Analyzing Blur and OpenSea fight for dominance in the NFT landscape

- Blur’s TVL witnesses a huge spike as interest in the protocol grows.

- OpenSea manages to outperform Blur in daily activity.

After Blur entered the NFT space, the prowess of marketplaces such as OpenSea has been threatened to some extent. By now, it is a well-known fact that the rapid growth of the Blur protocol could pose a threat to OpenSea’s market dominance.

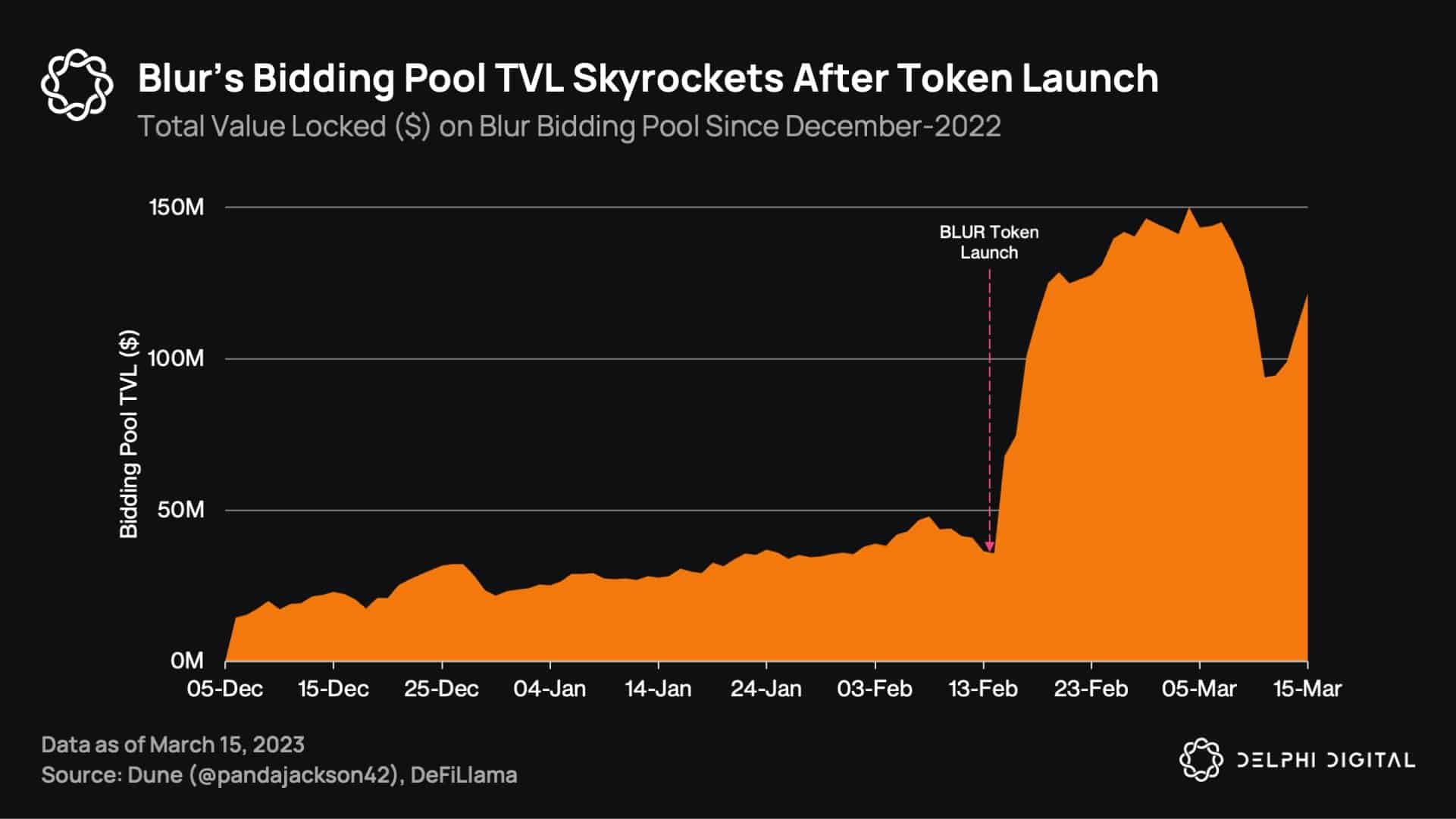

Additionally, one area where Blur observed massive growth was its TVL. According to a tweet by Delphi Digital, Blur’s TVL managed to reach an all-time high over the last month.

However, despite Blur’s high TVL, OpenSea still managed to have more daily active users on its network, as per the token terminal’s data. Curiously enough, Blur lagged behind in this area.

DAUs: OpenSea vs. Blur pic.twitter.com/RKgSwPW8w9

— Token Terminal (@tokenterminal) March 25, 2023

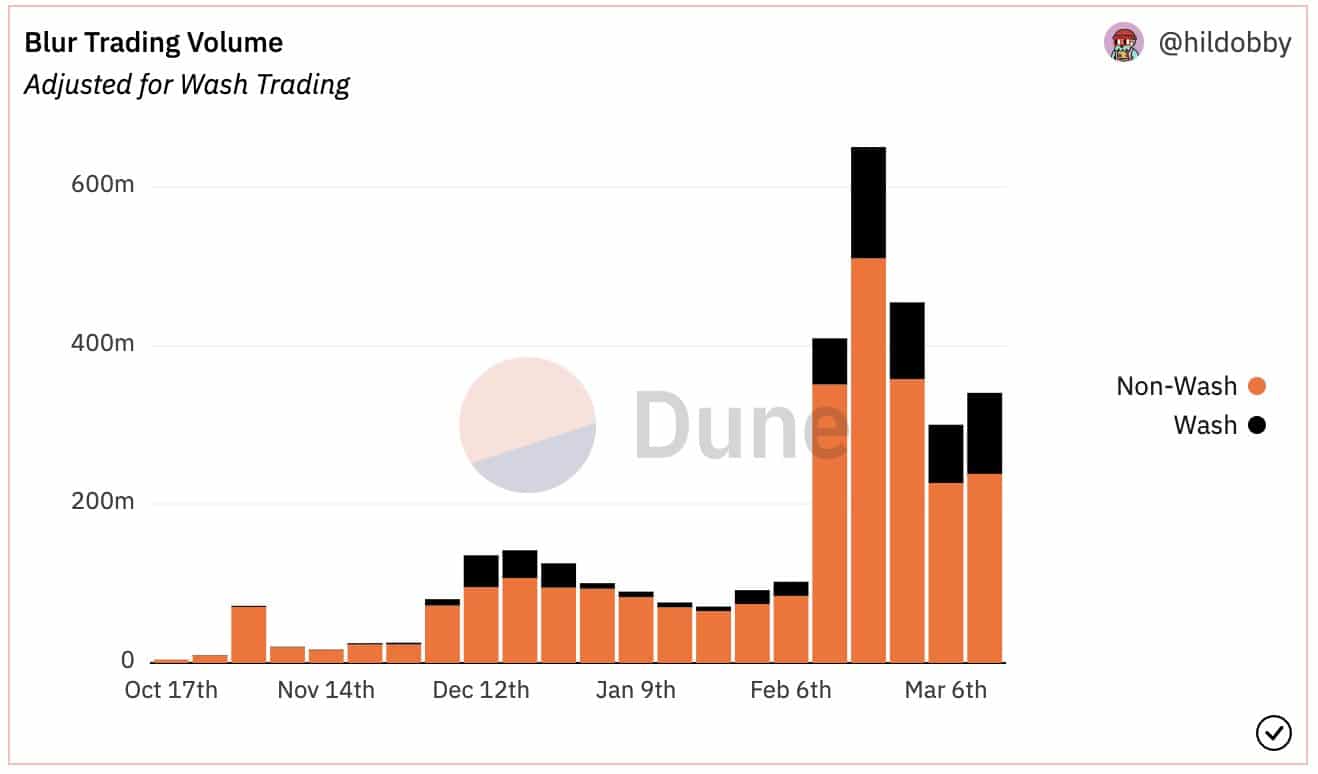

One of the reasons for the same could be the amount of wash trading taking place on the Blur network. According to Dune Analytics’ data, 11% of the trading volume on Blur occurred through wash trades.

At press time, OpenSea managed to capture 46.1% of all NFT trades made in the ecosystem. Blur came in a close second while capturing 42.5% of the overall market.

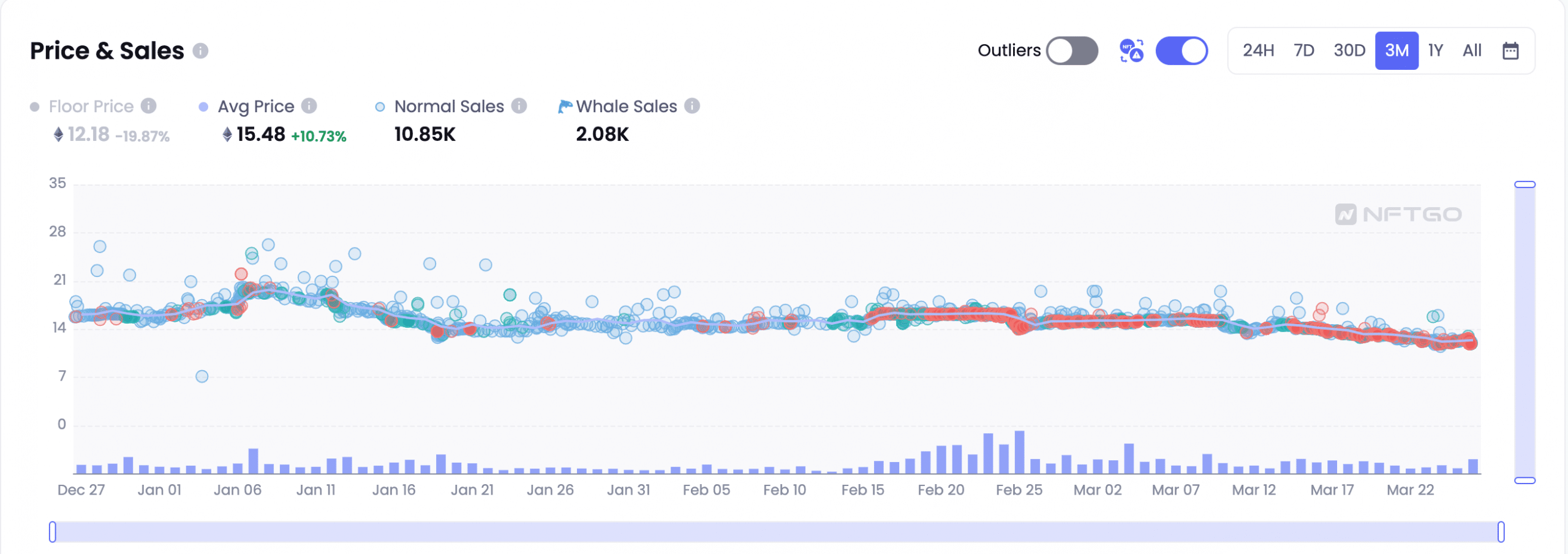

Despite high competition, both marketplaces exhibited growth in various sectors. Well, a large part of their growth could be attributed to the success and demand of blue chip NFTs such as BAYC and MAYC.

Of Apes and NFTs

According to data provided by NFTGO, the average price of the MAYC collection increased by 10.73% over the last three months. Interestingly, there was a surge in volume as well, which went up by a whopping 222.79% in the last 24 hours.

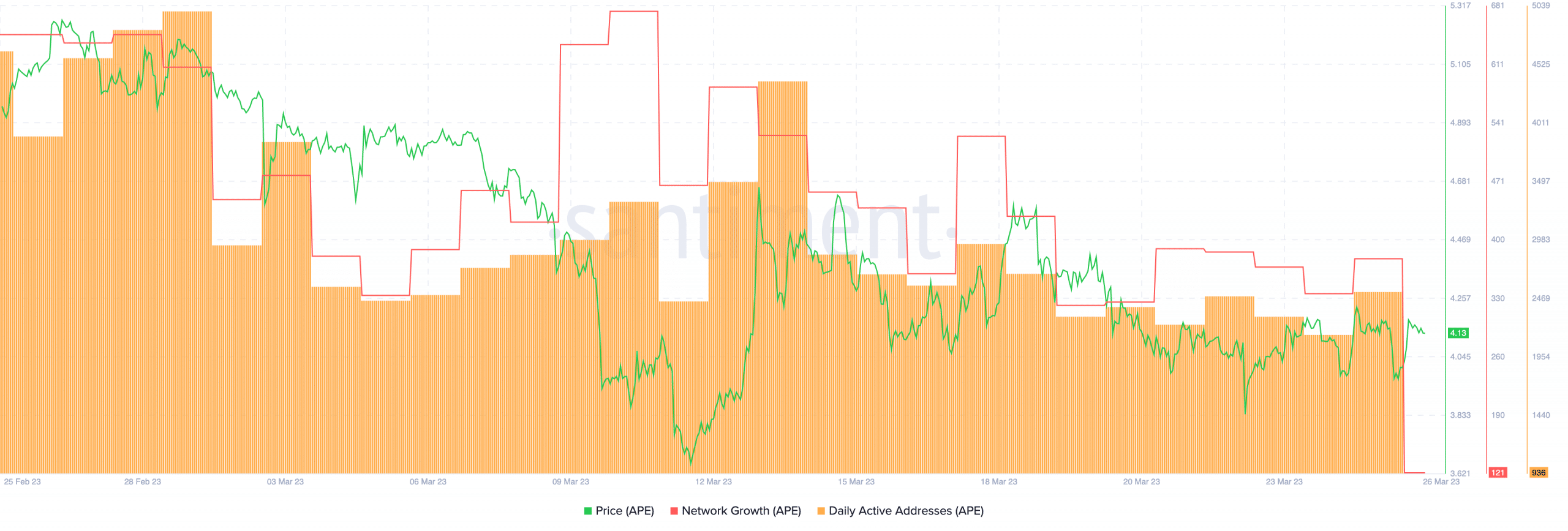

Even though the NFT collections did relatively well, the same couldn’t be said about their native token APE.

Over the last month, the overall price of APE fell significantly, along with its network growth. This implied that new addresses were not interested in the APE token at press time.

The number of daily active addresses transferring APE also fell during this period, indicating a bleak future for the token.

![Sonic [S] sees $1.4 billion liquidity surge as network upgrade sparks investor interest](https://ambcrypto.com/wp-content/uploads/2025/03/F0D8CF78-0B88-471B-BD85-84A9F049FDBA-400x240.webp)