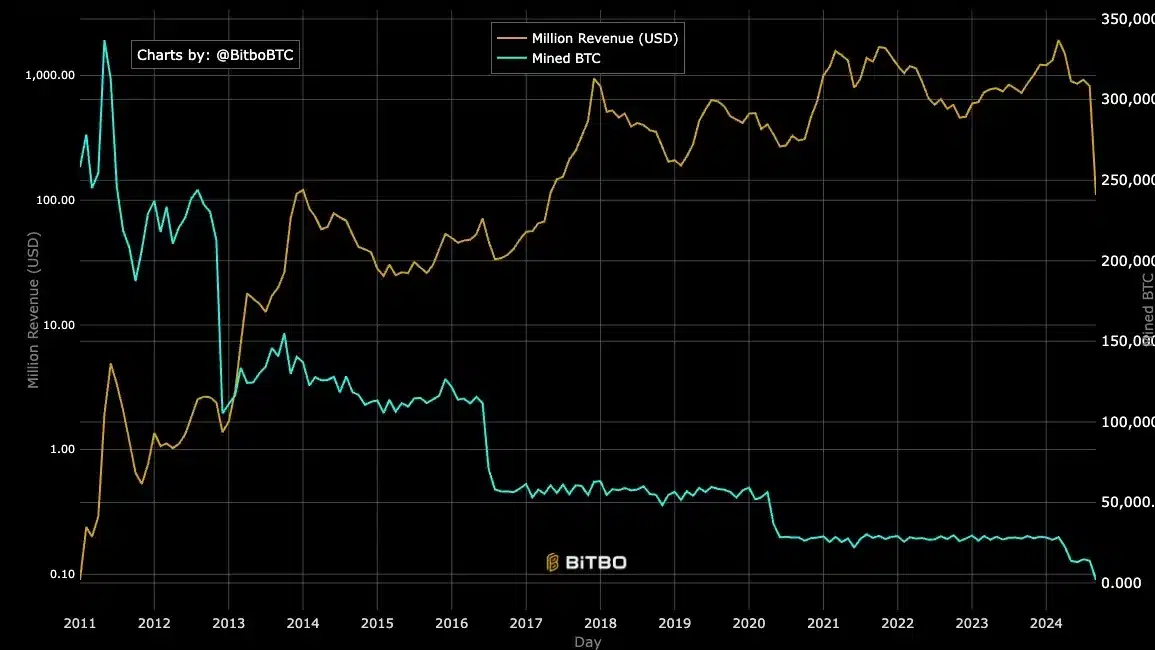

Bitcoin’s revenue slump

The recent push for Bitcoin miners to pivot towards AI data centers may stem from their significant revenue struggles.

For context, August marked the worst earnings month for BTC miners in nearly a year, with profits hitting their lowest since September 2023. Especially in light of mined coin quantities dwindling.

The significant operational costs of mining further exacerbated the situation. If these expenses outweigh the rewards, miners could be forced to capitulate.

This financial pressure has prompted many to explore alternative revenue streams, such as high-performance computing, to stabilize their operations.

In fact, a recent analysis by AMBCrypto revealed a significant drop in miner revenue, with the same falling to $820 million in August.

This represented a decline of over 10% from July’s $927 million and marked a staggering 57% fall from its peak of nearly $1.93 billion in March.

March was notable, not only for its high revenues but also for Bitcoin’s all-time high (ATH) surpassing $73,000.

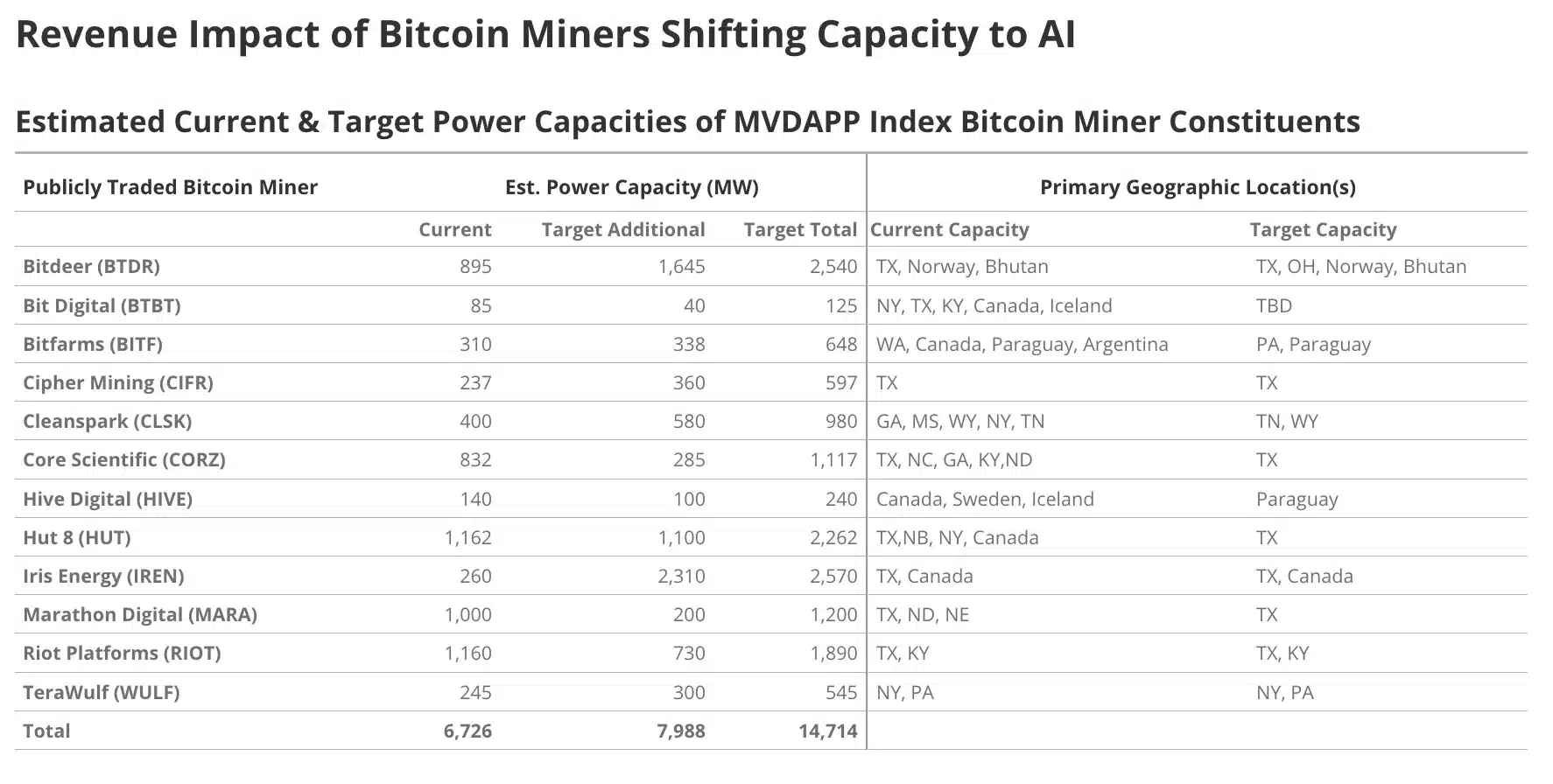

VanEck has a different perspective to share

Here, it’s worth noting that according to VanEck’s projections, publicly traded BTC mining companies could generate substantial revenues by reallocating 20% of their energy capacity to AI and high-performance computing by 2027.

“Total additional yearly profits could exceed an average of $13.9 billion per year over 13 years.”

The report added,

“AI companies need energy, and Bitcoin miners have it.”

Thus, as the Bitcoin mining industry explores the shift to high-performance computing and AI data centers, the path forward remains uncertain.

But, how this transition unfolds will be crucial in determining whether it can successfully stabilize and enhance mining revenues. Especially in the face of current financial pressures.