Analyzing Polygon’s eventful 2022 as layoffs raise questions

- Polygon Labs has reduced its workforce by 20%.

- A new report showed a steady decline in network revenue in 2022.

Polygon Labs, the developer company behind leading sidechain Polygon [MATIC], announced on 21 February that, at the beginning of the year, the company consolidated multiple business units, which resulted in a 20% reduction in its team.

Is your portfolio green? Check the MATIC Profit Calculator

While 2022 remained a significantly bearish year that saw the collapse of many crypto projects, in February last year, Polygon Labs completed its first major financing round of $450 million.

As reported, the private token event saw the involvement of a number of investors, including Tiger Global, SoftBank, Galaxy Digital, Republic Capital, Makers Fund, Alameda Research, Alan Howard, Dune Ventures, Seven Seven Six (founded by Alexis Ohanian), Steadview Capital, Unacademy, Elevation Capital, Animoca Brands, Spartan Fund, Dragonfly Capital, Variant Fund, Sino Global Capital, and Kevin O’Leary.

Polygon has grown exponentially.

To continue on this path of stupendous growth we have crystallized our strategy for the next 5 yrs to drive mass adoption of web3 by scaling Ethereum.

Our treasury remains healthy with a balance of over $250 million and over 1.9 billion MATIC

— Sandeep | Polygon ? Top 3 by impact (@sandeepnailwal) February 21, 2023

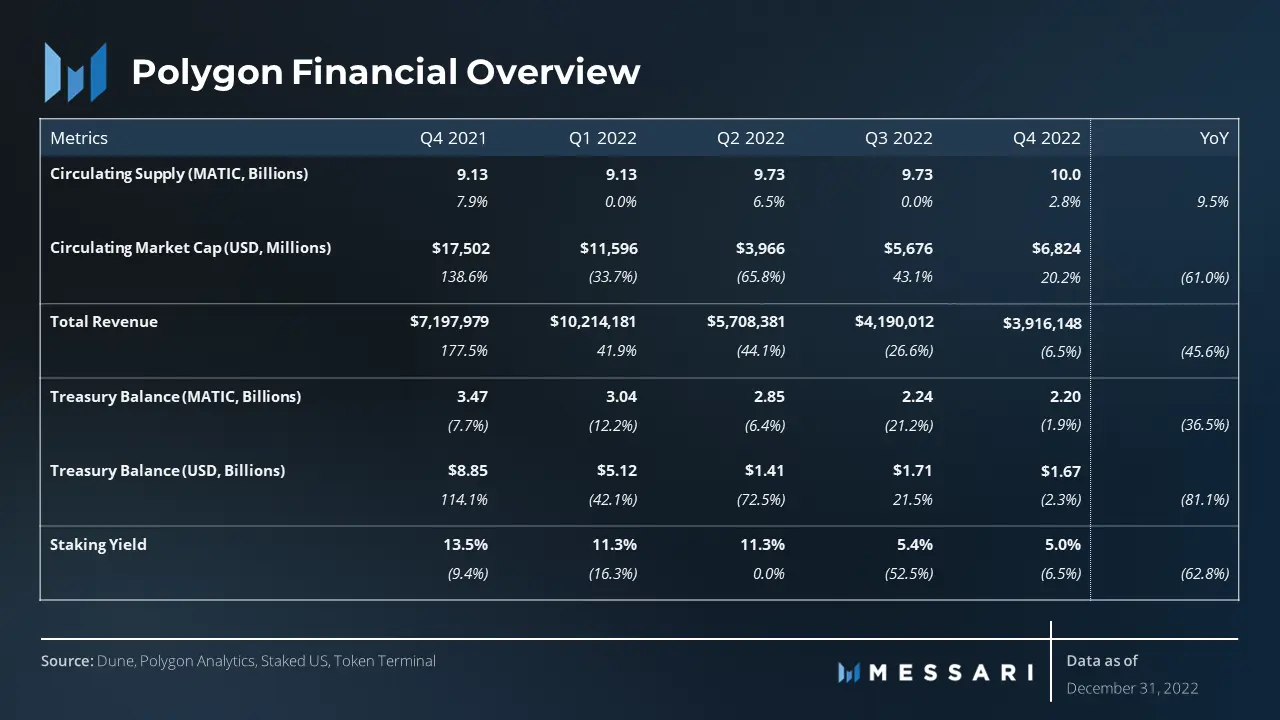

However, a look at the funding history and the current state of the network’s treasury has led many to question the team’s financial status.

Users flock to network in Q4 2022, but revenue remained elusive

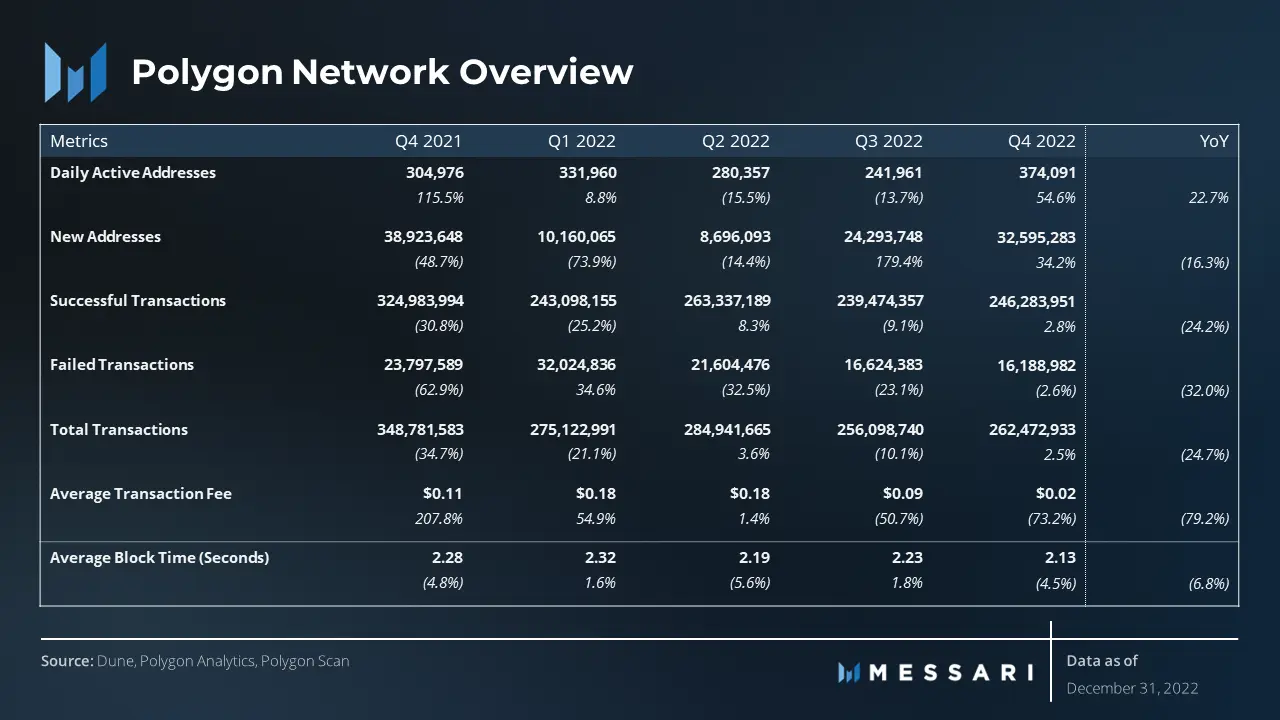

In a 21 February report released by Messari, Polygon experienced a surge in user activity during the last quarter of 2022. However, despite the increased user engagement, the platform logged a notable decline in revenue.

The hike in user activity was partly because of the launch of Polygon’s zero knowledge-EVM public testnet in October. According to the report, during the 90-day period, the count of daily active addresses on the network jumped by 55%, bringing the year-over-year increase to 23%.

Similarly, 32.59 million new addresses were created on Polygon between 1 October – 31 December. This culminated in a 34.2% hike in the new addresses on the chain from the 24.29 million new addresses recorded in Q3 2022.

Further, during the period under review, the network recorded 262.47 million completed transactions, according to Messari. This highlighted the significant volume of activity on the network and suggested a growing demand for Polygon’s services.

Realistic or not, here’s MATIC market cap in BTC’s terms

However, as the general state of the market put pressure on MATIC’s price, the token’s value fell, resulting in a decline in average transaction fees. As a result, per Messari, the average transaction fee on the network fell by 73% in Q3 2022.

Lastly, Polygon’s financials for the latest quarter showed a total revenue of $3.91 million, according to the report. This figure represented a significant decline compared to the $10 million revenue that the sidechain network recorded during the first quarter of 2022.

![Aptos [APT]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-12-1-400x240.webp)