All you need to know about Bitcoin’s current accumulation trends

- The Coinbase premium gap metric accurately projected another Bitcoin demand zone

- Bitcoin exchange flows and whale activity confirmed that liquidity is once again in favor of the bulls

Bitcoin could be on the verge of another short term rally, despite its recent struggle to maintain bullish momentum. The first half of October is almost done and while there were high expectations for Uptober, a contrarian outcome played out.

The fact that Bitcoin extended its downside this week and even dipped below $60,000 may have further crushed any bullish October expectations. However, a recent CryptoQuant analysis suggests that a strong bullish outcome is still possible in the short term and may have already began.

CryptoQuant’s analysis suggested that Bitcoin is currently in an accumulation phase. This assertion was based on the Coinbase Premium Gap metric. According to the analysis, a surge in accumulation has been taking place every time BTC Coinbase premium dropped below -50.

The Bitcoin Coinbase premium gap recently dipped well below -100, but does this mean there was a lot of accumulation too?

Bitcoin demand outweighs sell pressure

Bitcoin’s price action so far this week aligns with the analysis.

The cryptocurrency was trading at $63,667, at press time, after bouncing back by over 6% from its weekly low on Thursday. The sharp bounceback confirmed strong demand at and below the $60,000 price range.

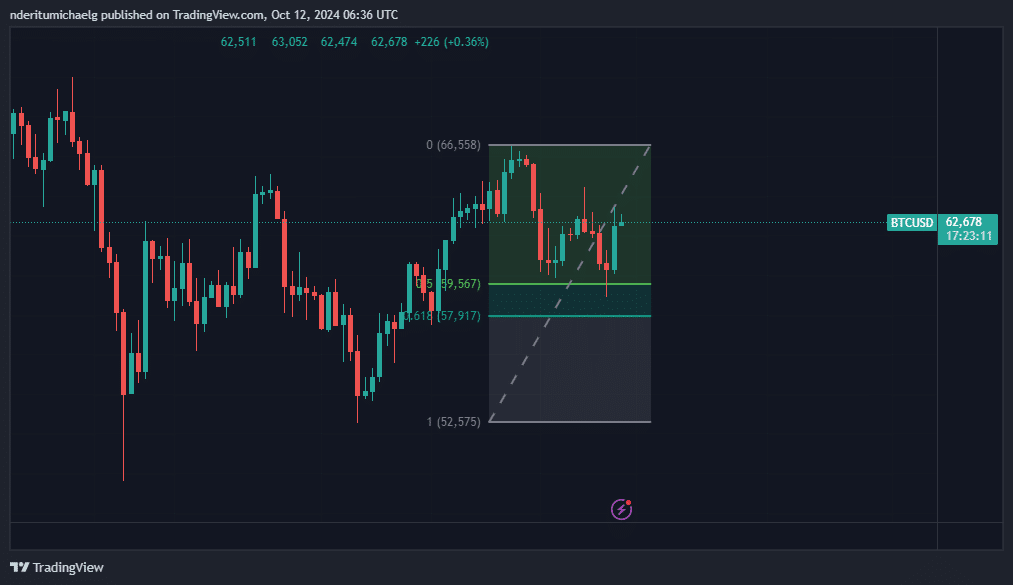

Here, it’s also worth noting that strong bullish momentum made a comeback after the price retested the 0.5 and 0.618 Fibonacci range. This was based on its lowest and highest price levels in September.

This suggests that there is a high likelihood that accumulation/demand would make a comeback after retesting this zone.

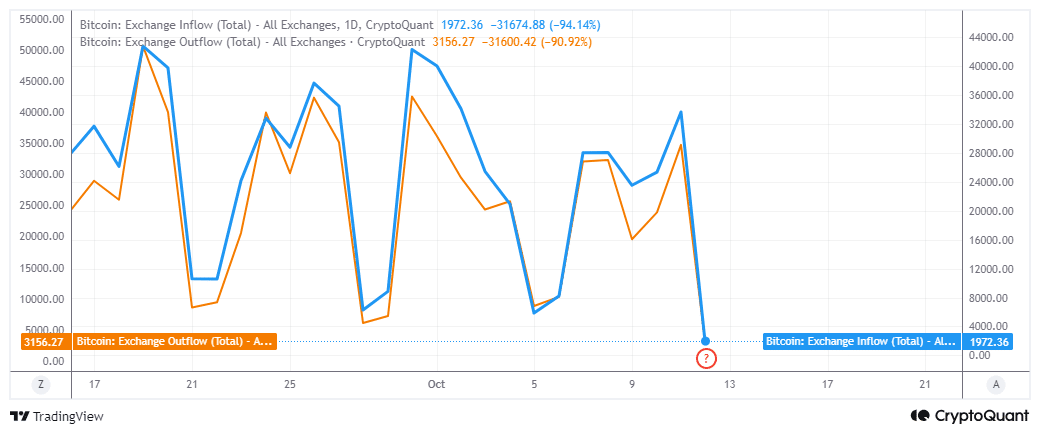

The gap between exchange inflows and outflows widened following the dip below $60,000. Bitcoin exchange outflows were notably higher at 3156 BTC in the last 24 hours, compared to 1972 BTC during the same period. This seemed to confirm that there was more buy pressure than sell pressure.

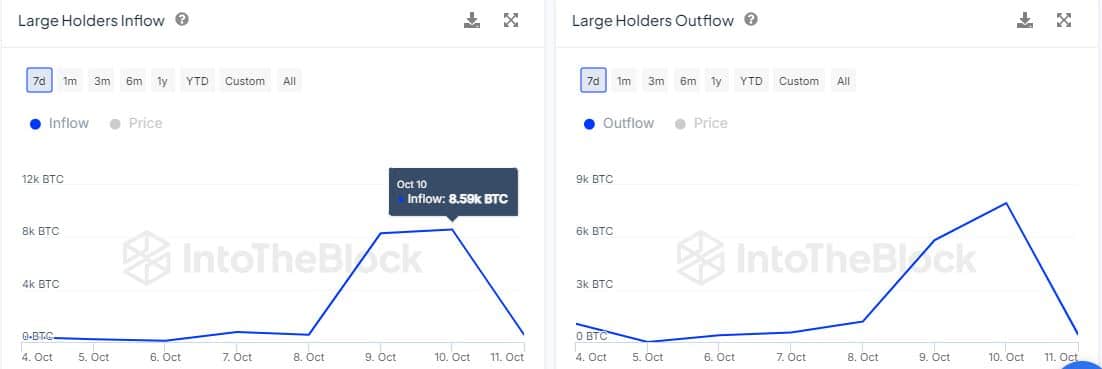

On-chain data also confirmed noteworthy whale activity this week.

We observed a surge in large holder flows over the week, with inflows peaking at 8,590 BTC on 10 October. This was significantly higher than large holder outflows which peaked at 7,960 BTC during the same period.

Large holder flows have cooled down slightly since then. However, inflows were still higher than outflows, pointing to net gains in terms of whale liquidity.

These findings, together, suggested that Bitcoin might be gearing up for another leg up. However, it remains unclear whether the current momentum will extend beyond the short term. For now, the recent bounceback confirmed that sub $60,000 prices may still be considered a good discount.