All about Bitcoin ETFs’ 10-day inflow streak and what it means for you

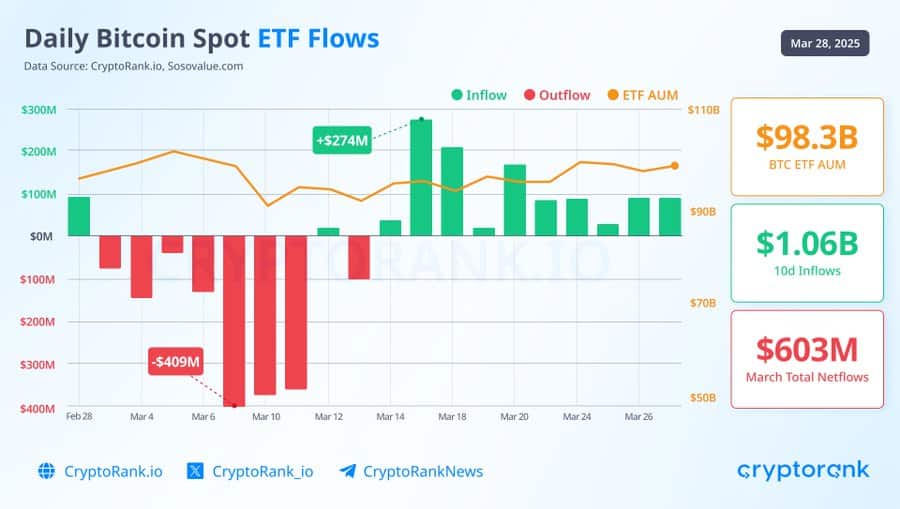

- Bitcoin ETF inflows totaled $1.06 billion over the past 10 days, reversing early March outflows

- Assets under management [AUM] climbed from $88 billion to $98.3 billion as demand stabilized across crypto ETFs

Bitcoin ETFs are back in the spotlight today after a strong streak of inflows reversed the sentiment seen in earlier March. With rising AUM and sustained demand, institutional investors are leaning back into BTC.

Here’s a breakdown of the latest ETF trends and what they could mean for the market.

Sustained inflows provide short-term relief for Bitcoin ETFs

Since 14 March, Bitcoin ETFs have seen an unbroken 10-day streak of inflows totaling $1.06 billion. This, after a significant recovery following a rough start to the month. In fact, they recorded $409 million in daily outflows on 6 March alone.

The turnaround in sentiment has pushed the total Assets Under Management [AUM] from $88 billion on 10 March to $98.3 billion by 28 March.

This streak of green days comes at a critical juncture as institutional investors regain confidence amid improving macro conditions and a recovering crypto market.

If the trend persists, it could serve as a strong tailwind for Bitcoin’s price trajectory.

March is still on track for massive net outflows

Despite the recent inflow streak, however, March remains on track to become the second-worst month for Bitcoin ETF netflows. With total net outflows hitting $603 million so far, it surpasses April 2024’s $345 million drawdown, although it still trails February’s record outflow month.

The mixed performance shows how investor behavior remains divided, with short-term optimism balanced against longer-term caution.

While the recent recovery in flows hinted at momentum, it hasn’t been enough to offset earlier losses in the month.

Comparing BTC and ETH ETF flows

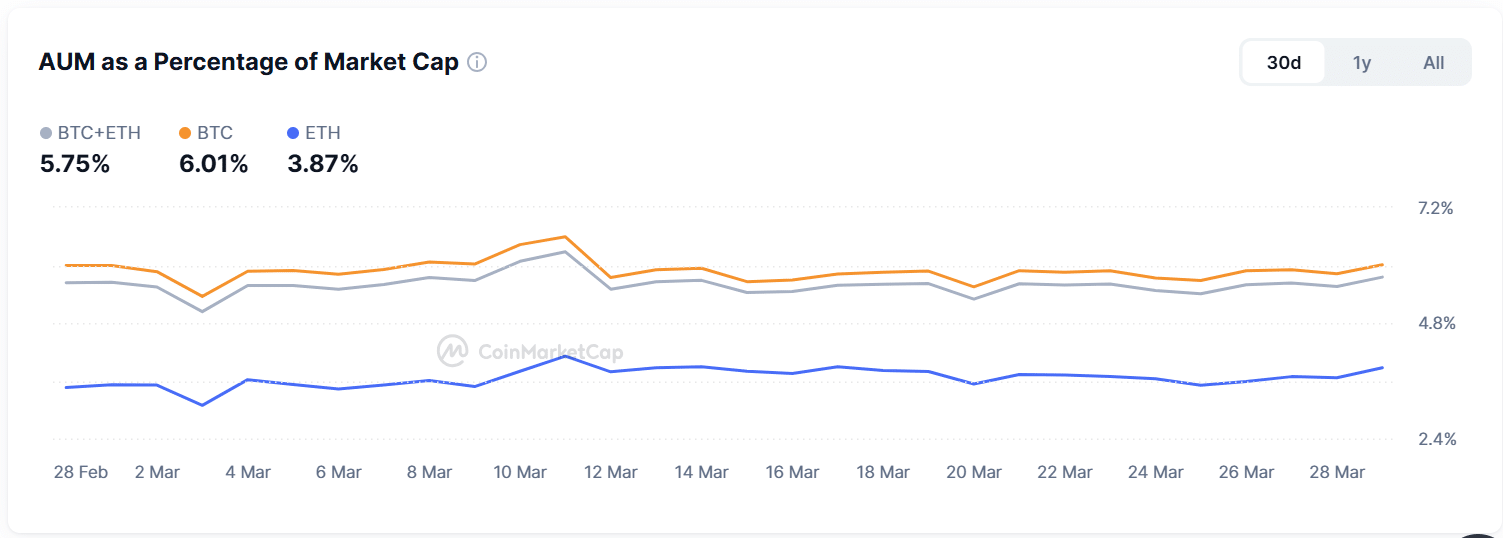

Data from CoinMarketCap revealed that while Bitcoin ETFs have seen net outflows of $93 million in the last 30 days, Ethereum ETFs have posted a modest $5 million in inflows. ETH’s steady but small inflows could hint at a growing base of long-term holders, although the volume still pales in comparison to BTC’s.

Moreover, Ethereum remains far behind in terms of ETF traction, with its total AUM contributing just 3.87% of ETH’s market cap, compared to Bitcoin ETFs holding 6.01% of BTC’s cap.

Combined, BTC and ETH ETFs currently make up 5.75% of the total crypto market cap.

Continuation or reversal in Bitcoin ETF flow?

If BTC ETF inflows continue into April, it could mark a broader institutional rotation back into crypto exposure. However, investors should remain cautious, as the month-to-date outflows still reflect ongoing volatility in sentiment.

A sustained uptick in AUM and a reduction in daily outflows would likely support bullish price action. Until then, ETF inflows may provide short-term support, but not a full reversal of broader risk-off trends.