Analyzing Bitcoin’s [BTC] unprecedented rally and market reaction

- BTC has experienced an unprecedented rally, with the crypto market following suit to a large extent.

- Traders’ reactions have, however, been mixed, with rising negative sentiment and modest improvements in funding rates.

Bitcoin [BTC] has been on an unprecedented upward trajectory recently, and the entire crypto market has followed suit, or at least to a large extent. Though a price increase is welcome news, restoring investors’ faith is a different matter entirely. These measures reveal traders’ reactions to the press time price movement.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Negative market sentiment on the rise

According to Santiment, the buzz surrounding Bitcoin and other asset prices is yet to translate into an increased activity in the community. The chart showed a disturbing trend; the number of terms expressing negative emotions increased, rapidly closing the gap with positive ones.

? Even with #crypto having a great week, the amount of discussion appears to be down. More importantly, negative sentiment keywords are closing the gap on positive keywords. Prices historically rise most often in times of #FUD and disbelief. https://t.co/cgfeVPFFH2 pic.twitter.com/etiEOOeSLD

— Santiment (@santimentfeed) March 20, 2023

While this rising tendency is certainly a cause for concern, it is important to remember that historically, prices and the crypto market have always risen in times of Fear, Uncertainty, and Doubt (FUD). This suggests that the value of crypto assets may rise, despite the widespread skepticism among investors.

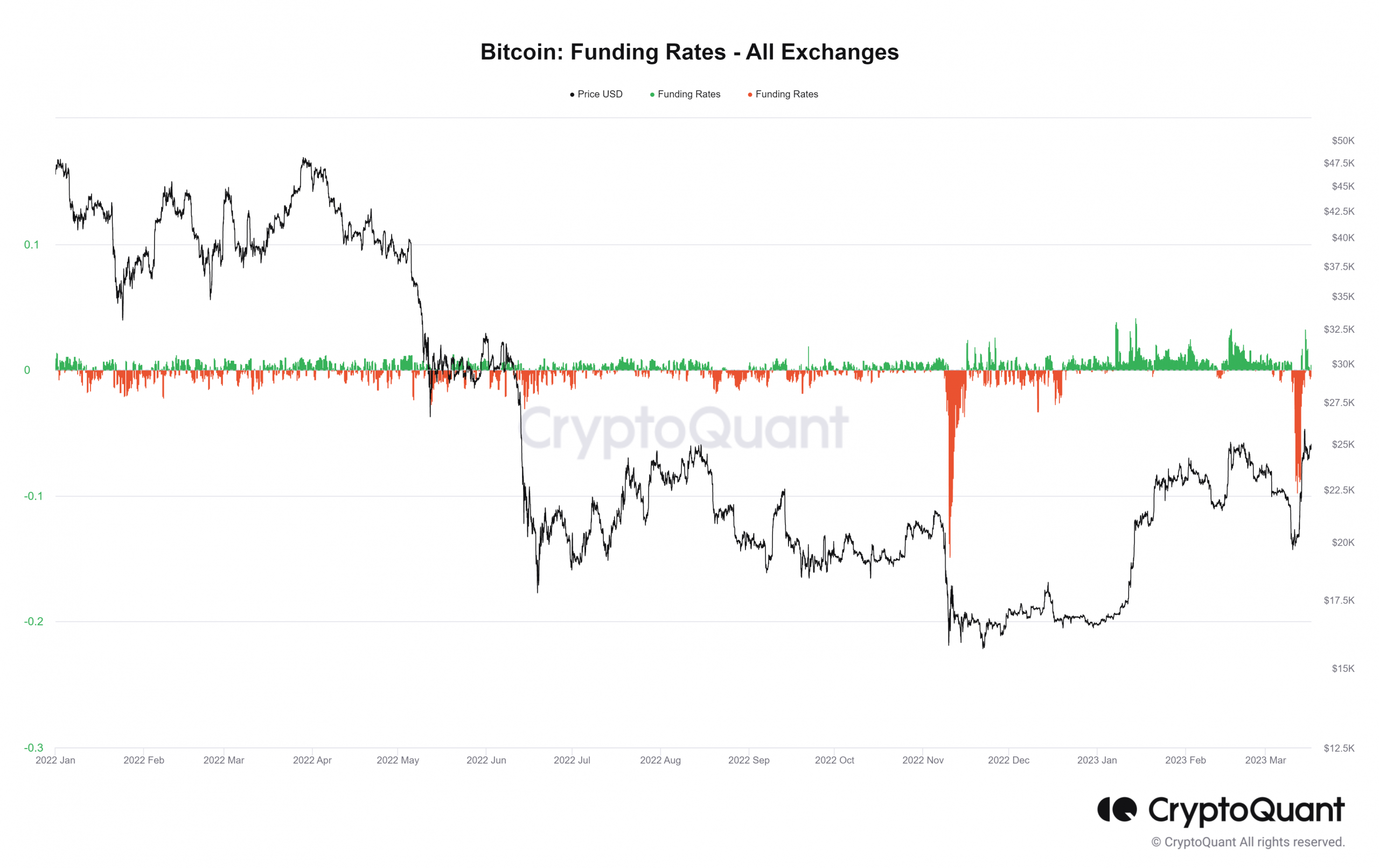

Funding Rates weekly average returns to positive

This past week had the third-lowest weekly funding rates for BTC, according to data from CryptoQuant. COVID and FTX, respectively, caused the previous crashes. High negative funding rates are often an indication of a short squeeze.

Spot purchasing prompted initial price drops before the futures market stepped in with intensity in all three cases. The current rate is positive but modest, suggesting market neutrality with a minor preponderance of optimism among traders of these perpetual contracts.

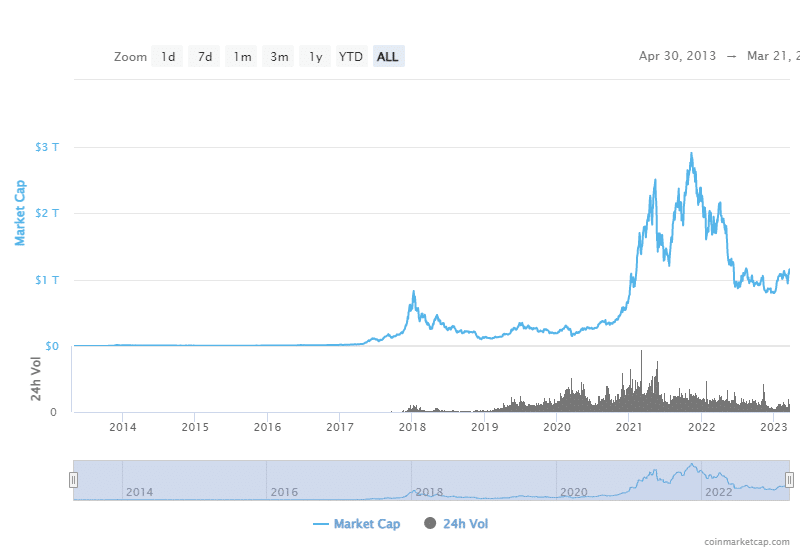

Crypto markets lift as Bitcoin surges

CoinMarketCap’s data also indicated an uptick in the cryptocurrency market. The overall value of all cryptocurrencies dropped at the beginning of March due to the downward price trend.

How much are 1,10,100 BTCs worth today?

As of this writing, however, the market cap has risen beyond $1 trillion and continues to rise. It has risen to over $1.1 trillion, with a 24-hour volume of nearly $77 billion at press time.

Indicators showed that investors were still paying close attention to see if the recent rally would hold. This explains why there have been only modest funding rate improvements, and negative search terms have remained persistent. Yet if the market continues its recent streak, that might soon change.