All about Solana’s recovery – Is an ATH likely?

- SOL eyes the trendline support it lost in June.

- Network traction has surged, similar to the March highs.

Since the current cycle bull run began in late 2023, Solana’s [SOL] peak rally hit over 850% by March 2024. It was a wild jump from $20 to $210, fronting a 10X play, a rare gem every crypto trader hopes for.

However, market headwinds from Q2 dragged SOL below $150 and breached key multi-month trendline support on the chart that began last year.

Now, SOL looks ready to reclaim the previous trendline support, raising speculation about further gains for the altcoin.

‘SOL is regaining an uptrend that started when it was at $21. There isn’t a better fundamentals x TA combo bet out there.’

Is SOL set for a record high?

Based on the SOLETH ratio, market analyst Ansem claimed a similar bullish breakout for SOL was likely.

‘SOLETH is the most bullish chart in crypto, rare that you get technicals & fundamentals to line up so cleanly like this at the same time.’

For perspective, SOLETH tracks SOL price performance relative to ETH. The ratio increased in the past few weeks and could hit a price discovery territory if the ceiling near 0.06 is cleared.

This means that SOL has outperformed ETH in the past few weeks and could continue to do so if SOLETH climbs above 0.06.

Ansem was convinced that SOL could retest the current cycle of $210 anytime, provided SOL stays above $160.

Will SOL’s network growth help?

A recent AMBcrypto report established that Solana network activity recovered significantly, especially on the TVL (total value locked) and stablecoins inflows.

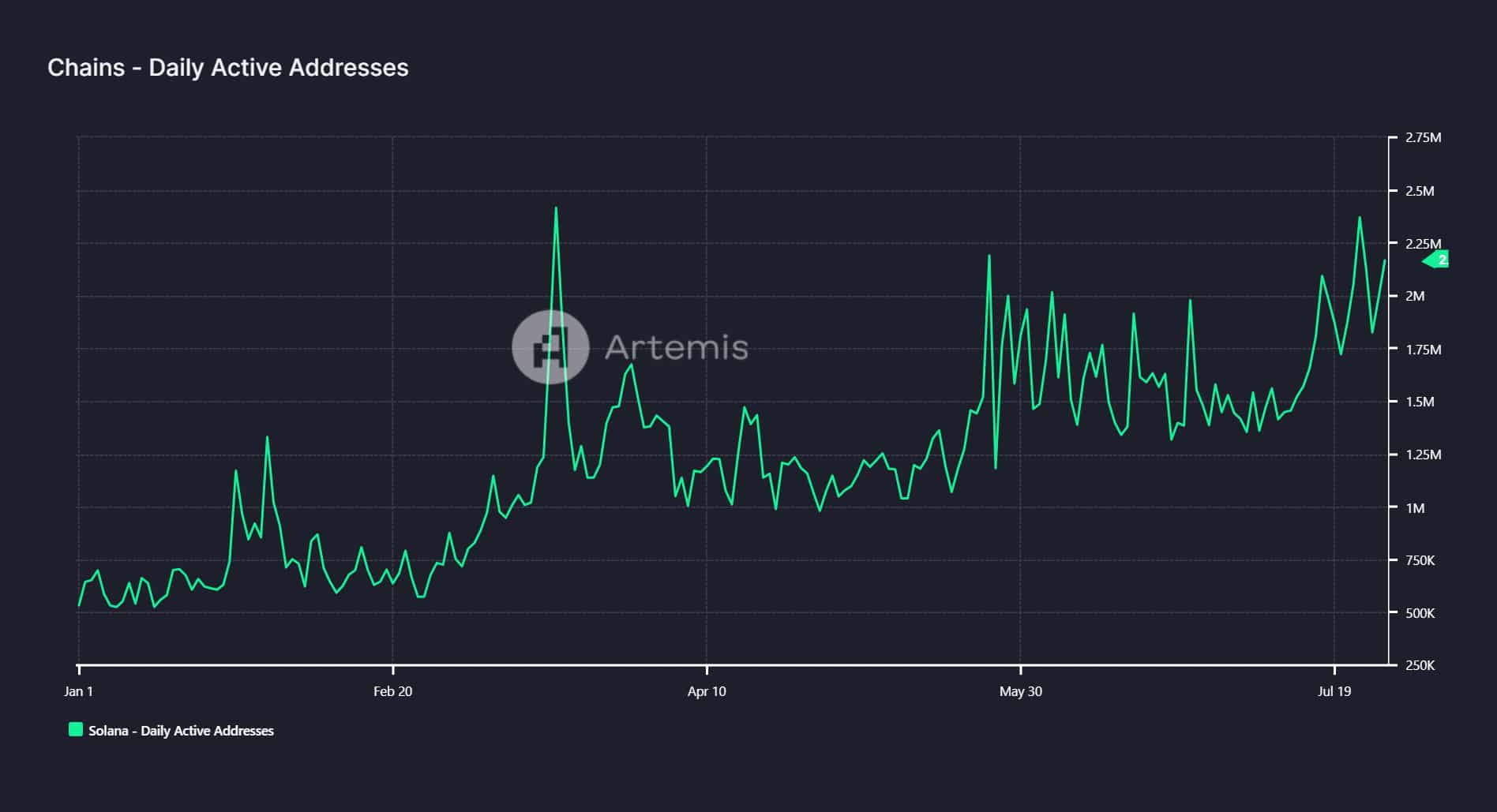

A review of Artemis data revealed that SOL’s daily active addresses spiked in July, surging above 2.2 million. For perspective, such a spike was last seen in March when SOL hit this cycle high of $210.

The massive network traction could bolster a possible reclaim of the previous trendline support.

However, per CryptoQuant data, key technical indicators flashed an overbought signal, suggesting that price trend reversal was likely in the short-term.

A convincing move could be confirmed during this week’s Fed rate decision on July 31st. Any dovish stance could rally SOL above the uptrend line. On the contrary, a hawkish announcement could delay the reclaim of the uptrend line.

![Ripple [XRP]’s subtle rebound – Will strong derivatives bets trump weak on-chain signals?](https://ambcrypto.com/wp-content/uploads/2025/04/E3CB2045-31A3-4BD4-B5BC-2142FF334BE1-400x240.webp)

![Shiba Inu [SHIB] price prediction - A 70% rally next after 300%+ burn rate hike?](https://ambcrypto.com/wp-content/uploads/2025/04/Erastus-2025-04-12T132907.604-min-400x240.png)