Altcoin

All you need to know about LSD tokens, Ethereum protocol

Liquid Staking Tokens dominate Ethereum staking with 41% utilization. Lido and Rocket Pool see surging interest in stETH and rETH tokens, amplifying DeFi trends.

- Liquid Staking Tokens control 41% of staked ETH, raising concerns about dependency and leveraging risks.

- Lido and Rocket Pool dominate, witnessing increased interest in stETH and rETH tokens.

Liquid Staking Derivative protocols have been increasingly occupying the DeFi space, gradually becoming dominant players in the Ethereum[ETH] staking arena. As a result, the tokens associated with these protocols experienced a massive surge in interest and adoption.

Is your portfolio green? Check out the Ethereum Profit Calculator

LSTs on the rise

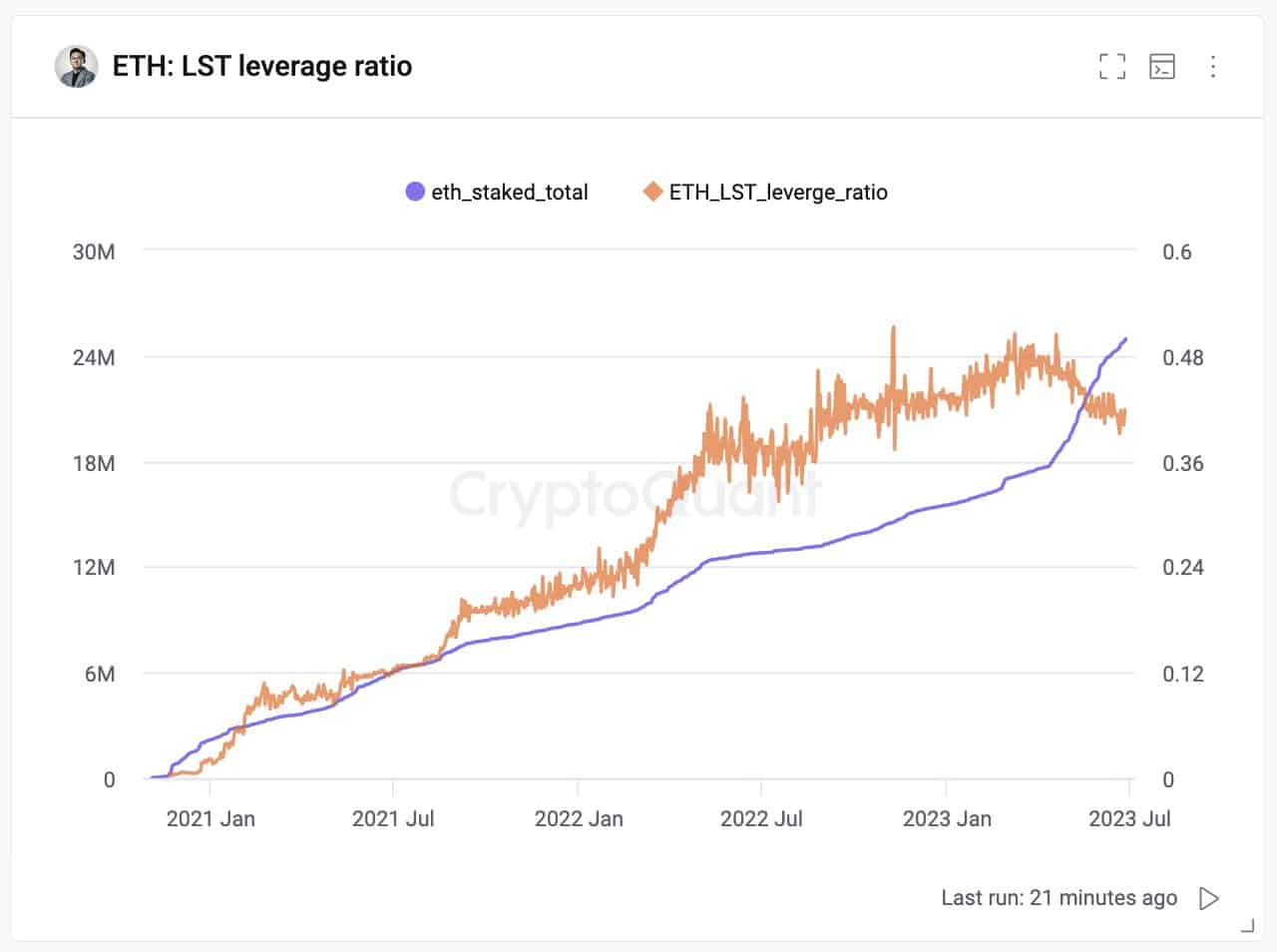

According to Kate Young Ju, an analyst on CryptoQuant, Liquid Staking Tokens (LSTs) have successfully utilized 41% of the total ETH staked in the ecosystem. This high level of utilization raises concerns, as it indicates a significant dependency on this particular form of staking.

Furthermore, it was worth noting that these LSTs were leveraged by a factor of 2, introducing potential dangers and weaknesses to the ecosystem. Leveraging amplifies both gains and losses, making investments more volatile and susceptible to market fluctuations. This increased risk can pose challenges for participants involved in LSTs and may impact the stability and resilience of the ecosystem as a whole.

At press time, the largest players in this sector were Lido and Rocket Pool. The staked ETH tokens associated with both protocols, stETH and rETH respectively, witnessed a notable surge in interest and usage. This surge was evident from the growing number of token holders, indicating an increasing interest among various addresses.

In addition to the growing number of token holders, the velocity of these tokens also witnessed an uptick. This suggested that the frequency with which these tokens were being transferred and used also increased, reflecting a higher level of activity within the ecosystem.

Ethereum plays a big role

However, it was essential to highlight that the growth of Liquid Staking Tokens was not solely driven by their own appeal, but also by the broader interest in the Ethereum protocol and ETH. Users are increasingly drawn to Ethereum, contributing to the rising traction and adoption of Liquid Staking Tokens.

Over the past month, the revenue generated by validators witnessed a significant decrease of 62.07%. Despite a decline in revenue for validators on the Ethereum network, the number of validators experienced a notable surge of 7.65% in the last 30 days, reaching a count of 637,732 according to Staking Rewards’ data. This sustained interest in staking remains intact, even in the face of falling revenue.

Realistic or not, here’s ETH’s market cap in BTC terms

As for the price of Ethereum, it was trading at $1,855.10 at press time according to CoinMarketCap’s data. It experienced a slight decline of 0.2% in the last 24 hours. Additionally, its trading volume decreased by 28.20% during the same period.