Memecoins

Can DOGE hold onto $0.7 – Yes or No?

DOGE has been fluctuating constantly, keeping prices firmly within the bears’ grasp.

- Dogecoin has been struggling to remain in the $0.7 zone.

- DOGE buyers became less aggressive as bullish sentiment waned.

Despite what could be considered a firm start to the week, Dogecoin [DOGE] DOGE has been unable to sustain its momentum.

Dogecoin longs see liquidations

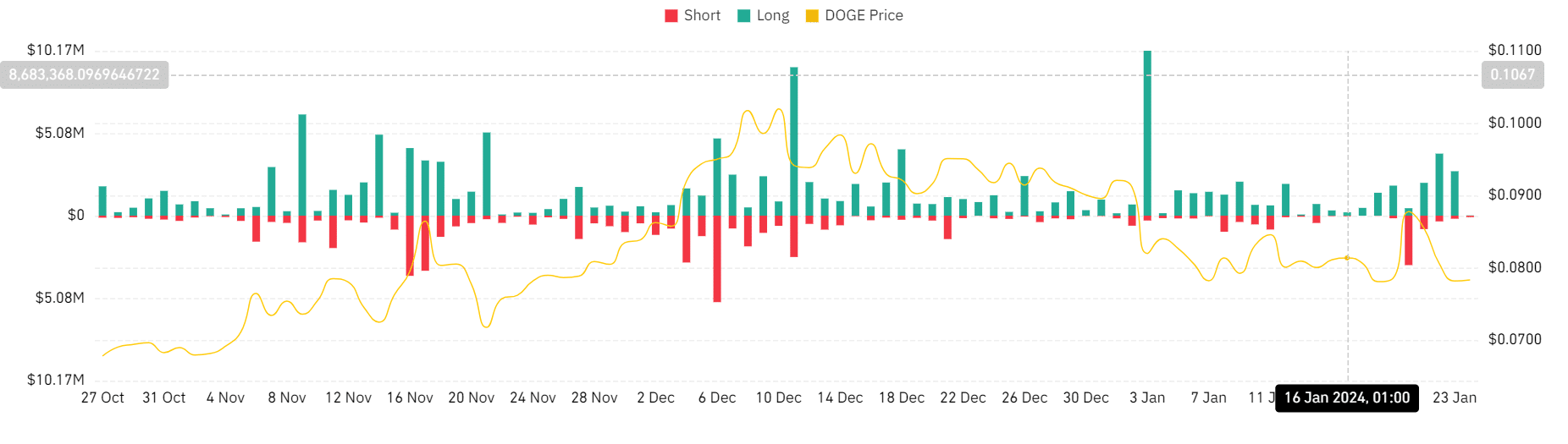

The surge in Dogecoin’s price on the 20th of January resulted in over $3 million in short liquidations, with long liquidations of around $460,000.

However, that marked the last occurrence of significant short liquidations, as long liquidations have dominated in recent days.

The chart showed a consistent trend of long liquidations, reaching its peak on the 22nd of January with over $3.8 million. On the same day, short liquidations were around $353,000.

On 23 January, long liquidations were over $2.7 million, while short liquidations were less than $200,000.

This liquidation pattern implied that traders speculating on DOGE’s price increase have suffered losses.

As of press time, the slight price uptick in DOGE has resulted in short liquidations of over $180,000, with long liquidations under $20,000.

Is Dogecoin’s recent rise enough to push it into a bull trend?

The daily timeframe chart of Dogecoin showed a notable conclusion to the previous week. On the 20th of January, Dogecoin exhibited gains of 16.14%, helping its price reach $0.09.

However, it experienced subsequent declines, losing nearly 15% within the following three days.

As of the latest update, there was a slight respite in its price trend, reflecting a modest increase of over 2%. The price had also climbed to the $0.7 range.

Furthermore, AMBCrypto’s examination of DOGE’s Relative Strength Index (RSI) showed that it has predominantly remained below the neutral zone throughout the year.

Despite briefly surpassing the neutral zone with the price rise on the 20th of January, it quickly returned below. Presently, the slight price increase has caused it to trend upward.

Still, it remained below the neutral line, indicating an ongoing bear trend.

The price decline has also led Dogecoin to trend below its short-moving average (yellow line). Consequently, the yellow line served as its immediate resistance at press time, at around $0.8.

This positioning below the yellow line underscored its current bearish trajectory.

Is your portfolio green? Check out the DOGE Profit Calculator

DOGE buyers remain cautious

The pricing trend in Dogecoin has decreased buyers’ aggressiveness, as evidenced by the Funding Rate on Coinglass. The chart showed that the Funding Rate, while still positive, has declined over the past few weeks.

At the time of this update, there has been a slight uptick in the Funding Rate, hovering around 0.01%. This recent movement is attributed to the uptrend observed in DOGE.