ALGO traders bet big: Potential 30% gain to $0.42 forecasted

- ALGO could surge by 30% to reach $0.42 if it closes a daily candle above $0.32.

- Following the bullish outlook, traders have increased their positions by 7.5% in the past 24 hours.

Amidst the price correction phase, Algorand [ALGO] is making a wave across the market with an impressive price surge. As of press time, ALGO has emerged as the third-largest gainer, attracting significant attention from whales and investors.

Algorand defies market trend

With an impressive price surge of over 12% in the past 24 hours, the altcoin is currently trading near $0.298. Meanwhile, its trading volume during the same period has jumped by 75%, indicating heightened participation from traders and investors.

Data from the on-chain analytics firm Coinglass reports that the altcoin’s open interest (OI) has increased significantly, indicating strong participation from traders.

According to the data, traders have increased their positions by 7.5% in the past 24 hours and by 4.2% in the past hour.

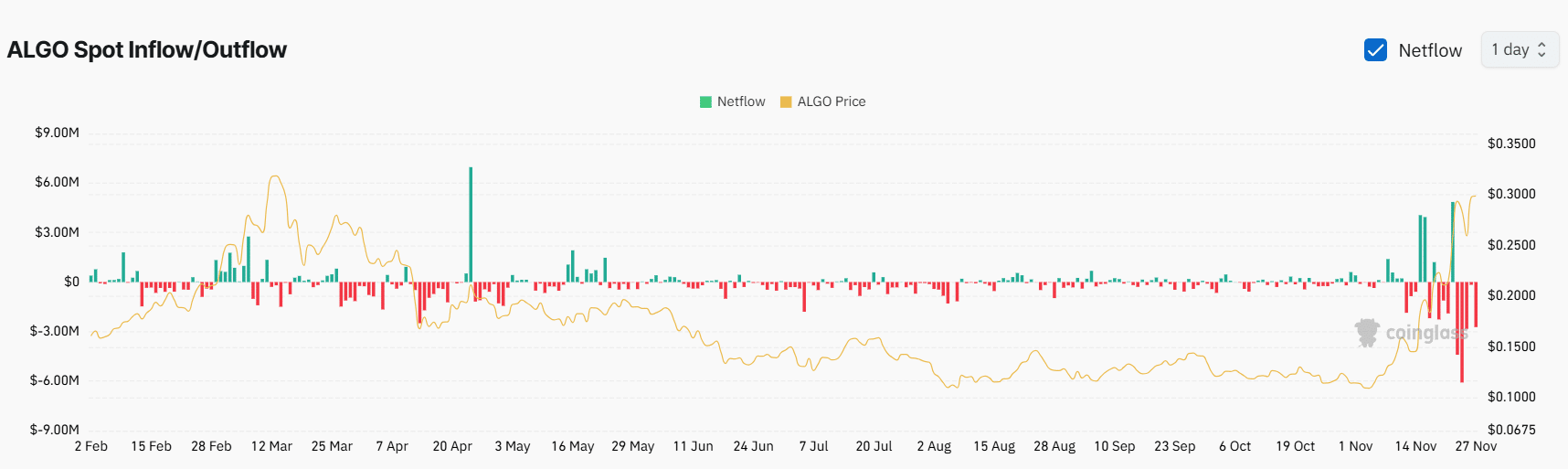

In addition to the increase in OI, Coinglass’s ALGO spot inflow/outflow data indicates strong participation from traders. Moreover, whales and investors have been consistently accumulating the token since November 23, 2024.

This strong interest from traders and investors has helped ALGO to defy the market correction phase.

Algorand technical analysis and upcoming level

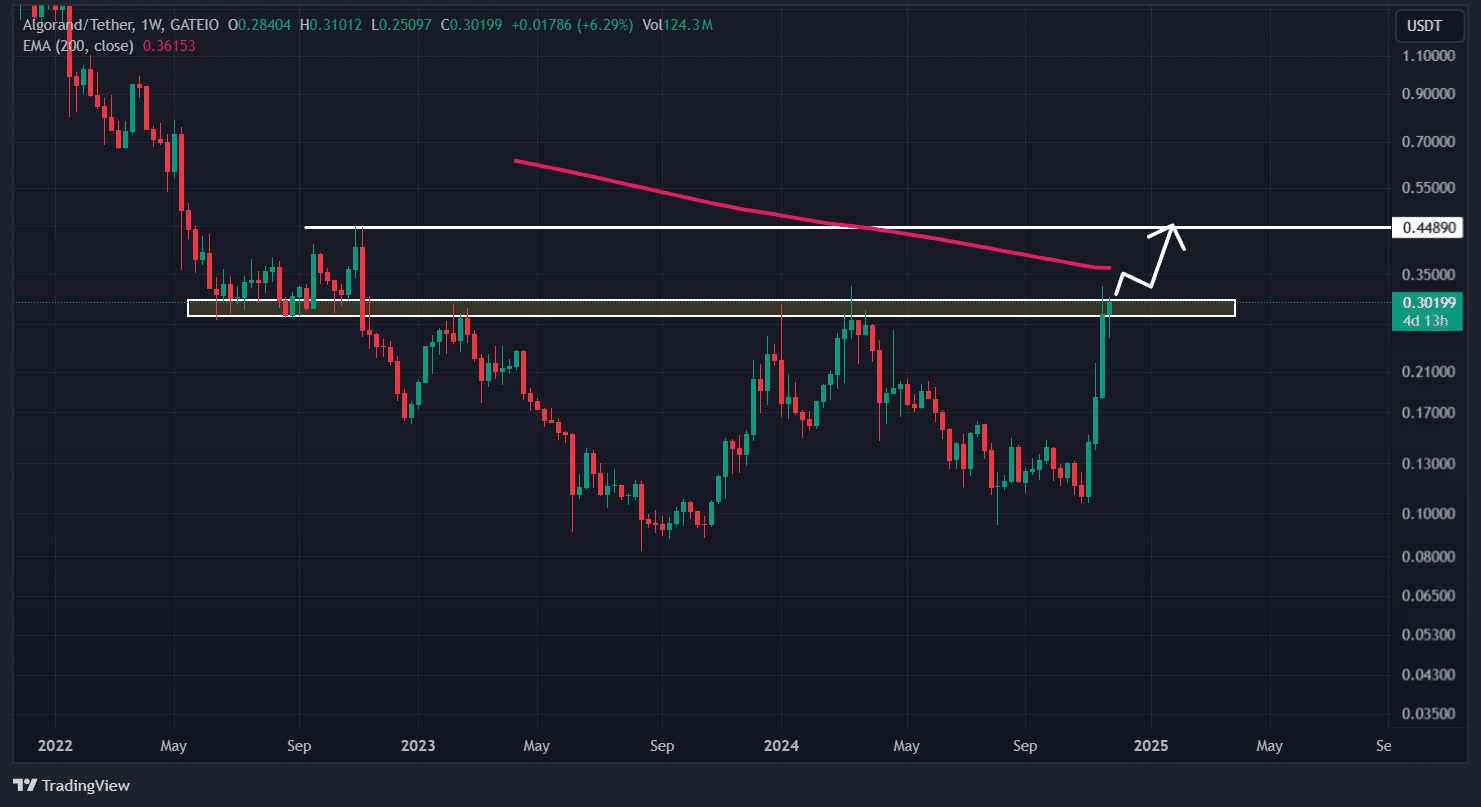

According to expert technical analysis, ALGO is currently consolidating within a tight range near the strong resistance levels of $0.25 and $0.30. Based on the altcoin’s daily chart, the price has been consolidating within this range for four days.

The current sentiment for ALGO appears bullish, driven by notable interest from investors and traders, which could help the altcoin breach this resistance level.

Based on historical price momentum, if ALGO breaks above this level and closes a daily candle above $0.32, there is a strong possibility it could surge by 40% to reach $0.45 in the coming days.

Is your portfolio green? Check out the Algorand Profit Calculator

On the positive side, the altcoin is trading above the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating an uptrend. However, its Relative Strength Index (RSI) suggests a possible price correction as it is currently in overbought territory.

Combining these on-chain metrics with technical analysis suggests that bulls are strongly dominating the asset and could soon overcome this significant resistance.