Amidst AI uptrend, NEAR Protocol reminds users of ‘one of the oldest dApps’

- NEAR reminded users of its AI-related background.

- Price analysis showed lower relative strength and the formation of a bearish divergence.

Artificial intelligence (AI) is undoubtedly the biggest trend in 2023. So much that investors are now interested in AI-related crypto projects. The NEAR Protocol [NEAR] has jumped onto this hype by reminding the world that it has been exploring or aiding AI development for quite some time.

Is your portfolio green? Check out the NEAR Profit Calculator

NEAR revealed that it’s NEAR Cloud dApp, which housed thousands of users from all over the world, has been dabbling in AI for some time. It was also one of the oldest apps on the NEAR protocol. The dApp has been running since 2021 and is used for data point labeling, which is then used to train machine learning models.

?@NEARProtocol can serve as an infrastructure empowering next generation #AI use cases.

It creates a value layer for setting rules and pricing of data, which can be utilized by different apps and protocols in an open, fair and transparent way. ?

— NEAR Blockchain (@NEAR_Blockchain) February 8, 2023

NEAR has thus been involved in AI development for almost two years. But will this propel NEAR into short- or long-term performance? Perhaps a look at some of its on-chain performance metrics may offer some clarity.

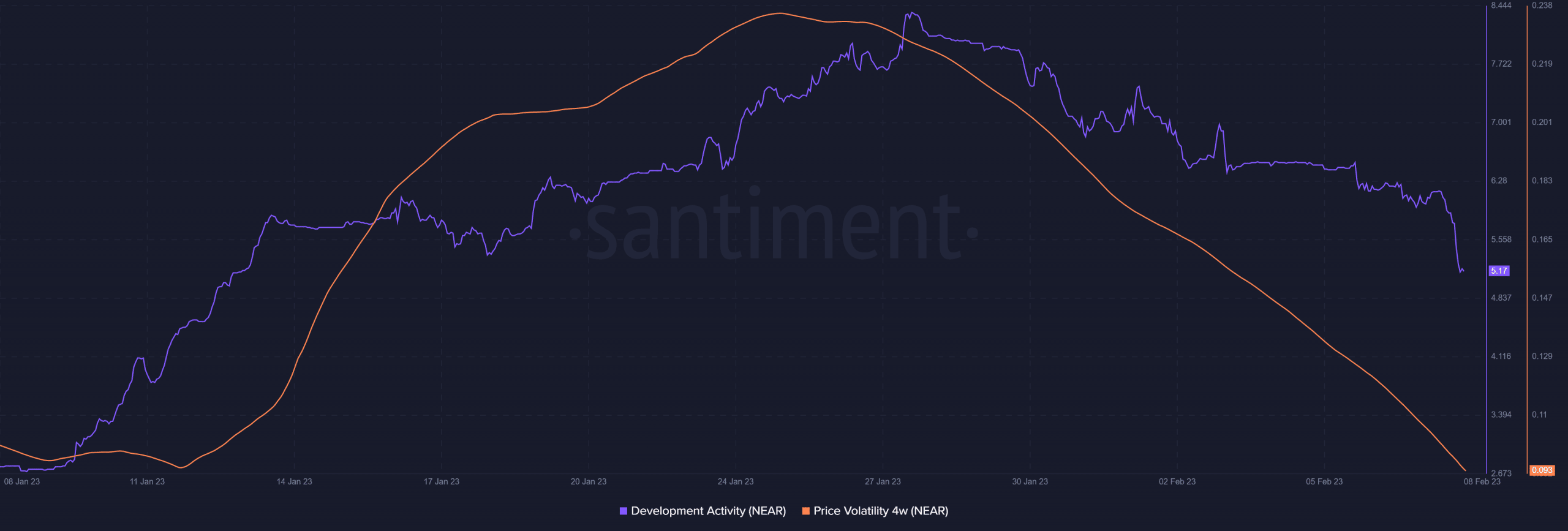

NEAR’s development activity was down significantly in the last two weeks, and was cooling off at press time. It previously enjoyed a period of strong development since early January 2023.

But a drop in development activity is not the only slowdown observed. NEAR’s price volatility also slowed down significantly since the last week of January to a new monthly low at press time. Things do not look that much different as far as investor sentiment is concerned.

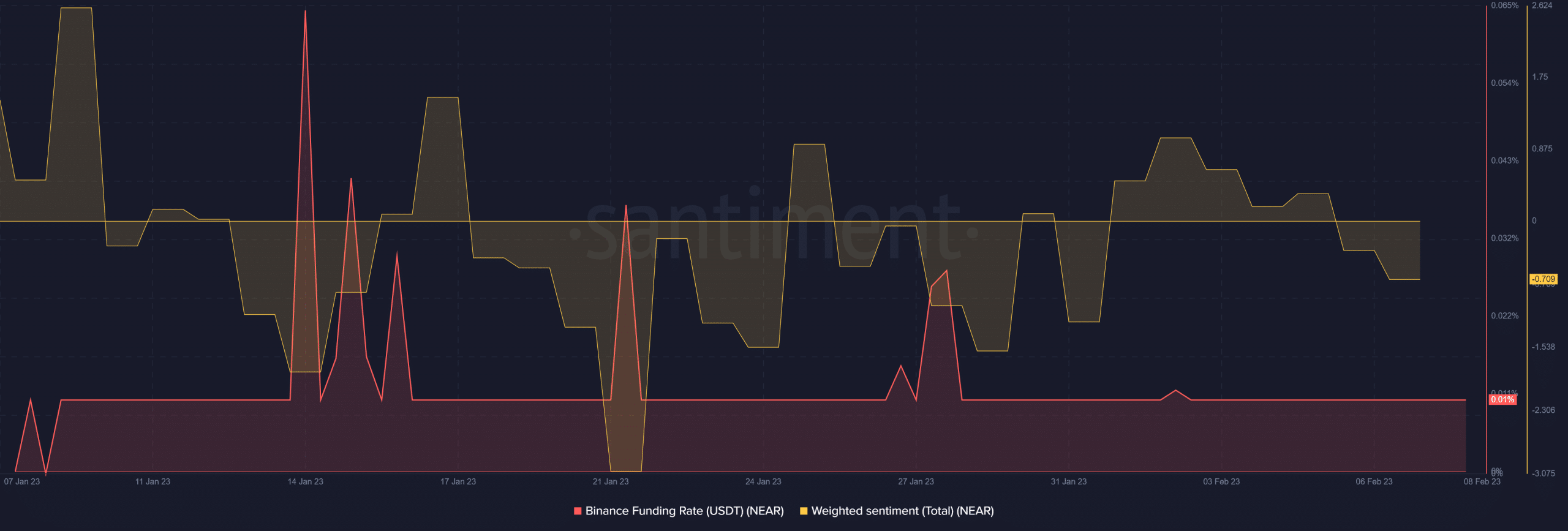

NEAR’s Binance funding rate has remained unchanged for the last few days until press time. This suggested that investor sentiment in the derivatives market remained in uncertain territory. Meanwhile, the weighted sentiment has tanked since the start of the year, confirming that investors have been leaning towards the bearish side.

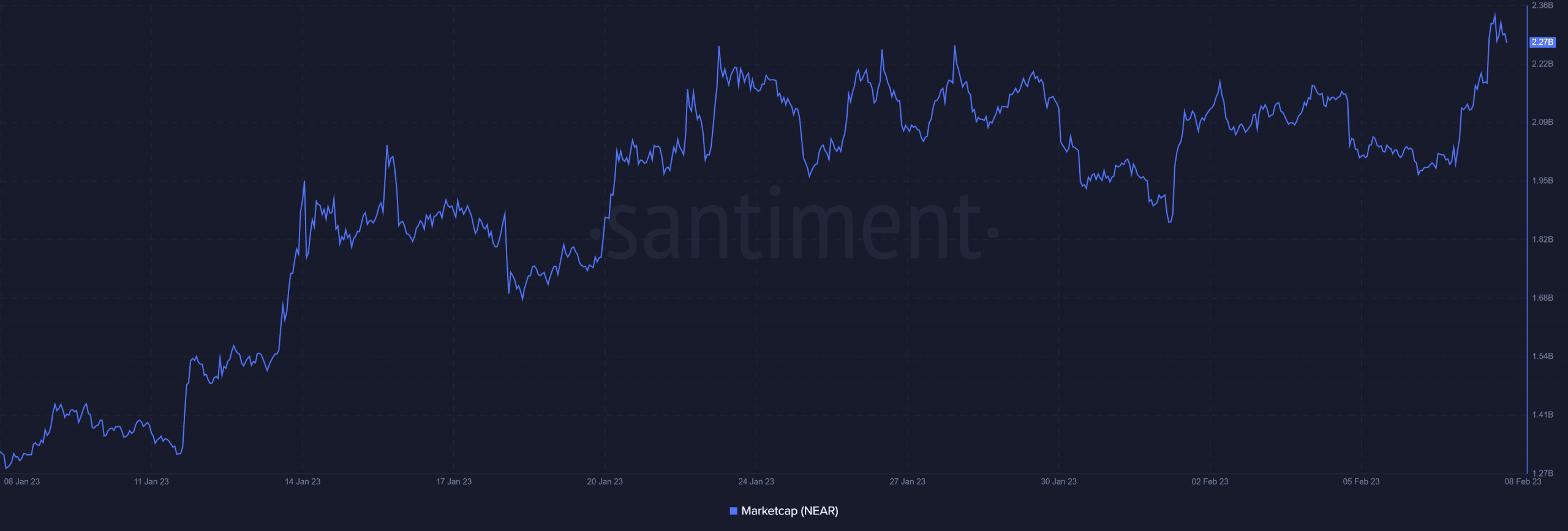

NEAR still gained significantly, especially in the last two days until press time, despite bearish sentiment. For example, its market cap gained by over $288 million just in the last 48 hours at press time. This allowed NEAR to achieve a new two-month high.

Realistic or not, here’s NEAR market cap in BTC’s terms

There may be some downside if the overall market direction entered a zone of uncertainty or sell pressure. This might further be exasperated by the fact that the price was forming a price-RSI divergence at press time, which was often considered a bearish sign.

NEAR’s RSI peaked in mid-January 2023, while the price has continued to extend its upside. Thus, it might be headed for some sell pressure ahead.