Amidst Ethereum ETF uncertainty, ETH falls 10% – More losses next?

- Spot ETH ETF’s prospective issuers are awaiting feedback from the SEC.

- ETH has seen significant selling pressure in the past few weeks.

Ethereum’s [ETH] selling pressure mounts as prospective spot ETH exchange-traded-fund (ETF) issuers await comments from the Securities and Exchange Commission (SEC) on the state of their S-1 filings, submitted on the 31st of May.

Many had expected the regulator to provide feedback on the state of these filings by the 7th of June.

However, none of the eight prospective issuers whose applications were approved on the 23rd of May have received any feedback.

While it is uncertain how long this process will take, SEC Chairman Gary Gensler noted in a recent interview with CNBC that the agency’s approval of the S-1 forms would “take some time.”

ETH bears the brunt

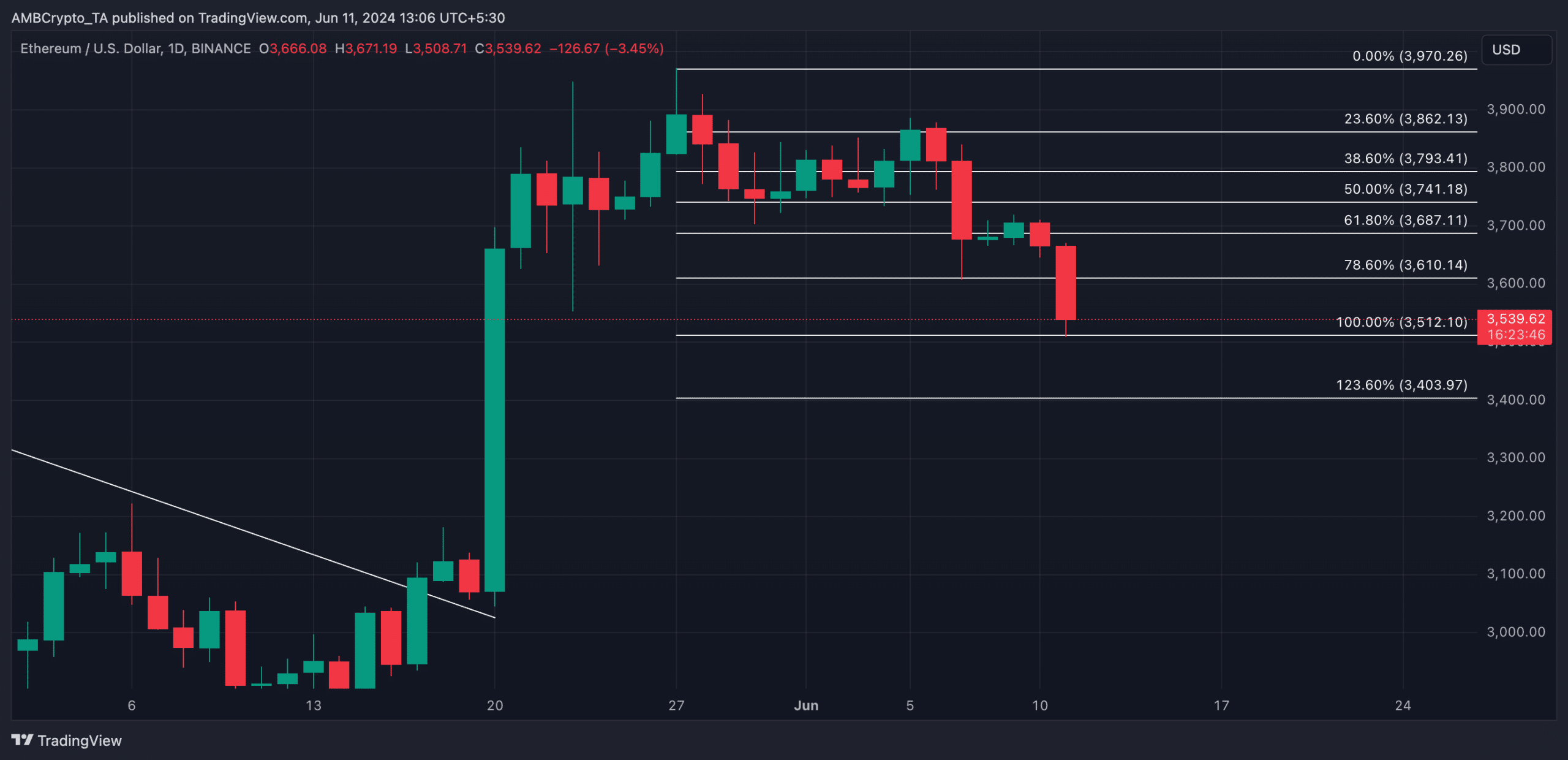

At press time, ETH was worth $3,539. According to CoinMarketCap data, the value of the leading altcoin has cratered by almost 10% in the last week.

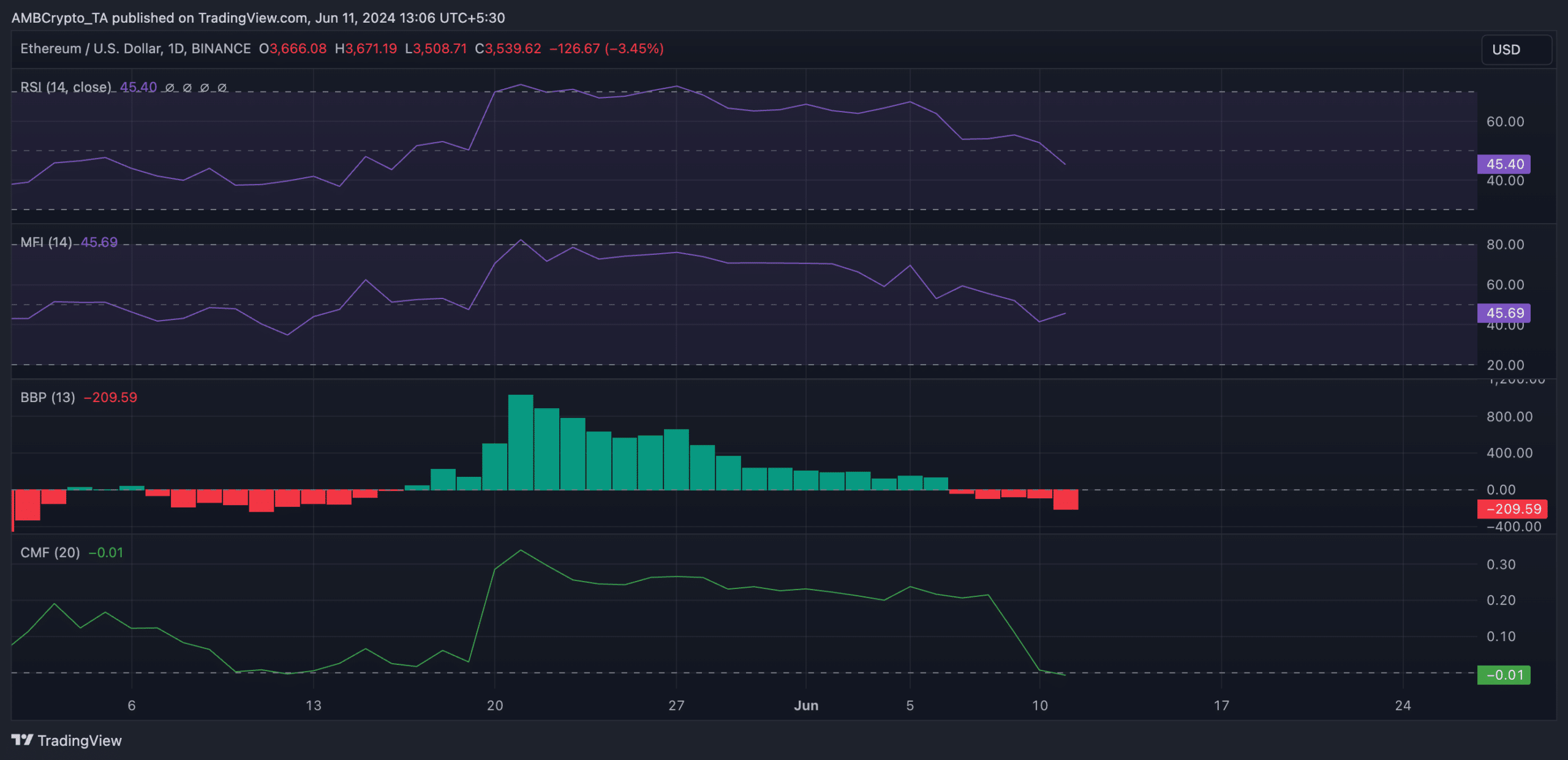

This price fall is attributable to the drop in new demand for the altcoin. At the time of writing, its key momentum indicators rested below their respective center lines, confirming the spike in selling pressure.

For example, ETH’s Relative Strength Index (RSI) was 45.40, while its Money Flow Index (MFI) was 45.69. These indicators measure the momentum and strength of an asset’s price movements.

At these values, they suggest that market participants favored ETH sell-offs over accumulating new coins.

ETH’s dwindling Chaikin Money Flow confirmed this trend. As of this writing, the coin’s CMF was in a downtrend and below the zero line at -0.01.

The indicator tracks how money flows in and out of an asset’s market. A negative CMF value is a sign of market weakness. It suggests capital outflow and indicates a bearish bias toward an asset.

Further, the negative values of ETH’s Elder-Ray Index confirmed the bearish bias toward the altcoin. This indicator measures the relationship between the strength of buyers and sellers in the market.

When its value is negative like this, bear power is dominant in the market.

As of this writing, the value of ETH’s Elder-Ray Index was -209.

Read Ethereum’s [ETH] Price Prediction 2024-25

If ETH’s selling momentum mounts, its price may drop below the $3500 territory to exchange hands at $3403.

If invalidated and bullish sentiment returns to the market, ETH’s price might rally toward $3610.