Analyzing Cardano’s price trend and interest levels after ASI token integration

- ADA’s price saw some consolidation at $0.341 following the ASI token integration and DeFi activity

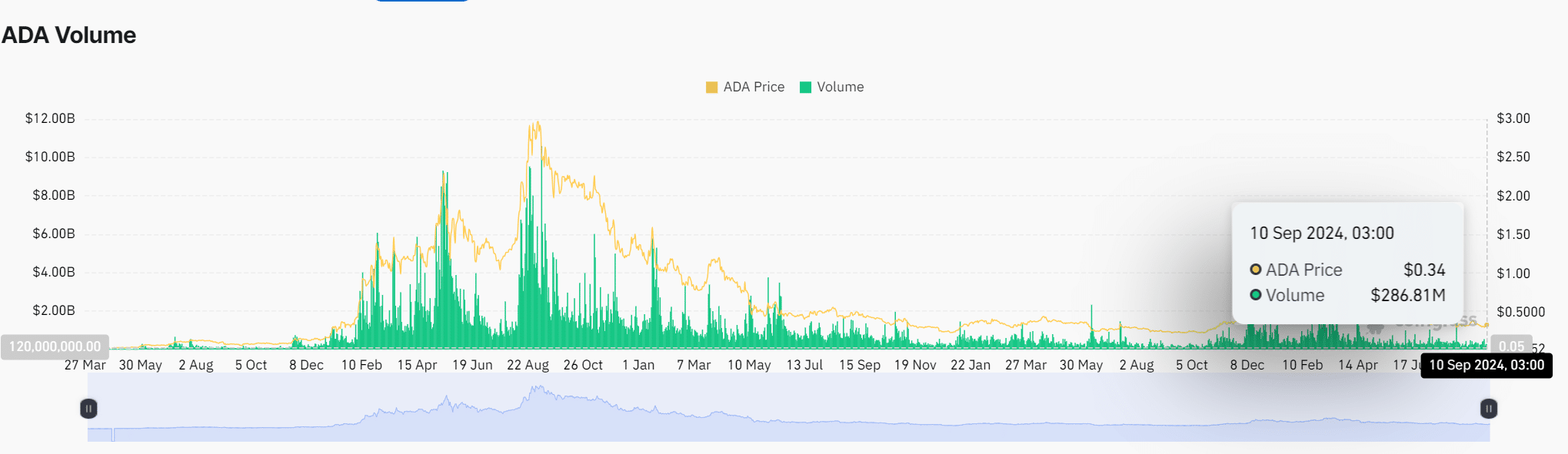

- On-chain activity has been rising too, with transaction volume at $286.81M

Cardano [ADA] has seen renewed interest after the integration of the ASI token into its blockchain. This development, along with greater activity in decentralized finance (DeFi), has drawn attention to the network again. Despite these positive moves, however, ADA’s price did drop by 0.49% in the last 24 hours. At press time, it was valued at $0.3429.

While there are signs of potential growth, market indicators suggest caution is necessary before making long-term bullish predictions.

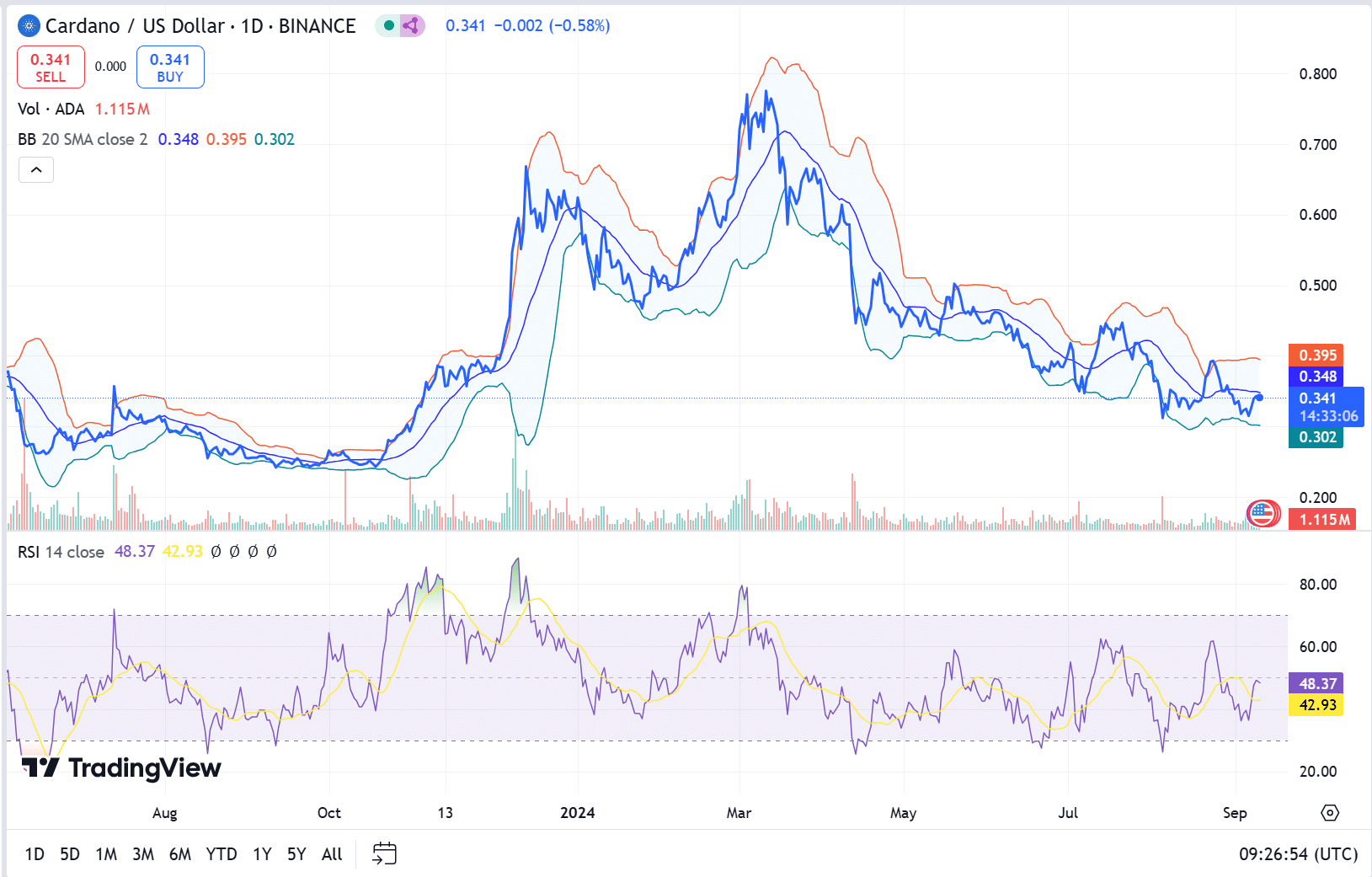

Current price movement

Cardano has been consolidating in a tight range between $0.302 and $0.395, with traders closely watching the $0.395 resistance level. The Bollinger Bands revealed a narrow trading range, typically signaling upcoming volatility. If ADA breaks through the $0.395 resistance, it could confirm a stronger bullish trend, which many traders have been waiting for.

Cardano’s technical indicators still presented a mixed picture though. For instance, the Relative Strength Index (RSI) was found at 48.37 – A sign that the market was in a neutral zone, providing room for price growth.

ADA’s trading volume fell by 3.16% in the past 24 hours too, bringing the total volume to $232 million. This decline in volume may hinder ADA’s ability to break through the $0.395 resistance. A stronger volume hike would be needed to confirm a bullish breakout.

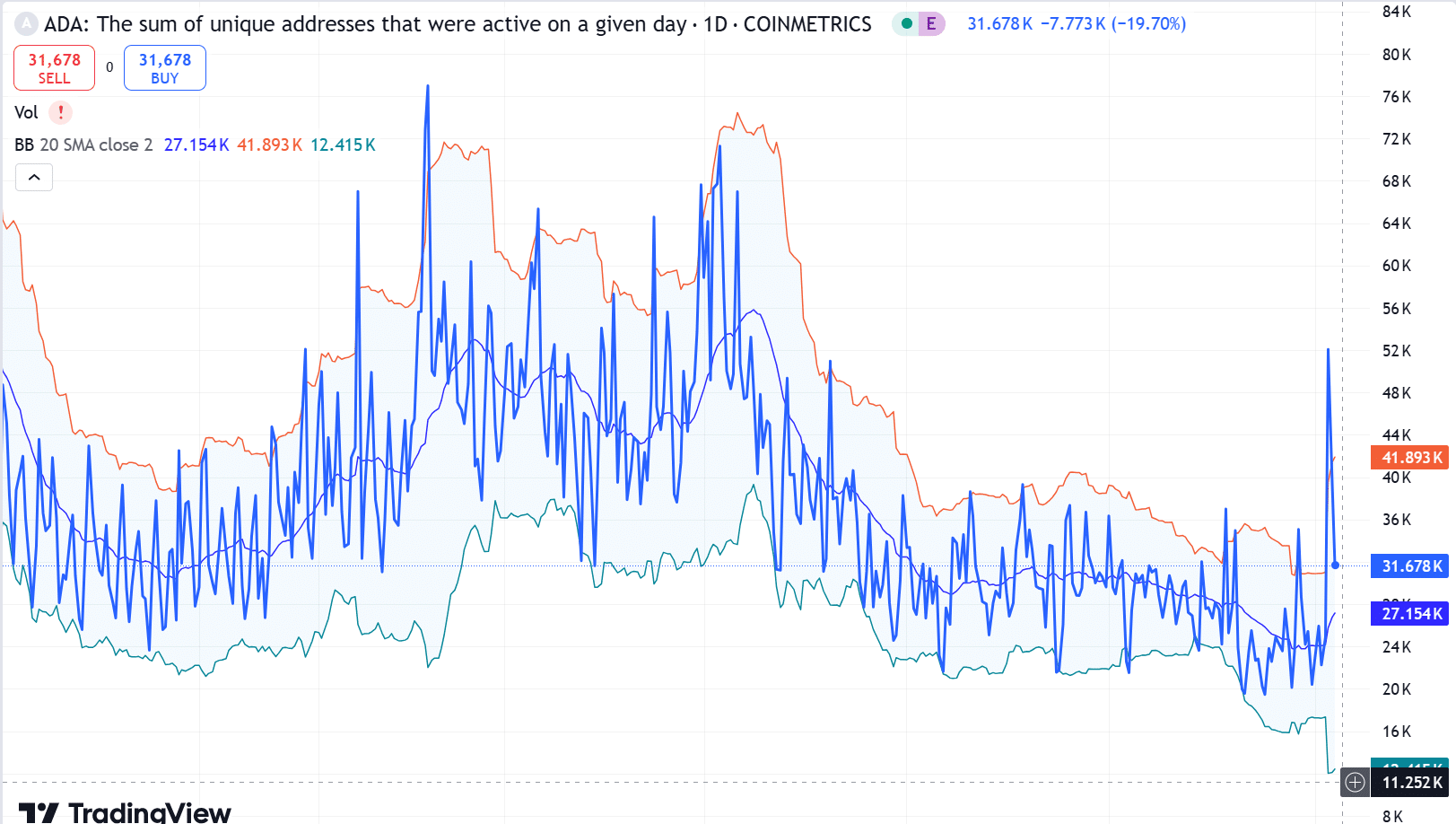

Active Addresses hit a 5-month high

On the contrary, on-chain activity did offer some positive signs for Cardano. The number of active addresses climbed to 31,678 – a 5-month high. This reflected a surge in network participation following the ASI token deployment.

Additionally, Cardano’s transaction volume spiked to $286.81 million – A sign of heightened on-chain activity, according to Coinglass. This rise in transaction volume demonstrates robust usage of the Cardano network, which could support future price movements.

Cardano’s ASI token integration has sparked renewed interest and a hike in active addresses. However, the decline in trading volume raises concerns about whether this enthusiasm will translate into sustained growth.

An uptick in trading and transaction volume will be critical for ADA to break out of its current consolidation. Traders should remain cautious, monitoring key levels and activity across the network before confirming a long-term bullish trend.

![Sonic [S] sees $1.4 billion liquidity surge as network upgrade sparks investor interest](https://ambcrypto.com/wp-content/uploads/2025/03/F0D8CF78-0B88-471B-BD85-84A9F049FDBA-400x240.webp)