Altcoin

Altcoins-1, Bitcoin -0: Why traders are moving away from BTC

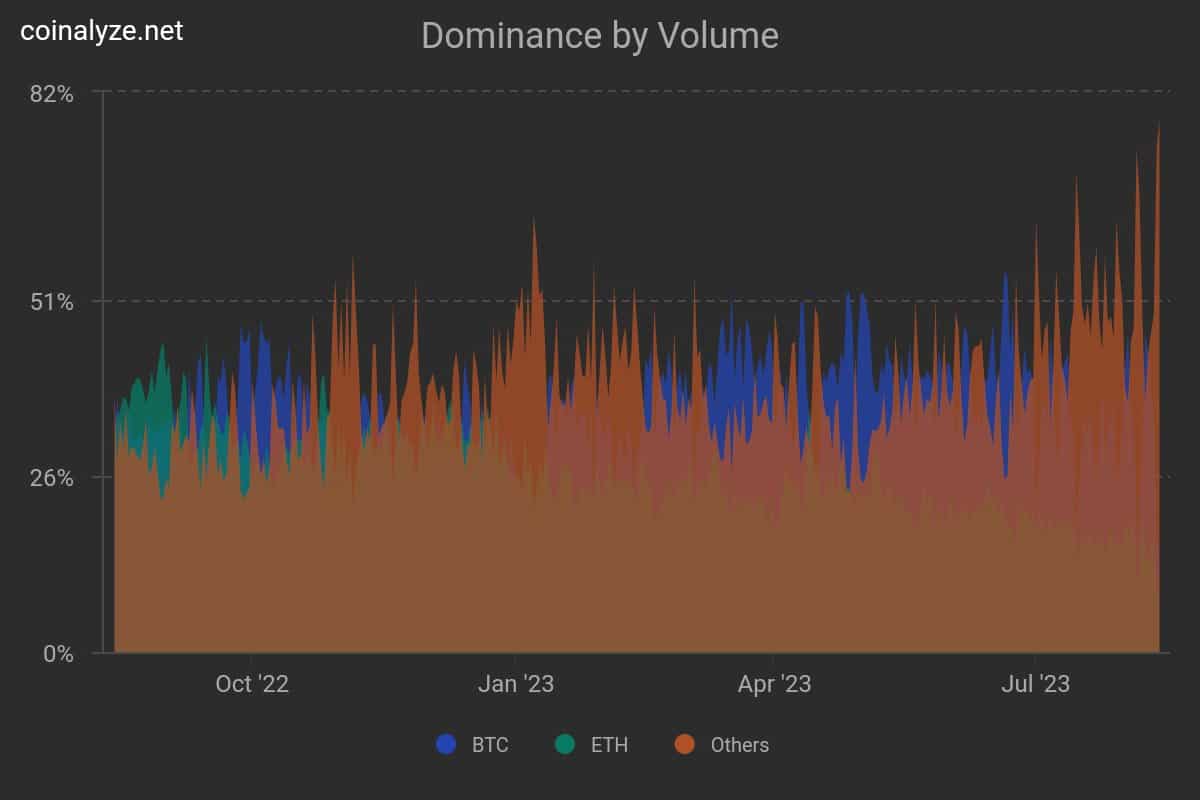

Altcoin dominance by trading volume ripped to 78%, the highest in the last two years. In contrast, Bitcoin’s volume plummeted to new depths.

- Bitcoin’s volatility was significantly lower than that of top altcoins.

- XRP led the recent altcoin rally, driven by the favorable outcome in the Ripple vs SEC case.

Of late, participants in the crypto market have gravitated towards altcoins, as the king of crypto assets Bitcoin [BTC] has left very little for them to profit from.

How much are 1,10,100 BTCs worth today?

According to an on-chain analyst, altcoin dominance by trading volume ripped to 78%, the highest in the last two years. In stark contrast, Bitcoin trading volume plummeted to new depths.

All quiet on Bitcoin’s front

After hitting yearly peaks in June’s market rally, BTC has meandered its way through a narrow trading range between $29,000-$30,000, as per CoinMarketCap. This lackluster movement has severely tested the patience of active traders who look to flip coins for quick gains.

Notice how from the peaks of March, the total amount of BTC getting transacted on the blockchain has fallen. The June rally, built on the hype of institutional interest in cryptos, provided a temporary boost and raised hopes for higher trading activity.

However, dashing all hopes, Bitcoin sank further with August turning out to be the quietest month. As of this writing, just about $131.8 billion has been settled on the network in August, per Token Terminal data.

To put this in context, it was a fraction of the $1-trillion sum recorded in March and less than half of the $345-billion figure recorded last month.

XRP leads the altcoin rally

Altcoins, on the other hand, have been a beehive of activity. Major coins like Ripple [XRP], Solana [SOL], Cardano [ADA], and Polygon [MATIC] have charged higher on the volume charts lately.

XRP, the payments-focused cryptocurrency, deserves a special mention. Ever since the favorable verdict

in the hotly contested legal battle against the U.S. Securities and Exchange Commission (SEC), XRP’s fortunes have swelled.Recall that the alt exploded by 70% following court’s judgement, enticing a lot of XRP investors to offload their bags. In fact, in the days following the event XRP outperformed Bitcoin in terms of trading volume. Even though the frenzy has subsided to a great degree, XRP remained 34% higher than what it was just before the verdict.

The optimism generated in the market for XRP soon spread to other coins like SOL, ADA, and MATIC. One of the major factors behind the shared excitement was the verdict which centered around the status of XRP as a ‘security’.

Like XRP, the SEC labeled aforementioned altcoins as securities in a lawsuit filed earlier against cryptocurrency exchange Binance. The resultant FUD caused a dent in their trading activity as jittery investors started to dump in hordes.

However, after the court cleared XRP of the security label, the market was swept up in a rush of excitement, rooted in the expectation that the ruling would serve as a precedent. Evidently, a lot of previous holders of altcoins tried to reacquire them.

Bitcoin not ideal for active traders?

Volatility has historically played a major role in an investor’s decision to add crypto instruments to their portfolios. Known for their wild intraday swings, these mercurial assets have long attracted short-term bullish traders who look to pocket quick gains and exit their positions.

Lately though, it’s not Bitcoin, but altcoins have emerged as the quintessential volatile assets. At the time of publication, Bitcoin’s 1-week volatility was significantly lower than that of top altcoins, according to Santiment.

Is your portfolio green? Check out the BTC Profit Calculator

These developments also drew attention to the diverging sentiments around the king coin and its juniors.

Lately, lot many traders have started to take BTC out of the secondary market to HODL. Growing TradFi interest, no looming threat from regulators, and the upcoming halving event, have strengthened Bitcoin’s narrative as a long-term investment.

This meant that the Bitcoin market was more enticing if you are looking to store your coins for long, expecting it to weather the headwinds of both the TradFi and crypto. If you seek quick gains, Bitcoin might not be an ideal bet.

These observations were supported by the widening gulf between long-term holders and short-term holders of the coin.

The contrast between the holdings of short-term and long-term investors has reached an unprecedented level.

It's a matter of time until the next cycle starts to unfold ?https://t.co/m1qncCBUi2 pic.twitter.com/WJ7E7FXWtj

— Maartunn (@JA_Maartun) August 14, 2023