Analyzing if Frax Finance can compete with MakerDAO

- Frax Finance has introduced sFRAX to compete in the yield-bearing stablecoins sector

- Protocol saw a spike in terms of activity, however, revenue continued to decline

After venturing into the RWA space, Frax Finance’s [FXS] sFRAX could help the protocol gain a standing in the yield-bearing stablecoin sector as well. A recent feature it introduced might help sFRAX holders participate in the short-end of the U.S treasury market, with its yield determined by the Interest Rate on Reserve Balances (IORB).

Is your portfolio green? Check out the MakerDAO Profit Calculator

Will Frax be able to compete?

Frax Finance also had plans for Frax Bonds (FXBs), extending access to the longer end of the yield curve. The interest rates of these bonds would be tied to the underlying bonds’ interest rates with matching durations. This expansion would enable an on-chain representation of the entire yield curve, adding depth to the protocol.

1/

Competition intensifies in the yield-bearing dollar market with the introduction of sFRAX: pic.twitter.com/KJrMhq54Fq

— parsec (@parsec_finance) October 20, 2023

The introduction of sFRAX and the multiple incentives for users to hold the stablecoin may give sDAI a run for its money.

However, despite the rising competition in the sector, MakerDAO continued to make new updates to sDAI. Recently, MakerDAO launched e-mode through the Spark protocol, permitting sDAI holders to borrow USDC and USDT or explore leveraged DeFi trading strategies.

USDC and USDT are now live on Spark with e-mode on sDAI

For sDAI users, this means you can borrow USDC and USDT for your leveraged DeFi strategies.

For USDC and USDT users, take advantage of the interest rate from these borrowers.

⚡️ https://t.co/wP36gAlcFB ⚡️ pic.twitter.com/K8Pf7pjXpL

— Spark (@sparkdotfi) October 20, 2023

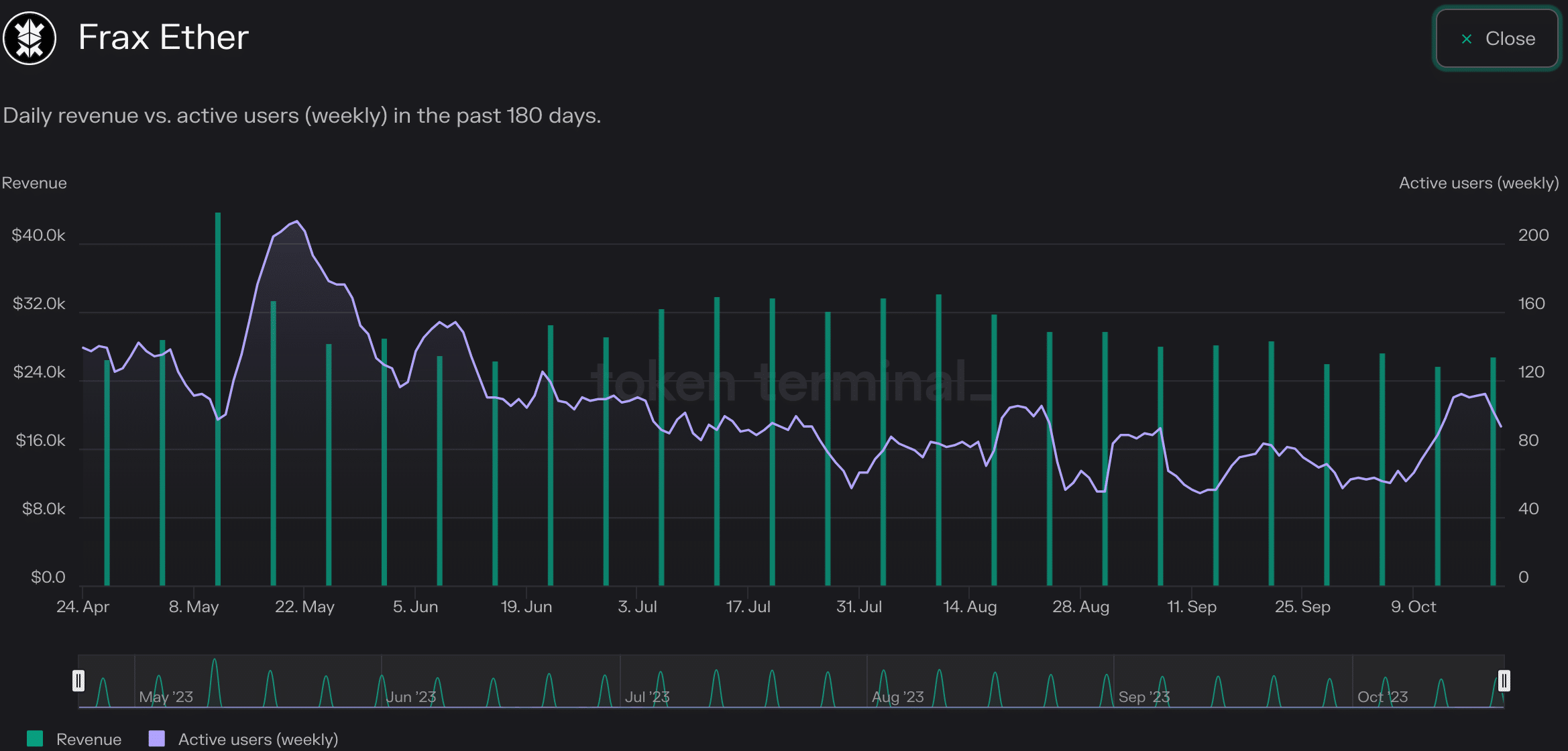

As these developments unfold, the performance of both Frax Finance and MakerDAO improved. In fact, data indicated a noteworthy 209.1% hike in active users on the Frax Finance platform over the last six months. However, this hike in users was accompanied by a 25% decline in platform revenue over the same period.

With an additional line of products and incentives added to the protocol, it is yet to be seen whether Frax Finance will be able to see green in terms of revenue. On the other hand, MakerDAO noted a remarkable 185% appreciation in revenue over the last six months.

Realistic or not, here’s MKR’s market cap in BTC’s terms

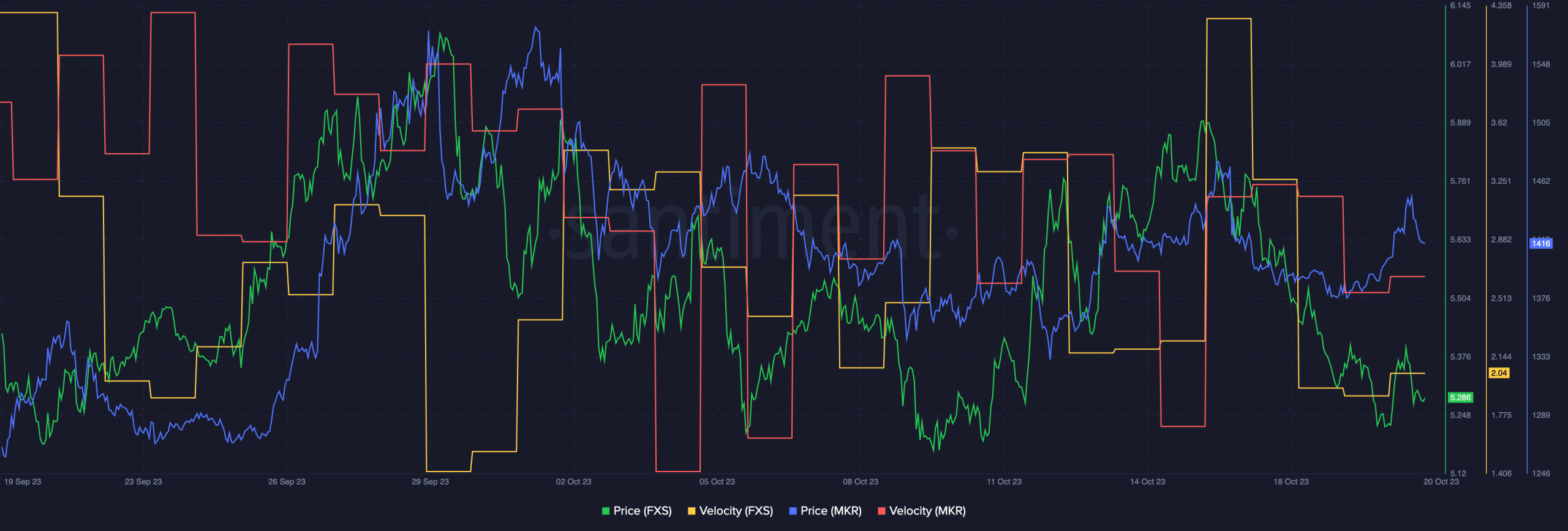

Regarding token prices, FXS, Frax Finance’s native token, registered a price decline. It was trading at $45.28, at the time of writing. Additionally, its velocity, indicating the rate of token movement within the ecosystem, also fell in recent weeks.

On the other hand, MKR, MakerDAO’s native token, saw an uptick in its price. Furthermore, the velocity of MKR also surged during this period.