All the reasons why Ethereum is struggling to catch up with Bitcoin

- ETH’s underperformance relative to BTC hit a yearly low

- Coinbase analysts linked weak performance to investors’ interests and other factors

After peaking in March, the world’s largest altcoin, Ethereum [ETH], has continued to trail Bitcoin [BTC].

ETH hit $4k in March and attempted to retest the level after partial approval of U.S spot ETH ETFs later in the year. And yet, ETH has continued to underperform BTC.

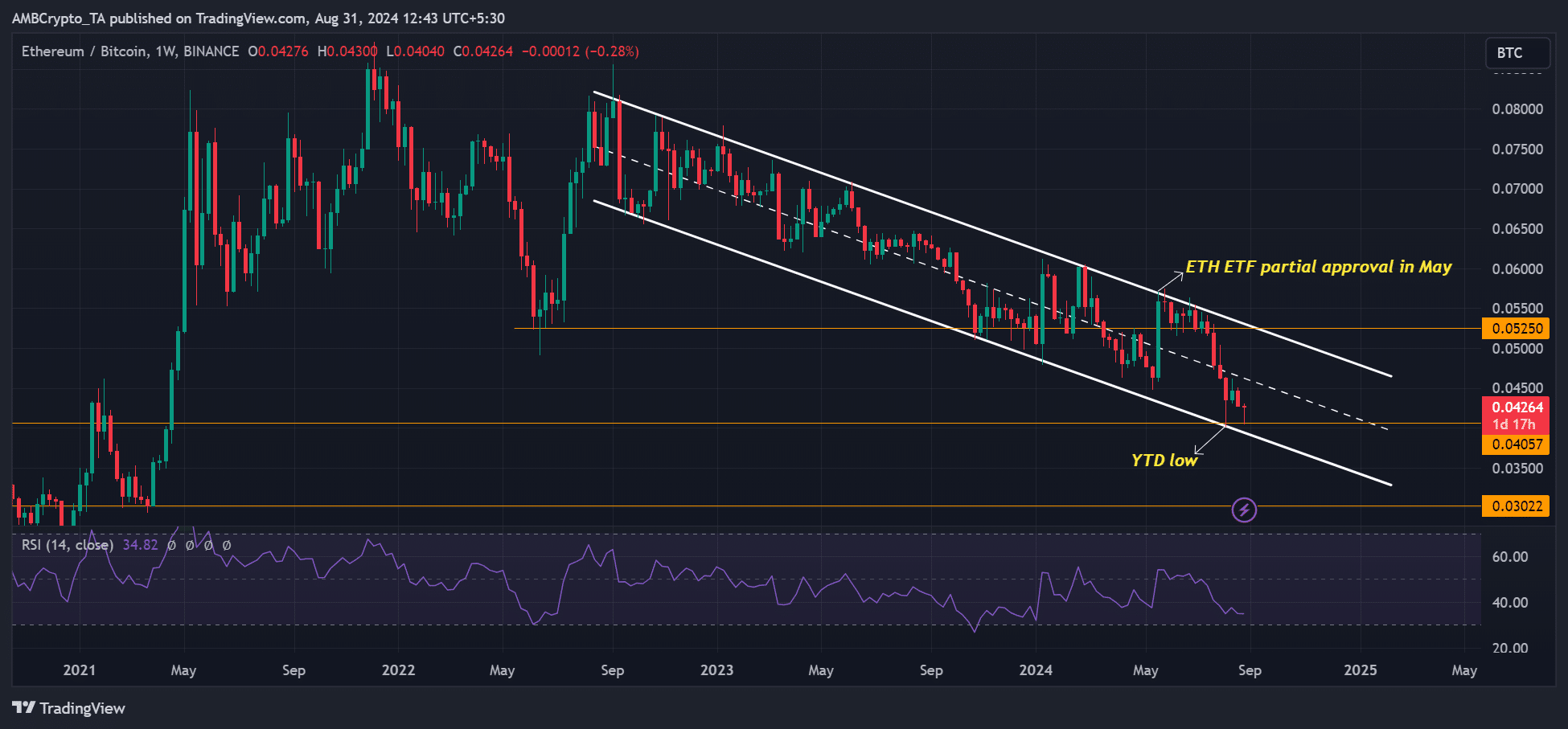

Even July’s final ETH ETF approval didn’t help the altcoin’s underperformance. In fact, it recently hit a yearly record low of 0.040 on the ETHBTC ratio, which tracks ETH’s value relative to BTC.

Reasons for ETH’s dismal performance

In their latest weekly commentary, Coinbase analysts linked ETH’s weak performance to “net buyer interest divergence” based on ETF flows and other factors. Part of the report read,

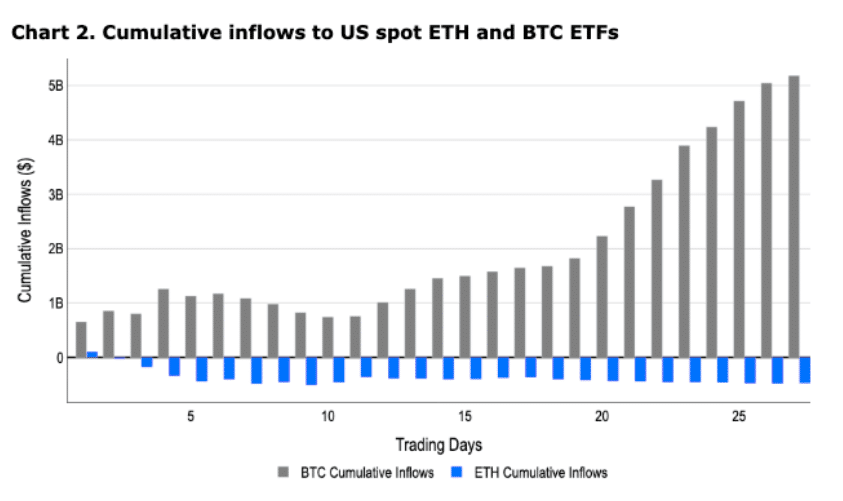

“This divergence in net buyer interest is embodied in US spot ETF flows in our view. ETH ETFs have had nine consecutive days of outflows between August 15 and 27 totaling $115M, while BTC ETFs had inflows eight of those nine days netting to $427M.”

Coinbase analysts David Duong and David Han added that ETH ETFs recorded cumulative net outflows of $477 million since inception. On the contrary, BTC ETFs have netted $17.8 billion in inflows since their debut.

The same divergent trend played out when adjusted to the first month of trading. In short, BTC ETFs saw massive demand, unlike weak interest in ETH ETFs.

However, the analysts noted that varying debut periods might have affected the flow difference too.

BTC ETFs were launched in January when liquidity was prevalent. On the other hand, ETH ETFs were launched in July amid the summer liquidity crunch, when most players were on vacation.

Analysts Han and Duong also believe that the lack of a staking feature on U.S spot ETH ETFs and competition from other smart contract chains like Solana [SOL] could have derailed ETH.

Additionally, the lack of a cohesive vision for the ETH ecosystem narrative and direction might have limited investor interest in the altcoin. Finally, the report cited recent fierce criticism of Ethereum founder Vitalik Buterin, who has been skeptical of “pure DeFi” as a crypto growth driver.

According to the analysts, divergent views and an incoherent vision could make it difficult for investors to understand ETH and its value proposition.

“This divide between thought leaders in the Ethereum community may make it challenging to understand ETH’s narrative and direction, particularly for those not familiar with the sector.”

At the time of writing, BTC was trading at $58.9k, about 20% from its March high of $73k. On the contrary, ETH was valued at $2.5k, down 38% from its March high of $4k.