ALGO still down 88% from ATH DESPITE recent 480% hike – What next?

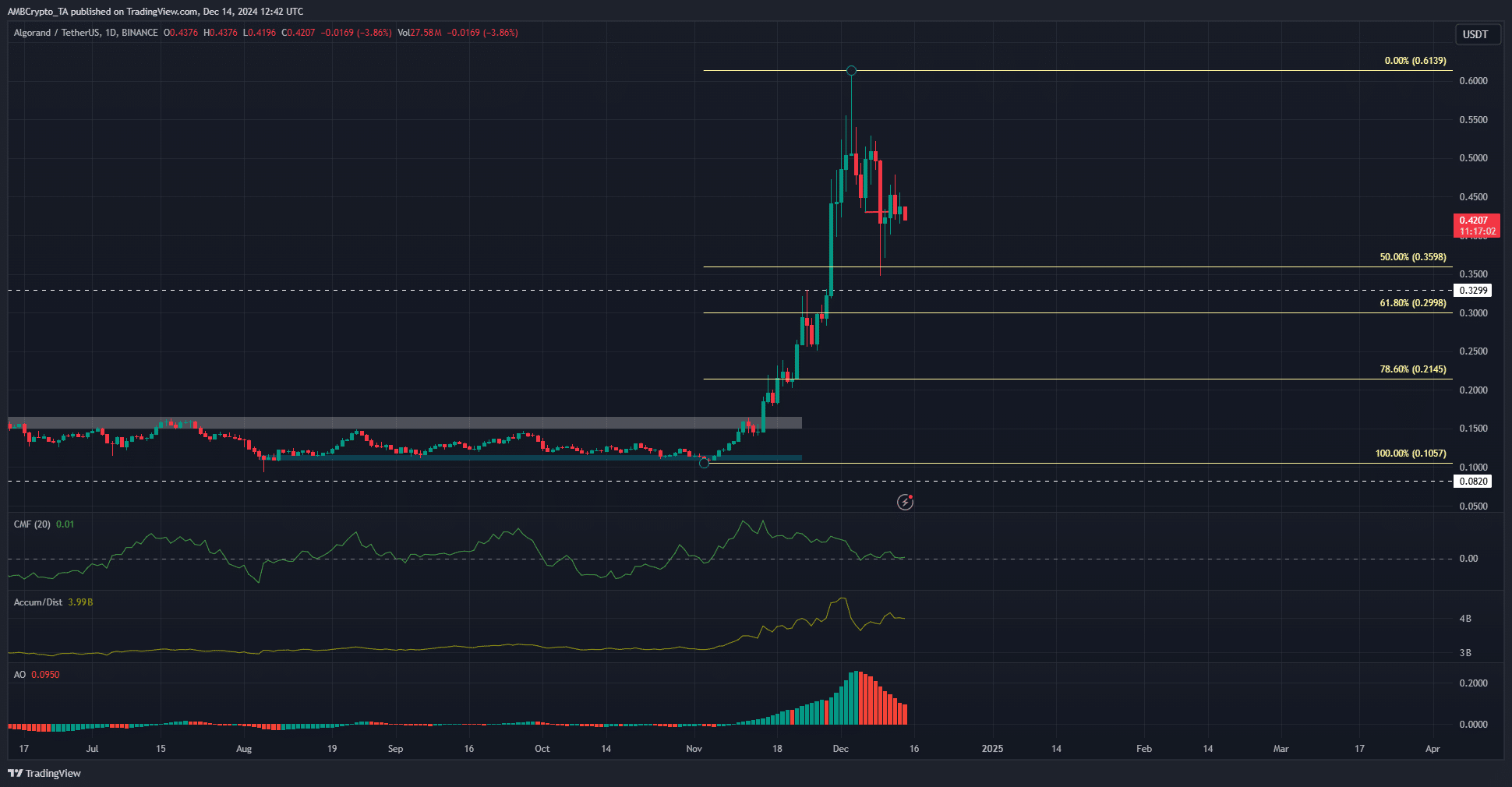

- Algorand had a bearish market structure on the daily chart

- Reduced speculations and spot demand suggested further losses may be likely in the short-term

Algorand [ALGO] was one of the coins that did well in the past cycle, one that revived itself last month and went on a good bullish run. In fact, it gained by 480% in a month, but began to recede in early December.

Additionally, the altcoin’s volume indicators outlined trouble ahead on the price front.

Algorand losing bullish momentum

ALGO has been forced to retreat from its local high at $0.613. The retracement began in the first week of December, when Bitcoin [BTC] was still trading within its short-term range. Over the last three days, BTC broke above the range and climbed past $100k again. And yet, at press time, ALGO was falling again.

The market structure of Algorand flipped bearishly on the 1-day chart on 9 December. Since then, the CMF has trended south to show decreased capital inflows. Its press time reading of +0.01 indicated neutrality and was not enough to recover a bullish structure.

The A/D indicator was also slumping on the charts. The two volume indicators highlighted how Algorand bulls were losing strength quickly over the last ten days. The Awesome Oscillator highlighted the loss of momentum too.

The Fibonacci retracement levels would be the next support levels to watch. The 50% level at $0.36 has been tested as support, but it is likely that ALGO would test it again. The $0.3 and $0.2145 levels could be the targets for the next month or two. Unless the demand for Algorand can recover.

Positive sentiment on its way to…

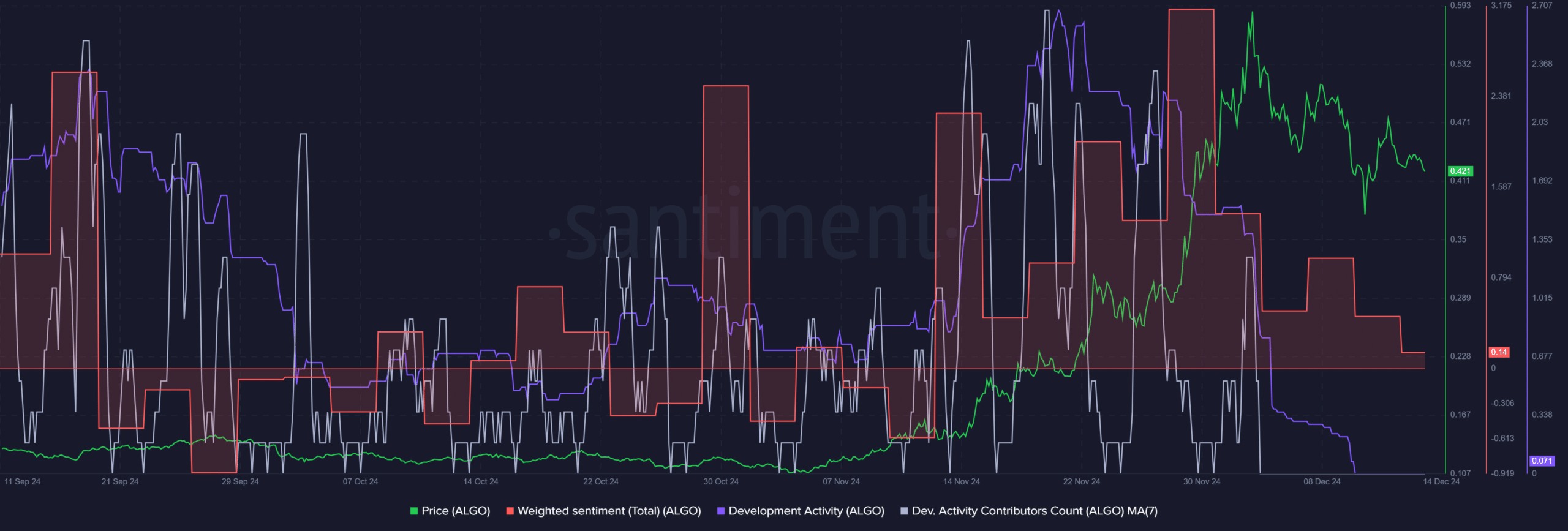

Source: Santiment

Santiment’s data showed that the weighted sentiment, which had been highly positive just two weeks back, has begun to drop. At the same time, the development activity also trickled lower and halted on the charts.

In fact, the dev activity and contributors count have been zero since 10 December. This could be due to the holiday season, but it did not occur in recent years and can be seen as an anomaly.

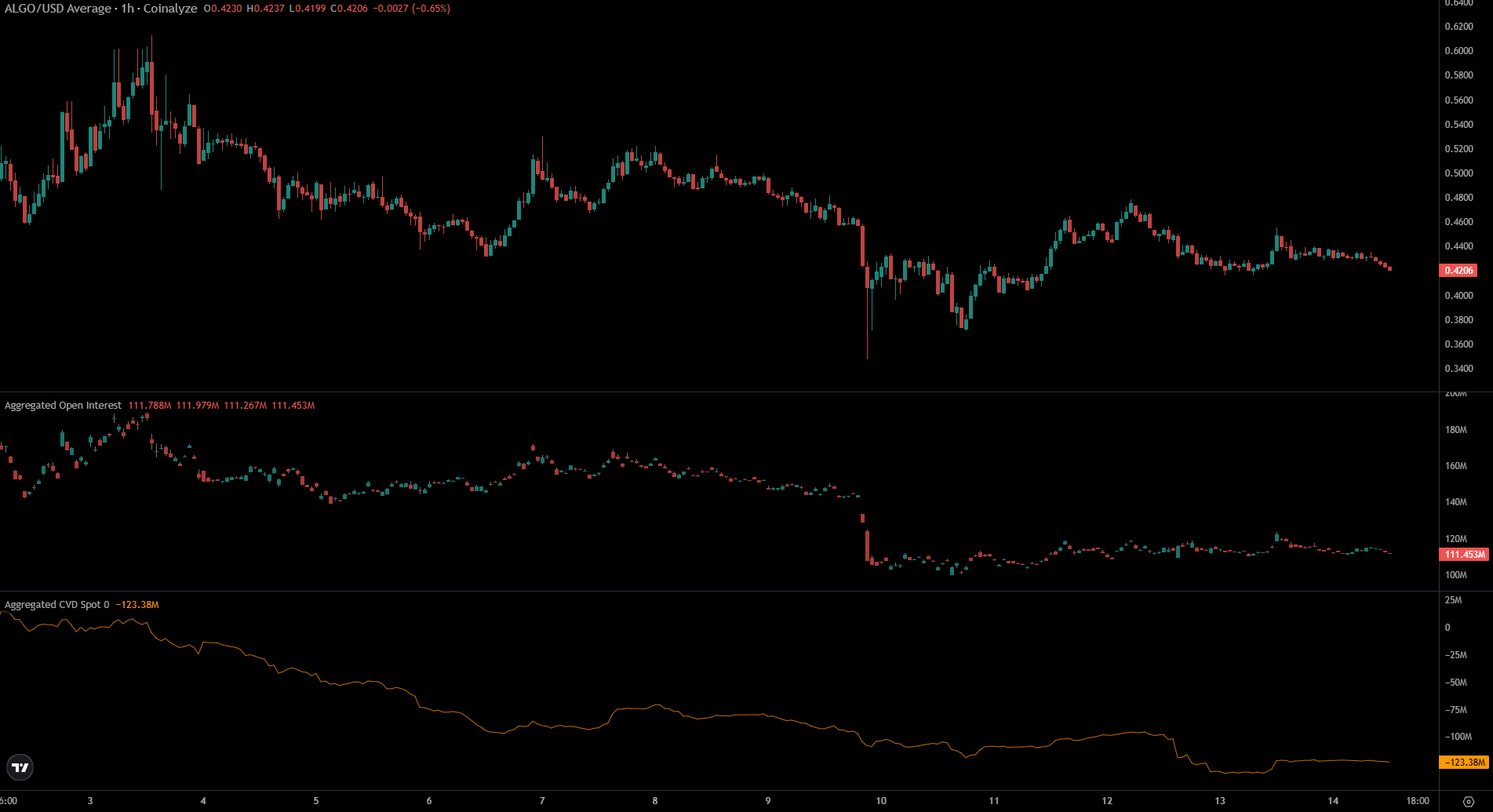

Source: Coinalyze

Is your portfolio green? Check the Algorand Profit Calculator

Finally, the Open Interest has been slowly trending lower, as has the spot CVD. It has been flat over the past 24 hours, but it may be too soon to tell if the selling pressure has been arrested.

Overall, further losses appeared likely at press time.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

![Solana [SOL]](https://ambcrypto.com/wp-content/uploads/2025/08/Solana-SOL-1-400x240.webp)