All about Curve Finance’s declining stETH pool

- The staked ETH pool on Curve has witnessed a significant downtrend.

- ETH staking continued to see new entrants.

Kaiko’s report on 9 August highlighted a diminishing liquidity trend within one of Curve Finance’s [CRV] pools. The stETH-ETH pool, as indicated by the report, experienced a substantial outflow, resulting in decreased liquidity.

The $steth-ETH liquidity pool on Curve continues to see large outflows, reducing liquidity for the largest liquid staking token. pic.twitter.com/RDhNpq6vNt

— Kaiko (@KaikoData) August 9, 2023

Is your portfolio green? Check out the CRV Profit Calculator

Notably, Curve Finance has been among the platforms benefiting from the increased utilization of staked ETH [stETH] following Ethereum’s [ETH] transition to Proof of Stake (PoS) and the subsequent activation of staking capabilities.

Curve stETH trading volume and TVL declines

In addition to the reduction in stETH liquidity, there have been declines in trading volume and Total Value Locked (TVL) within the ETH-stETH pool over the past few months.

Dune Analytics data indicated that the TVL for this particular pool, which began the year at approximately $1.6 billion, has now decreased to roughly $398 million. This decline has consequently impacted the overall TVL of the Curve Finance platform.

Additionally, DefiLlama’s data illustrated a significant decrease in the platform’s TVL following a hack incident. The TVL plummeted from over $3 billion to around $1 billion. However, as of this writing, the TVL has recovered to approximately $2.4 billion, suggesting signs of improvement.

Analyzing ETH’s staking landscape

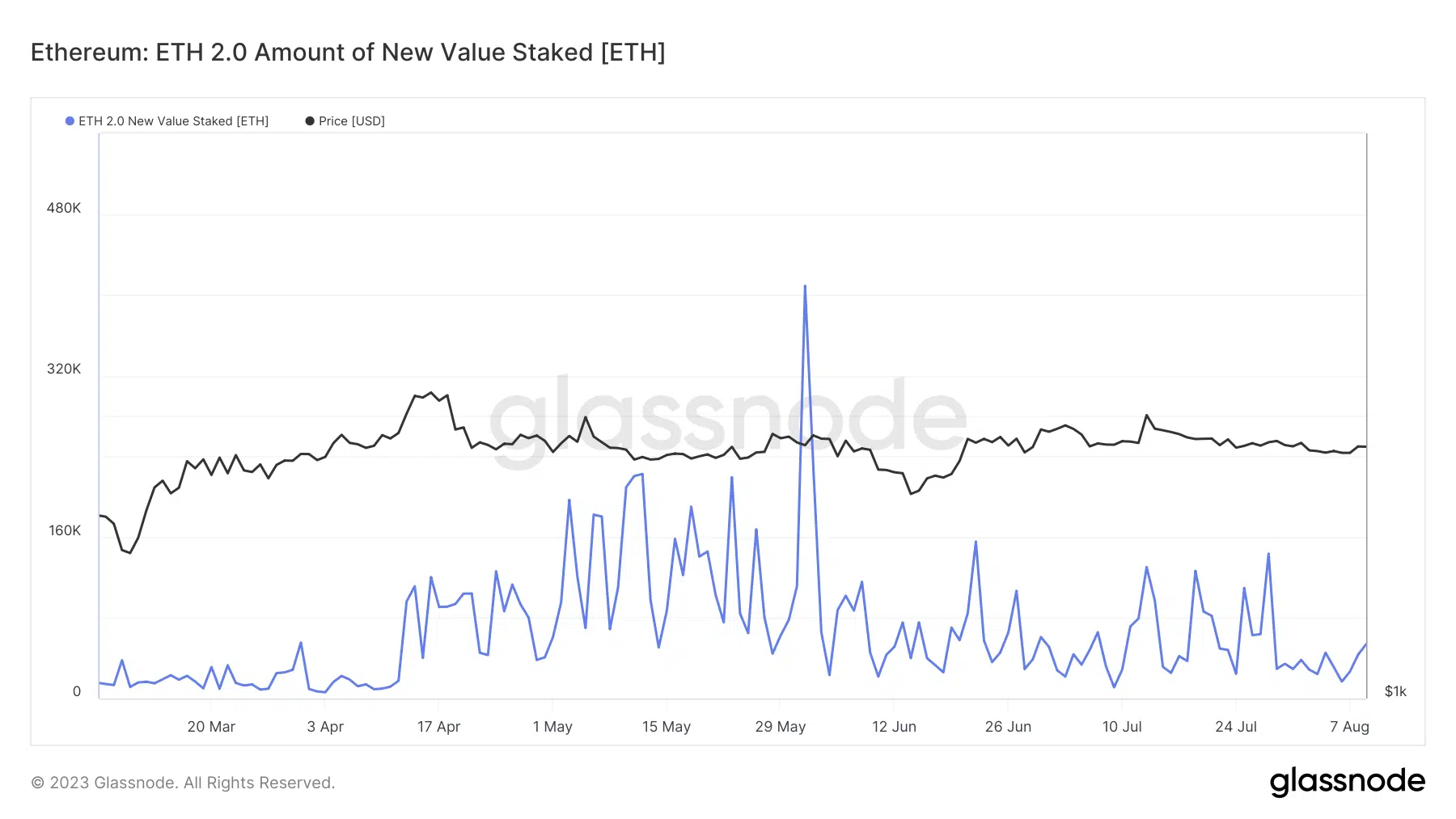

The decrease in the stETH pool’s size on Curve Finance prompted questions about the press time state of ETH staking. Insights from Glassnode revealed that ETH continued to be staked, albeit with a recent decline in the influx of new stakes.

How much are 1,10,100 CRVs worth today?

Nevertheless, a notable number of new stakes were still being observed.

As of this writing, the volume of newly staked ETH amounted to around 54,000. This situation indicated an ongoing and consistent inflow of stETH, although it appears that Curve Finance might not be capturing a significant portion of these inflows.