All about Monero’s [XMR] ‘under the radar’ July performance and what’s next

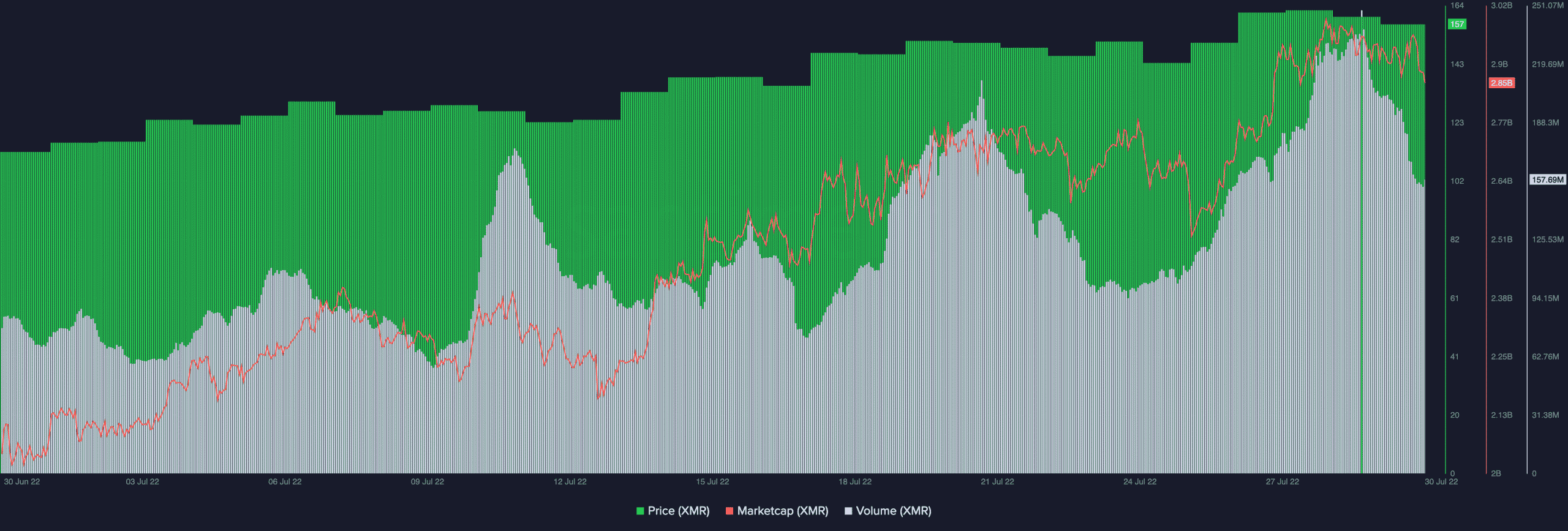

Monero [XMR] was among the few crypto-assets to take full advantage of the bullish retracement in July. Seeing its price hike from $118 to $154, July saw the altcoin record a 30% uptick.

According to data from Santiment, while the rest of the cryptocurrency market suffered at the hands of the bears in June, XMR has rallied gradually by over 41% since the middle of that month. Additionally, on 5 August, on-chain data revealed that the crypto flashed a massive spike in its sentiment, the highest it has seen since 21 May.

Now, how else has this privacy-focused cryptocurrency fared over the last month?

Monero moons and more

Noting a hike of 30% in July, XMR was not left behind after Bitcoin appreciated by over 18% while Ethereum was up by 54%. Within that period, the crypto’s price rose to a high of $162 on 28 July before closing the month at an index price of $154.

Within the 31-day period, the alt’s market capitalization rose from $2.08 billion to $2.85 billion – A 37% hike. Rising steadily throughout the month, XMR’s trading volume grew by 115% too.

So far this month, XMR’s price has registered a minor uptick of 2%. At press time, the altcoin was exchanging hands at $160.66 – Down by 1% in the last 24 hours. With $83,801,108 logged as the alt’s trading volume in the same period, a 24% decline was spotted.

On the daily chart, XMR has been consolidating within a tight range over the past few days. At press time, higher buying pressure was spotted. Furthermore, the Relative Strength Index was positioned at 62.20 on an uptrend while its Money Flow Index had a reading of 64.19.

On-chain performance

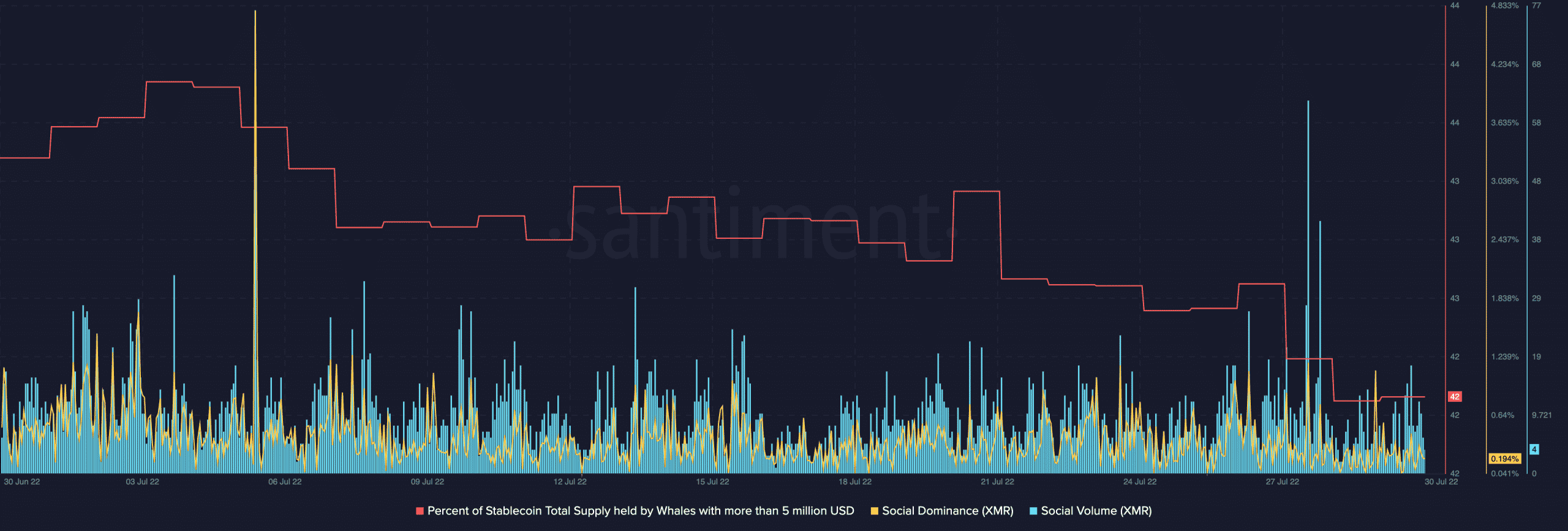

According to data from Santiment, whales began profit-taking in July as XMR’s price went up. Within the 31-day period, the supply of XMR tokens held by whales declined by 3%. This has dropped further by 0.11% since the beginning of this month.

Interestingly, despite impressive price growth in July, XMR failed to record any significant traction on the social front. Last month, its social dominance declined by 53%. Its social volume also dropped by 30%.

![Bonk Coin [BONK]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-19-1-400x240.webp)