Aided by spot buying, Toncoin bulls target the $7.5 resistance next

- Toncoin continued to trade within the month-long range.

- Traders could anticipate a price bounce soon due to rising buying pressure.

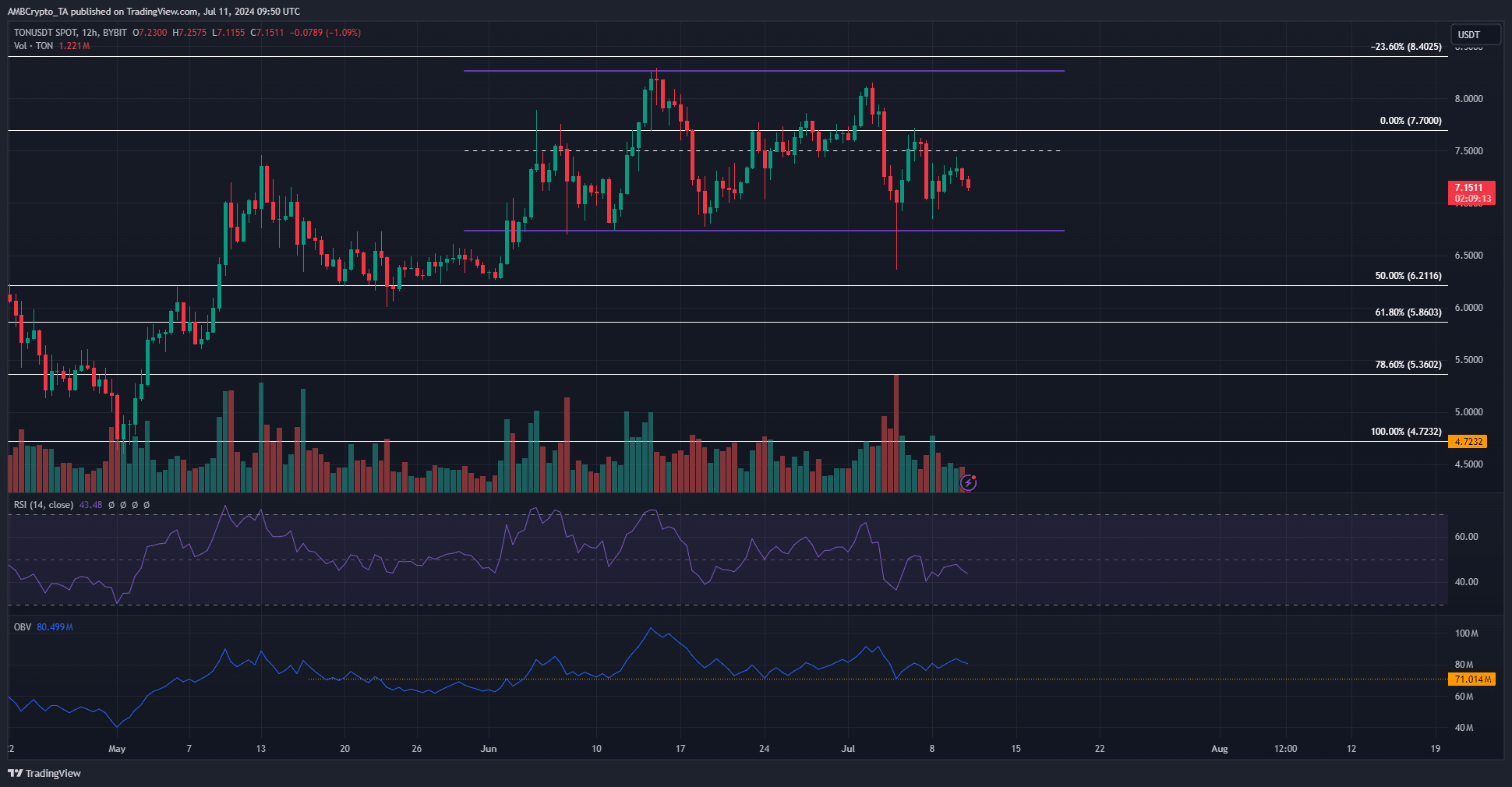

Toncoin [TON] tried to recover from the deep losses it faced on the 5th of July, but the past week’s trading activity did not see prices successfully reclaim the $7.5 as support.

Instead, $7.7 served as resistance and rejected the bulls’ attempts.

The mid-range level of resistance was also a thorn in the side of the buyers. Technical indicators painted a bearish picture for TON, but there is some evidence the range will continue to persist.

Bulls have not lost the battle yet

TON traded within a range that extended from $6.75 to $8.27 with the mid-range at $7.5. This is not just the mid-range, but was also long-term resistance that TON could not break through in April and May.

The price was in the lower half of the range, while the daily RSI was at 43 to signal bearish momentum, which meant that Toncoin would likely move toward $6.75 next.

The OBV has defended a support level since June. The bulls have adamantly held one, which highlighted some buying pressure despite the bearish sentiment in the past two weeks.

This is why TON bulls can bid a retest of the $6.75 support and hope for a positive reaction.

Speculator sentiment feeble, but spot buyers fuel hopes

Source: Coinalyze

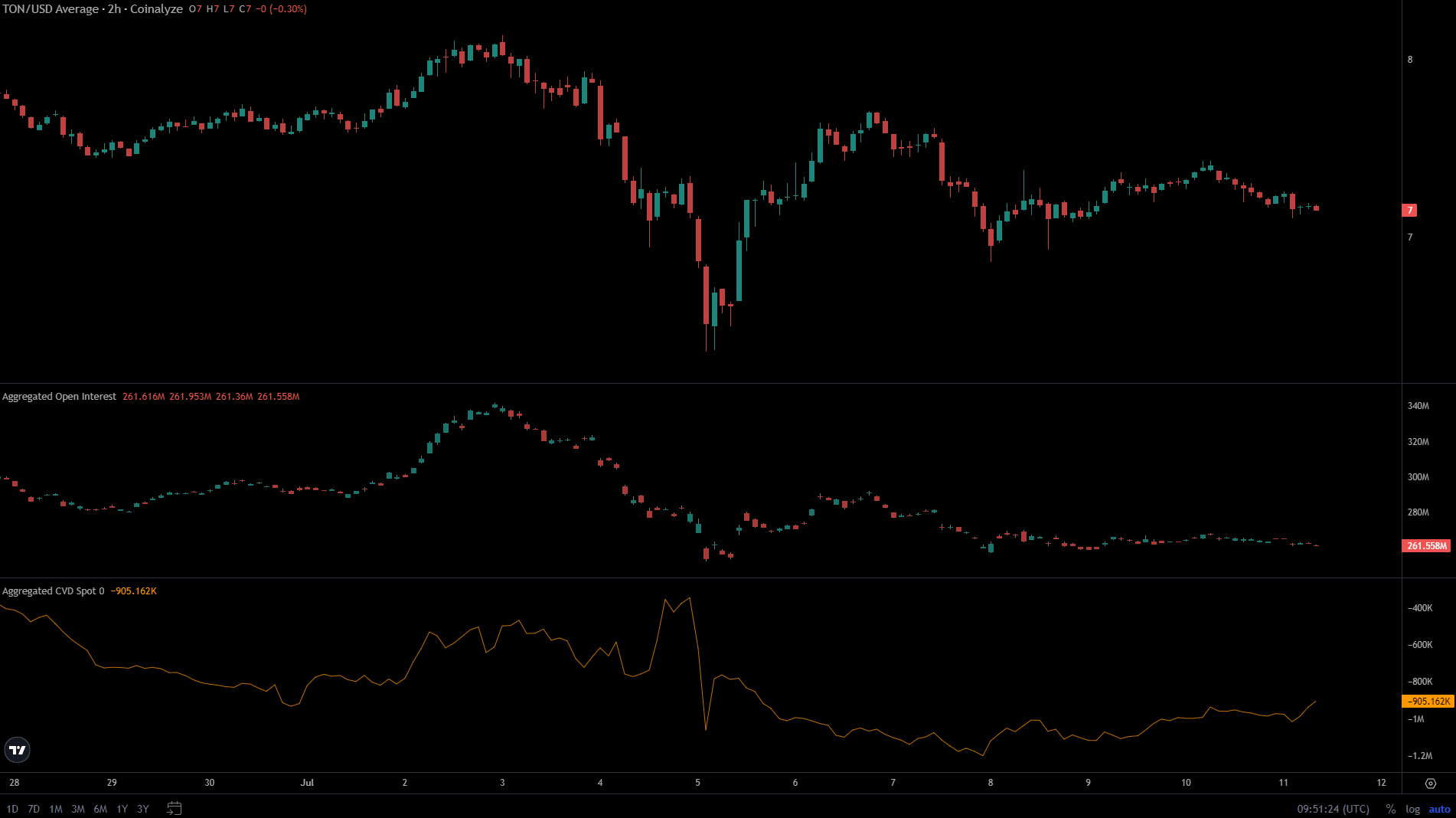

Open Interest has remained at the $261 million level over the past three days even though prices jumped from $7.2 to $7.4. This lack of activity highlighted the absence of bullish conviction amongst futures traders.

Read Toncoin’s [TON] Price Prediction 2024-25

Another cohort of traders remained optimistic about TON. The spot CVD has trended higher since the 9th of July to reflect increased buying pressure in the past two days.

This is a good sign, but it might not be enough to drive a rally past the $7.5 resistance yet.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.