Ethereum

Altcoin season alert: Ethereum leads as it eyes a move towards $5K

Ethereum’s rally to $3,898 has sparked renewed interest in altcoins, with $5,000 and $7,000 price targets.

- Ethereum’s breakout could lead to a $5,000 target as altcoin season looms.

- Technical indicators suggest Ethereum’s dominance is fueling a potential market shift.

Ethereum’s [ETH] price has been on an impressive upward trajectory – trading at $3,898 at press time – with analysts predicting a potential breakout to $5,000 or even higher.

Ethereum’s rally is sparking renewed interest in altcoins. With some experts setting bold price targets for ETH, including a hopeful $7,000, the cryptocurrency market is closely watching how Ethereum’s momentum could influence broader market trends and potentially trigger an “altcoin season.”

Ethereum approaches key breakout levels

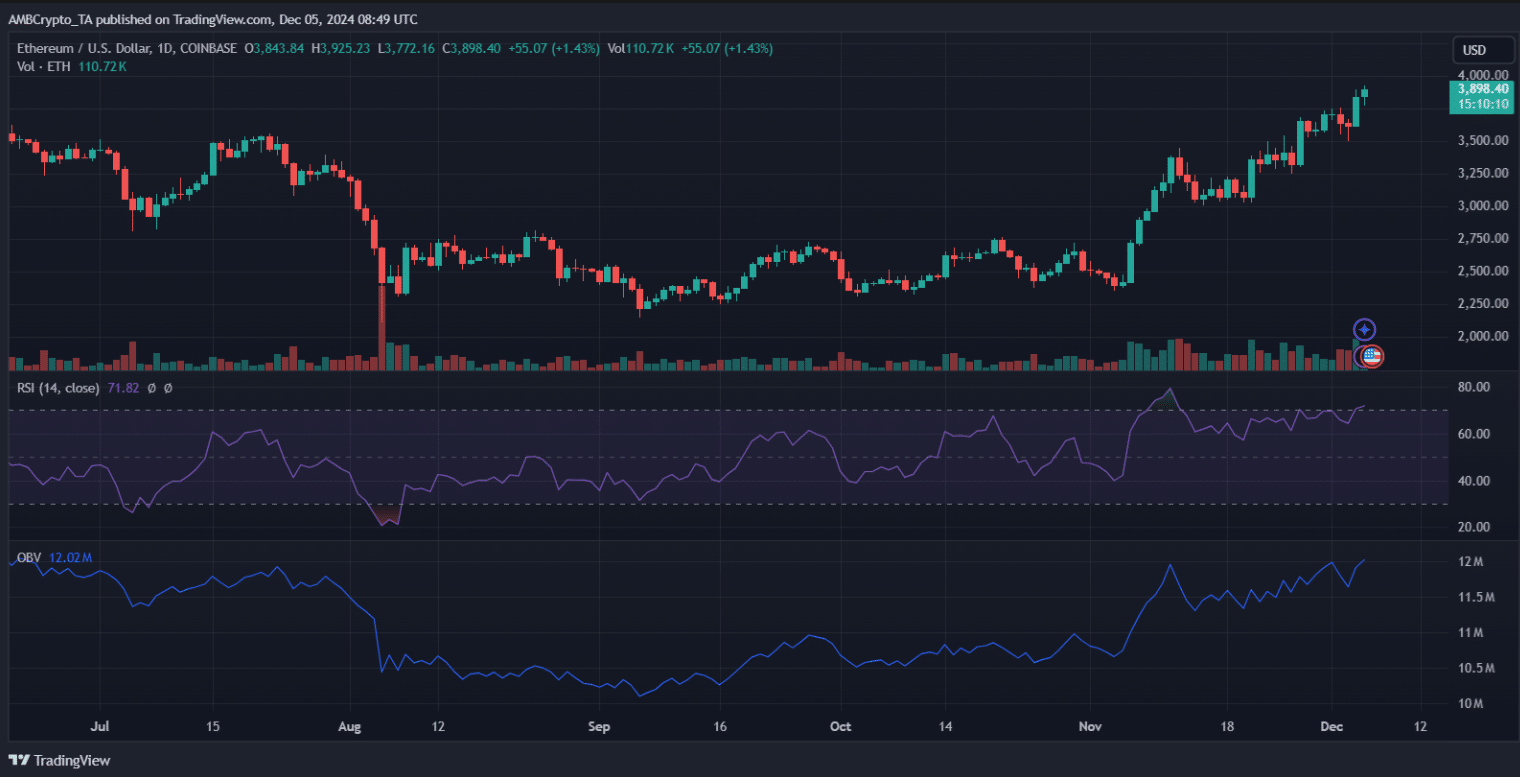

Ethereum’s recent rally positions it near a critical inflection point, with price action breaking past $3,850. The RSI above 70 indicates overbought conditions but also reflects strong bullish momentum, suggesting potential continuation toward $4,000 and beyond.

OBV shows increasing accumulation, signaling strong demand as institutional inflows support the rally.

Key resistance lies at $4,200, a pivotal level for confirming a path to $5,000, while $3,650 serves as immediate support.

Ethereum’s performance against Bitcoin [BTC] in recent weeks highlights a rotation of capital into altcoins, fueling speculation of an upcoming altcoin season.

Market participants are closely monitoring ETH’s performance, as its price trajectory could set the tone for broader market sentiment, especially if it triggers technical breakouts in correlated assets.