Algorand investors can breathe a sigh of relief as…

- Discussions about ALGO surpassed most projects, leading to a hike in price.

- The sentiment around the token improved, and most open contracts went long.

Algorand’s [ALGO] social mentions, contributions, and engagement increased significantly on 16 June. According to social intelligence platform LunarCrush, the project’s social activity rose above most of its rivals such that it named it the “coin of the day.”

Is your portfolio green? Check the Algorand Profit Calculator

The hike in these metrics means that the depth of community interaction around Algorand was much more than in other projects. Also, the spike in discussion and search might not be surprising as ALGO’s volume surged to its highest since March on 14 July.

Fresh wind in the house

Furthermore, the increase in volume backed the ALGO price. And consequently, the value of the 45th-ranked cryptocurrency spiked by 7.32% in the last 24 hours. The rise in price serves as a breath of fresh air for ALGO, which has experienced a monumental fall this year.

In June, the SEC proscribed ALGO as an unregistered security following a class action lawsuit against Binance and Coinbase. As a result, ALGO dropped to an All-Time Low (ATL). But now that the trend has changed, has the perception towards the token also followed?

Well, from Santiment’s data, Algorand’s weighted sentiment had been improving since 19 June. The weighted sentiment considers unique social commentary about an asset and uses this to evaluate the average perception.

Therefore, the increase implies that the broader community viewpoint of ALGO was no longer as pessimistic as it was before. But since the metric was still negative, it suggests that market participants were still cautious of the token.

A collapse isn’t the end

Despite the boost, Algorand has had to shut down Algofi, its Decentralized Finance (DeFi) infrastructure. In a community update six days ago, the decentralized network noted that it could no longer maintain the platform.

So, previous lending activity on Algofi involving Circle [USDC], ALGO, vALGO, and others would be reduced until the liquidity. The statement read,

A confluence of events has taken place that no longer makes building and maintaining the Algofi platform to the highest standards a viable path for our company.

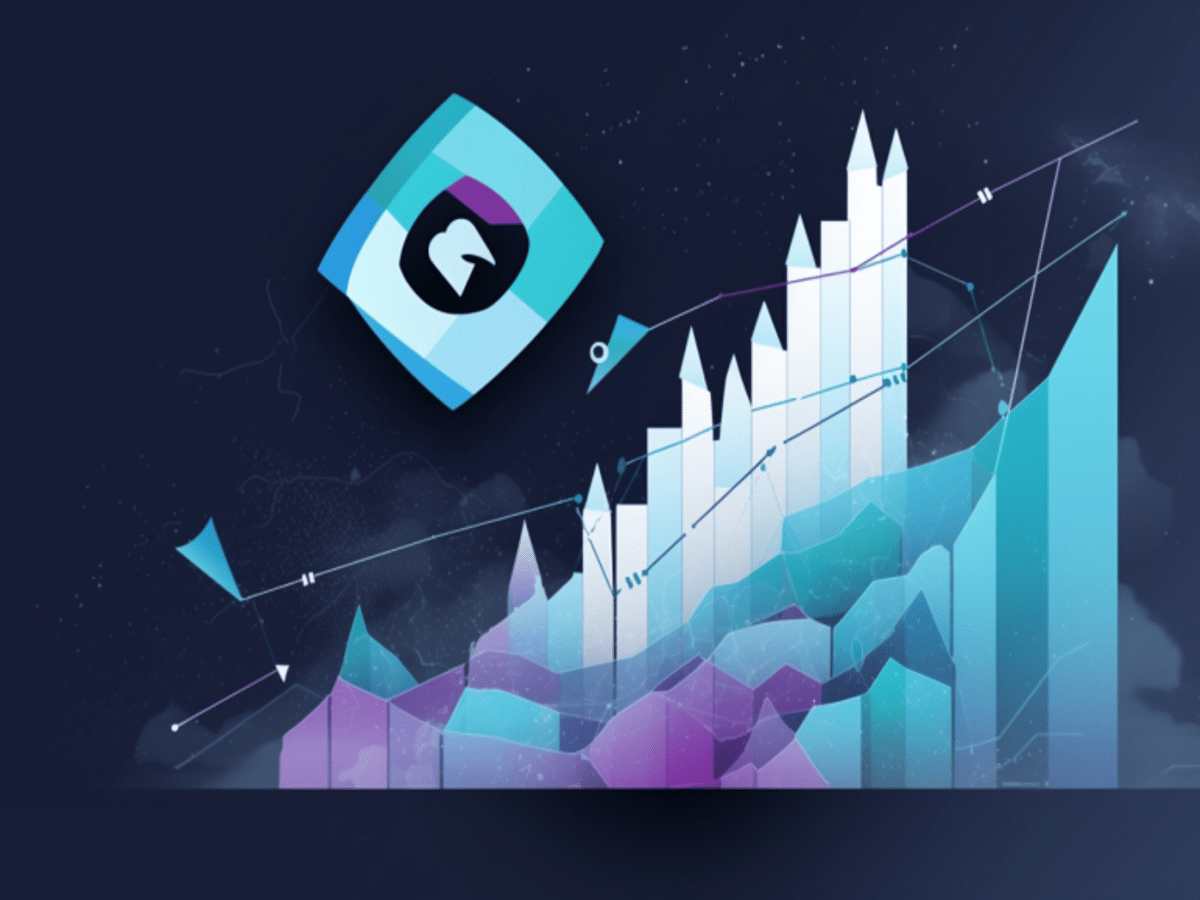

Meanwhile, ALGO’s funding rate left its stay in the negative region, according to data from Coinglass. Funding rates are periodic amounts of assets paid between short and long-positioned traders with open perpetual contracts.

Realistic or not, here’s ALGO’s market cap in BTC terms

A negative funding rate implies short are willing to pay longs to keep their position open. This suggests an average bearish sentiment. However, the positive funding rate, displayed by ALGO, means traders are still bullish on the price action.

![Algorand [ALGO] funding rate](https://ambcrypto.com/wp-content/uploads/2023/07/Screenshot-2023-07-17-at-11.10.20.png)