AIOZ crypto price prediction: Is a new high expected this December?

- While profit-taking could trigger a minor price dip in the short term, the broader trend suggests a potential rally.

- Chart analysis indicates that the asset is likely to test support levels before resuming its upward trajectory.

AIOZ has been among the top-performing crypto assets recently, recording a remarkable 178.45% price surge within a single month. Market activity remains robust, signaling that bullish sentiment persists.

Over the past 24 hours alone, the asset has gained 16.06%, further reinforcing its strong performance.

According to AMBCrypto’s analysis, while the current positive returns are noteworthy, a slight correction may precede a more pronounced upswing, setting the stage for another potential high.

Profit-taking may temporarily slow AIOZ’s momentum

Spot traders have begun taking profits on AIOZ following its impressive market performance. The asset’s market capitalization rose by 16.08% to $1.34 billion, while trading volume increased by $166.60 million after a 71.13% gain per CoinMarketCap.

Profit-taking occurs when traders sell part or all of their holdings to secure gains after a price surge. This behavior typically intensifies after a sharp rally, as seen with AIOZ.

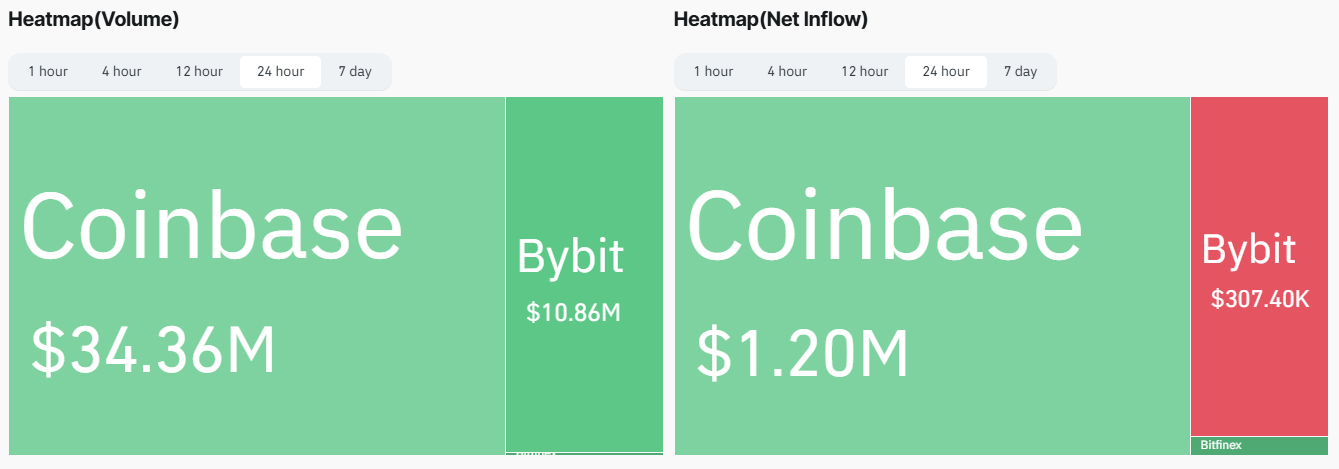

One indicator of profit-taking is a rise in Exchange Netflow, where significant amounts of an asset are transferred from wallets to exchanges in preparation for sales. At the time of writing, over $1 million worth of AIOZ has been moved to exchanges within the past 24 hours.

Such actions, which increase asset supply, often result in price declines unless offset by rising demand. According to AMBCrypto, if this trend continues, AIOZ could test its next support level.

AIOZ tests lower support levels

Recent selling pressure may push AIOZ lower, forcing the asset to find a support level where buying interest can accumulate before resuming its upward trajectory.

Analyzing AIOZ’s chart with Fibonacci retracement levels suggests the asset could drop to the 0.9472 zone, where sufficient buy orders may exist to fuel a recovery.

If this support fails to hold, AIOZ might retrace 50% of its recent gains, potentially dipping further to the red Fibonacci line at 0.8297 before an upward movement is likely.

If AIOZ rebounds from either of these levels, it could pave the way for a new all-time high in the near future.

Strong bullish sentiment persists

Data from Coinglass indicates that Open Interest, which tracks the total number of unsettled derivative contracts in the market, has favored long traders.

This trend is evident from the recent surge in Open Interest, which has increased by 13.07% over the past 24 hours to $9.41 million.

Similarly, the number of long contracts continues to rise. At the time of writing, the Long-to-Short ratio has reached 1.0028. When this ratio remains above 1, it suggests that long traders hold greater influence in the market, potentially driving prices higher.